Digital Nomads: UK Tax Residency Rules & Avoiding Double Taxation While Working Abroad

- MAZ

- Jul 9, 2025

- 15 min read

The Audio Summary of the Key Points of the Article:

Navigating the UK Statutory Residence Test as a Digital Nomad

What Is the Statutory Residence Test and Why Does It Matter?

Let’s kick things off with the big question: how does the UK decide if you’re a tax resident? The Statutory Residence Test (SRT), introduced in 2013, is HMRC’s tool to determine your tax residency status for a given tax year (6 April to 5 April). As a digital nomad, your jet-setting lifestyle—coding in Lisbon one month, consulting in Singapore the next—makes this test critical. If you’re deemed a UK tax resident, you’re liable for tax on your worldwide income. If not, you only pay tax on UK-sourced income, like rental income from a flat in Manchester.

The SRT is a three-step process: automatic overseas tests, automatic UK tests, and the sufficient ties test. It’s designed to be clear-cut, but for nomads hopping between countries, it can feel like a tax maze. Let’s break it down.

How Do the Automatic Overseas Tests Work?

Start here, because if you meet any of these tests, you’re automatically non-resident for the tax year, and you can skip the rest of the SRT. There are three key tests:

Less than 16 days in the UK: If you spend fewer than 16 days in the UK in a tax year, you’re non-resident, no questions asked. This is a godsend for nomads who barely touch down in Heathrow.

Less than 46 days with no recent UK residency: If you weren’t a UK resident for the previous three tax years and spend fewer than 46 days in the UK, you’re non-resident.

Full-time work abroad: If you work full-time (at least 35 hours a week) abroad, spend fewer than 91 days in the UK, and have fewer than 31 UK workdays (days with over three hours of work), you’re non-resident.

For example, Priya, a freelance graphic designer, spent 10 days in the UK in the 2024/25 tax year visiting family in Bristol. She’s automatically non-resident under the first test. But if you’re popping back to the UK often, you’ll need to dig deeper.

What Happens If You Don’t Pass the Overseas Tests?

If none of the automatic overseas tests apply, you move to the automatic UK tests. Meet any of these, and you’re a UK tax resident—full stop. The tests are:

183 days or more in the UK: Spend 183 days or more in the UK during the tax year, and you’re a resident. This is the most straightforward rule but tricky for nomads who don’t track their days meticulously.

UK home: If your only home (or the only one you use for at least 30 days) is in the UK for 91 consecutive days, you’re a resident.

Full-time work in the UK: If you work full-time in the UK for 365 days (with at least one day in the tax year), you’re a resident.

Consider Ewan, a UK-based consultant who spent 190 days in the UK in 2024/25, splitting the rest between Thailand and Portugal. He’s automatically a UK resident because he crossed the 183-day threshold. For nomads, this rule often catches those who return for extended periods, so keep a travel diary.

What’s the Sufficient Ties Test?

Now, if you don’t meet any automatic tests, the sufficient ties test kicks in. This is where things get fiddly. It combines the number of days you spend in the UK with “ties” to the UK, like family, accommodation, or work. The fewer days you spend in the UK, the more ties you can have without becoming a resident. Here’s a breakdown for the 2024/25 tax year:

Days in UK | Ties Needed to Be Resident (Previous 3 Years Resident) | Ties Needed (Not Resident in Previous 3 Years) |

16–45 | 4 ties | Not applicable |

46–90 | 3 ties | 4 ties |

91–120 | 2 ties | 3 ties |

121–182 | 1 tie | 2 ties |

Ties include:

Family tie: A spouse, partner, or minor child living in the UK.

Accommodation tie: A UK home available for your use for 91+ days.

Work tie: Working in the UK for 40+ days.

90-day tie: Spending 90+ days in the UK in either of the previous two tax years.

Country tie: Spending more days in the UK than any other country (only for previous residents).

Take Ailsa, a freelance coder who spent 80 days in the UK in 2024/25, with a UK-based partner and a flat she rents out. She was a UK resident in 2023/24. With two ties (family and accommodation) and 80 days, she’s a UK resident because she only needed one tie to tip the scale. Tracking ties is crucial, so use apps like NomadList to log your movements.

Can Split-Year Treatment Save You?

Here’s a game-changer for nomads: split-year treatment. If you leave the UK to work or live abroad partway through the tax year, you can split the year into a UK resident part and a non-resident part. This means you only pay UK tax on foreign income during the UK part. There are eight cases where this applies, like leaving for full-time work abroad or moving with a partner. You must claim this on your Self Assessment tax return, providing evidence like travel documents or employment contracts.

For instance, in July 2024, Rory left the UK to work full-time in Estonia as a remote developer. He claimed split-year treatment, so only his UK income from April to July 2024 was taxed as a resident. The rest was tax-free in the UK, though he paid Estonian taxes. Check HMRC’s RDR3 guidance for the exact cases.

Why Does Residency Matter for Your Taxes?

So, why all this fuss about residency? If you’re a UK tax resident, you owe tax on your worldwide income—freelance gigs in Dubai, dividends from a US client, or rental income from Spain. The 2024/25 tax bands are:

Income Band | Tax Rate |

Up to £12,570 (Personal Allowance) | 0% |

£12,571–£50,270 | 20% (Basic Rate) |

£50,271–£125,140 | 40% (Higher Rate) |

Over £125,140 | 45% (Additional Rate) |

Non-residents only pay tax on UK-sourced income, like rent from a London property. But here’s the kicker: even non-residents might face UK tax on specific income, so understanding your status is vital to avoid overpaying.

Mastering Double Taxation Agreements for Digital Nomads

What Are Double Taxation Agreements and Why Do They Matter?

Now, let’s tackle the elephant in the room: getting taxed twice on the same income is every digital nomad’s nightmare. You’re sipping coffee in Lisbon, freelancing for a UK client, and suddenly both Portugal and the UK want a slice of your earnings. Enter Double Taxation Agreements (DTAs)—treaties between the UK and other countries designed to prevent you from paying tax twice on the same income. As of April 2025, the UK has DTAs with over 130 countries, from Spain to Singapore, ensuring you’re not left penniless by double tax bills. These agreements are your lifeline, but they’re not automatic—you need to know how to use them.

How Do DTAs Actually Work?

So, how does a DTA save you? A DTA assigns taxing rights to one country—either the UK or the country where you’re working—based on the type of income and your residency status. For example, if you’re a UK non-resident freelancing in Thailand, the UK-Thailand DTA might state that your freelance income is only taxed in Thailand. Alternatively, if both countries can tax the income, you can claim relief in the UK, either as a tax credit (offsetting foreign tax paid) or an exemption.

Take Lachlan, a UK-based web developer who moved to Spain in 2024/25. He earns €50,000 from Spanish clients and pays €10,000 in Spanish tax. Without a DTA, the UK could tax this income at 20% (£8,000 on £40,000 after the personal allowance). The UK-Spain DTA allows Lachlan to claim a foreign tax credit, reducing his UK tax bill by the €10,000 already paid in Spain. He files a Self Assessment return with Form SA106 to claim this relief. Always check the specific DTA on GOV.UK, as terms vary by country.

How Can You Claim DTA Relief in Practice?

Be careful! Claiming DTA relief isn’t as simple as ticking a box. You’ll need to take action, and the process depends on whether you’re a UK resident or non-resident. Here’s a step-by-step guide to make it crystal clear:

Step-by-Step Guide: Claiming Double Taxation Relief

Determine Your Residency Status: Use the Statutory Residence Test (SRT) to confirm if you’re a UK tax resident. If you’re non-resident, you only need to worry about UK-sourced income.

Check the DTA: Visit GOV.UK’s “Double Taxation Agreements” page to find the treaty with the country you’re working in. Look for articles on your income type (e.g., employment, self-employment, dividends).

Gather Evidence: Keep records of foreign taxes paid (e.g., tax receipts, payslips) and proof of residency, like a Certificate of Residence from the foreign tax authority.

File a Self Assessment Return: UK residents must report worldwide income on their Self Assessment. Use Form SA106 to claim foreign tax credit relief or exemption under the DTA.

Apply for a Certificate of Residence: If the foreign country requires proof you’re a UK resident to grant DTA benefits, request a Certificate of Residence from HMRC using Form DT-Individual.

Submit Before Deadlines: For the 2024/25 tax year, file your online Self Assessment by 31 January 2026. Paper returns are due by 31 October 2025.

Seek Professional Help if Needed: If you’re juggling multiple countries, a tax advisor can ensure you’re claiming the right reliefs without errors.

For instance, Morag, a digital marketer, worked in Canada for six months in 2024, earning CAD 60,000 and paying CAD 12,000 in tax. As a UK resident, she used the UK-Canada DTA to claim a tax credit on her UK Self Assessment, offsetting the Canadian tax against her UK liability. She kept payslips and a Canadian tax certificate as evidence, avoiding a hefty double tax hit.

What Happens If There’s No DTA?

Now, here’s a curveball: not every country has a DTA with the UK. Think places like Costa Rica or the Bahamas. If you’re working in a non-DTA country, you’re at the mercy of unilateral relief, where the UK allows a tax credit for foreign taxes paid, but only up to the UK tax rate on that income. This can get messy if the foreign tax rate is higher.

Consider Finlay, a remote consultant in Dubai (no DTA with the UK) in 2024/25. He earns £50,000, paying 0% tax in Dubai but faces a 20% UK tax (£7,644 after personal allowance) as a UK resident. Since there’s no foreign tax to offset, he’s stuck with the full UK bill. If he’d worked in a high-tax non-DTA country like Brazil, he could claim unilateral relief, but only up to the UK rate. Always check tax rates in your host country to avoid surprises.

How Do DTAs Affect Different Types of Income?

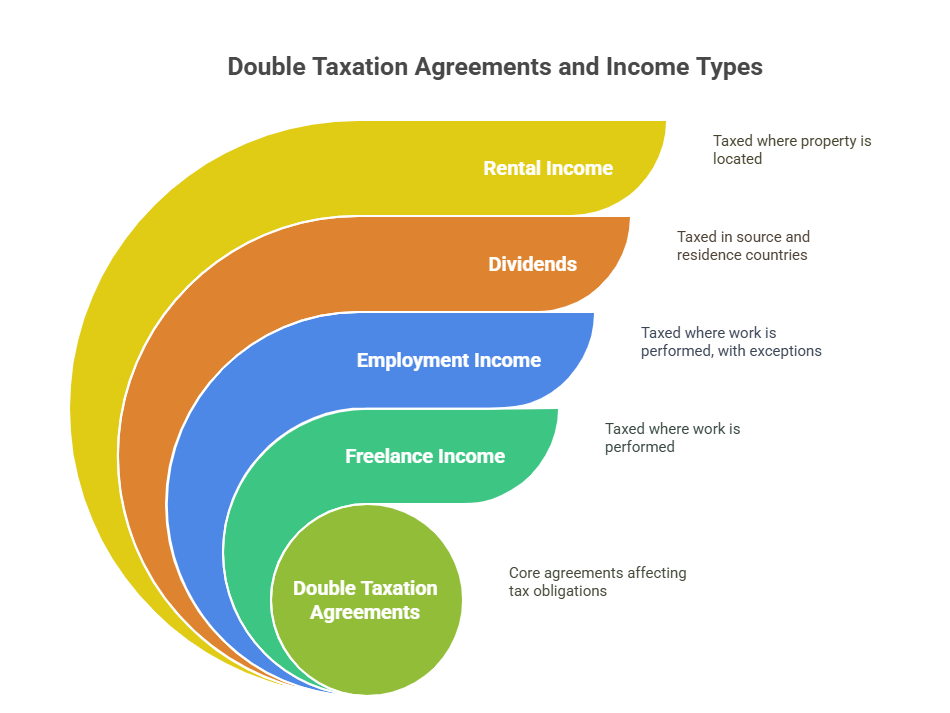

Not all income is treated the same under DTAs. Here’s a breakdown for digital nomads:

Income Type | DTA Treatment |

Freelance/Self-Employment | Usually taxed in the country where the work is performed, unless you have a fixed base (e.g., an office) in the UK. |

Employment Income | Taxed where the work is done, but if you’re employed by a UK company, the UK may have taxing rights. Check the DTA’s “dependent services” article. |

Dividends | Often taxed in both countries, but you can claim a credit for foreign tax paid. Some DTAs cap withholding tax rates (e.g., 15% in the US-UK DTA). |

Rental Income | Typically taxed in the country where the property is located, with relief claimed in the UK if you’re a resident. |

For example, Niamh, a UK resident, rents out a flat in London while working remotely in Germany. The UK-Germany DTA ensures her UK rental income is taxed in the UK, but her German freelance income is taxed in Germany, with a UK tax credit for German taxes paid. She uses HMRC’s HS264 form to report foreign property income.

What About National Insurance and Other Obligations?

Here’s something you might overlook: National Insurance (NI) contributions. If you’re working in an EU country, a Social Security Agreement (similar to a DTA) ensures you only pay NI in one country, usually where you work. For non-EU countries, you might still owe UK Class 2 NI (£3.45/week in 2024/25) as a self-employed nomad to maintain pension eligibility. Check GOV.UK’s NI guidance for country-specific rules.

Also, don’t forget visa rules. Working remotely in a country without a digital nomad visa (like Portugal’s, valid as of 2025) could trigger local tax residency, complicating DTA claims. For instance, Thailand’s 183-day rule might make you a tax resident there, even if you’re non-resident in the UK.

Can You Plan to Minimise Tax Liabilities?

Now, consider this: strategic planning can save you thousands. If you’re close to the 183-day UK threshold, cut your UK visits to fall under an automatic overseas test. Choose countries with favorable DTAs and low tax rates, like Portugal’s Non-Habitual Resident regime, which offers tax breaks for 10 years. Keep meticulous records—spreadsheets, travel apps, or even boarding passes—to prove your days and income sources to HMRC or foreign tax authorities.

For example, in 2023/24, Eilidh, a freelance writer, structured her year to spend 170 days in Portugal, 100 in the UK, and 95 elsewhere. By staying under 183 UK days and leveraging the UK-Portugal DTA, she avoided UK tax on her Portuguese income, claiming relief via SA106. She also applied for Portugal’s NHR status, slashing her local tax rate.

Key Takeaways for Digital Nomads on UK Tax Residency and Double Taxation

What Are the Most Critical Points to Remember?

Now, let’s wrap things up with the essentials you need to keep in mind as a digital nomad navigating UK tax residency and double taxation. This section distills the most important insights into a concise list of actionable takeaways, ensuring you can quickly grasp the key rules and strategies to stay compliant and minimise your tax burden. Each point is designed to help you make informed decisions, whether you’re freelancing from Bali or consulting in Berlin.

Why Should You Keep Detailed Records?

Let’s get real: HMRC doesn’t mess around. If you’re audited, you’ll need evidence to back up your residency claims and DTA relief applications. Use tools like Google Sheets or apps like NomadList to log your travel dates, workdays, and income sources. For instance, in 2024, Fiona, a remote UX designer, faced an HMRC audit. Her detailed travel log—showing 120 days in the UK, 150 in Croatia, and 95 elsewhere—proved she qualified for split-year treatment, saving her £5,000 in taxes. Keep boarding passes, contracts, and tax receipts handy, as they’re your golden ticket to avoiding disputes.

What Are the Risks of Getting It Wrong?

Be careful! Misjudging your residency or DTA claims can lead to hefty penalties. If you incorrectly claim non-resident status, HMRC can charge you back taxes plus interest (2.5% above base rate in 2025) and penalties up to 100% of the tax owed for deliberate errors. Similarly, failing to claim DTA relief could mean overpaying tax in both countries. In 2023/24, Alastair, a nomad developer, didn’t file Form SA106 for his US income, missing out on a $4,000 tax credit under the UK-US DTA. He later paid a tax advisor £1,500 to amend his return. Double-check your calculations and consider a tax professional for complex cases.

How Can You Stay Ahead of the Game?

Here’s the deal: tax rules evolve, and so should your strategy. HMRC’s guidance is updated annually, so check GOV.UK for the latest SRT rules and DTA texts before filing your 2024/25 Self Assessment by 31 January 2026. If you’re in a non-DTA country or juggling multiple income streams, consult a tax advisor familiar with nomad lifestyles—firms like RSM UK or BDO offer specialised services. Also, explore visa options like Estonia’s digital nomad visa, which aligns with low-tax regimes, to simplify compliance. Staying proactive keeps you out of HMRC’s crosshairs and your wallet fuller.

What’s the Big Picture for Nomads in 2025-26?

Now, consider this: the digital nomad lifestyle is booming, with over 40,000 UK remote workers abroad in 2024, per NomadList data. But tax complexity is the trade-off for freedom. By mastering the SRT, leveraging DTAs, and planning your stays, you can legally minimise your tax burden. For example, in 2024/25, Catriona, a freelance writer, spent 100 days in the UK, 150 in Malta (with a favorable DTA), and 115 in Thailand. By claiming split-year treatment and DTA relief, she reduced her UK tax liability by £6,200, proving that knowledge is power. Stay informed, keep records, and you’ll thrive as a tax-savvy nomad.

10 Key Takeaways for Digital Nomads

The Statutory Residence Test (SRT) determines your UK tax residency based on days spent in the UK, automatic tests, and ties like family or accommodation.

Spending fewer than 16 days in the UK in a tax year (2024/25) automatically makes you a non-resident, freeing you from UK tax on foreign income.

If you spend 183 days or more in the UK, you’re automatically a UK tax resident, liable for tax on your worldwide income at rates up to 45%.

The sufficient ties test combines UK days and ties (e.g., work, family) to determine residency if automatic tests don’t apply, so track your movements carefully.

Split-year treatment can exempt foreign income from UK tax if you leave for work abroad mid-tax year, but you must claim it on your Self Assessment.

Double Taxation Agreements (DTAs) with over 130 countries prevent double taxation by assigning taxing rights or allowing tax credits, verifiable on GOV.UK.

Claim DTA relief using Form SA106 on your Self Assessment, supported by evidence like foreign tax receipts or a Certificate of Residence from HMRC.

In non-DTA countries, unilateral relief limits foreign tax credits to the UK tax rate, so choose work locations with favorable DTAs like Portugal or Spain.

National Insurance contributions may still apply in the UK for self-employed nomads to maintain pension eligibility, even if you’re non-resident.

Strategic planning, like limiting UK days or choosing low-tax DTA countries, can significantly reduce your tax liability while staying compliant.

FAQs

Q1: What qualifies someone as a digital nomad for UK tax purposes?

A1: A digital nomad is typically a self-employed or remote worker who performs services from multiple countries, often without a fixed base, impacting their UK tax residency under the Statutory Residence Test.

Q2: How does the UK define a 'day' in the country for the Statutory Residence Test?

A2: A day in the UK is counted if an individual is present in the UK at midnight, with exceptions for transit or exceptional circumstances like illness.

Q3: Can a digital nomad be a UK tax resident and a resident of another country simultaneously?

A3: Yes, dual residency is possible, but Double Taxation Agreements often determine which country has primary taxing rights to avoid double taxation.

Q4: What is the role of a Certificate of Residence in claiming DTA relief?

A4: A Certificate of Residence from HMRC proves UK tax residency to foreign tax authorities, enabling digital nomads to claim benefits under a Double Taxation Agreement.

Q5: How does working remotely for a UK employer affect tax residency?

A5: Working remotely for a UK employer may create a work tie under the SRT, increasing the likelihood of being deemed a UK tax resident if other ties or days in the UK are significant.

Q6: What happens if a digital nomad misses the Self Assessment filing deadline?

A6: Missing the Self Assessment deadline (31 January for online, 31 October for paper) incurs a £100 penalty, with additional penalties for late payment or errors.

Q7: Can digital nomads claim tax relief on travel expenses?

A7: Self-employed digital nomads can claim travel expenses as business costs if they’re wholly and exclusively for work, but personal travel is not deductible.

Q8: How does the UK tax rental income from a property abroad?

A8: UK tax residents pay tax on worldwide rental income, but foreign tax paid can be offset via DTA relief or unilateral relief, reported on the Self Assessment.

Q9: What is the impact of a digital nomad’s visa status on tax residency?

A9: Visa status, like a digital nomad visa, can trigger local tax residency in the host country, potentially complicating UK residency and DTA claims.

Q10: Can digital nomads use tax software to manage their UK taxes?

A10: Yes, software like FreeAgent or QuickBooks can help track income, expenses, and days in the UK, simplifying Self Assessment and DTA relief calculations.

Q11: What are the penalties for incorrect residency status claims?

A11: Incorrectly claiming non-resident status can lead to back taxes, interest at 2.5% above the base rate, and penalties up to 100% for deliberate errors.

Q12: How does the UK tax dividends received from foreign companies?

A12: UK residents pay tax on foreign dividends, with relief for foreign tax paid under a DTA, typically at rates of 20%, 40%, or 45% based on income bands.

Q13: Can a digital nomad qualify for the UK’s Personal Savings Allowance?

A13: Yes, UK tax residents can use the Personal Savings Allowance (£1,000 for basic rate, £500 for higher rate) to reduce tax on foreign interest income.

Q14: What is the 90-day tie in the Statutory Residence Test?

A14: The 90-day tie applies if a digital nomad spent 90 or more days in the UK in either of the two previous tax years, counting as a tie toward residency.

Q15: How does a digital nomad prove their days spent abroad to HMRC?

A15: Proof includes travel documents, boarding passes, hotel receipts, or digital tracking apps showing time spent outside the UK.

Q16: Can digital nomads claim tax relief on home office expenses abroad?

A16: Self-employed nomads can claim home office expenses as business costs, provided they meet HMRC’s criteria for work-related expenditure, even abroad.

Q17: What is the impact of Brexit on EU-based digital nomads?

A17: Post-Brexit, UK nomads in the EU face stricter visa rules, and Social Security Agreements replace EU regulations for coordinating National Insurance.

Q18: How does a digital nomad handle taxes in a country without a DTA?

A18: Without a DTA, unilateral relief applies, capping foreign tax credits at the UK tax rate, which may result in higher overall tax if the foreign rate is higher.

Q19: Can digital nomads contribute to a UK pension while abroad?

A19: Yes, UK tax residents can contribute to a UK pension and claim tax relief, while non-residents may contribute but won’t receive UK tax relief.

Q20: What role does a tax advisor play for digital nomads?

A20: A tax advisor can navigate complex SRT scenarios, ensure accurate DTA claims, and optimise tax planning for nomads working across multiple countries.

About the Author

Mr. Maz Zaheer, FCA, AFA, MAAT, MBA, is the CEO and Chief Accountant of My Tax Accountant and Total Tax Accountants—two of the UK’s leading tax advisory firms. With over 14 years of hands-on experience in UK taxation, Maz is a seasoned expert in advising individuals, SMEs, and corporations on complex tax matters. A Fellow Chartered Accountant and a prolific tax writer, he is widely respected for simplifying intricate tax concepts through his popular articles. His professional insights empower UK taxpayers to navigate their financial obligations with clarity and confidence.

Disclaimer:

The information provided in our articles is for general informational purposes only and is not intended as professional advice. While we strive to keep the information up-to-date and correct, My Tax Accountant makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained in the articles for any purpose. Any reliance you place on such information is therefore strictly at your own risk. The graphs may also not be 100% reliable.

We encourage all readers to consult with a qualified professional before making any decisions based on the information provided. The tax and accounting rules in the UK are subject to change and can vary depending on individual circumstances. Therefore, My Tax Accountant cannot be held liable for any errors, omissions, or inaccuracies published. The firm is not responsible for any losses, injuries, or damages arising from the display or use of this information.

Comments