Every Way To Extract Money From Your Ltd.

- MAZ

- 4 minutes ago

- 9 min read

Every Way to Extract Money From Your LTD in the UK – Losses and Gains

The Core Strategies for Taking Money Out of Your Limited Company in 2026/27

Picture this: You've built a successful limited company, profits are rolling in, and now you're wondering how to get that money into your own pocket without HMRC taking a massive bite. Over my 18 years advising business owners across the UK – from tech startups in Manchester to family firms in London – I've seen directors leave thousands on the table simply because they stuck to the old "salary plus dividends" routine without reviewing the options.

The truth is, there isn't one "best" way to extract profits. It depends on your company's profit levels, your personal tax position, whether you have family shareholders, and longer-term goals like retirement planning or selling the business. But with the significant changes from the Autumn Budget 2024 – particularly the hike in employer National Insurance to 15% and the lowered secondary threshold to £5,000 from April 2025 – the landscape has shifted dramatically for the 2025/26 tax year.

Why Profit Extraction Matters More Than Ever in 2026/27

Corporation tax rates remain stable: 19% on profits up to £50,000, marginal relief between £50,000 and £250,000, and 25% above £250,000. That's unchanged. But the real sting comes from employer NICs now at 15% on salaries above £5,000 per employee. The Employment Allowance has risen to £10,500 (and the £100,000 cap removed), which helps many small companies offset this entirely.

On the personal side, the personal allowance stays frozen at £12,570, dividend allowance at just £500, and dividend tax rates hold at 8.75% (basic), 33.75% (higher), and 39.35% (additional) for 2025/26 – though brace for increases from April 2026.

In my experience, directors who review their strategy annually keep 10-20% more of their profits. Let's break down the main methods, with real calculations based on current rules.

Salary: The Reliable but Costly Option

Paying yourself a salary is straightforward – it's deductible for corporation tax, qualifies for state pension, and can use your personal allowance.

For most single-director companies in 2025/26, the sweet spot is £12,570. No employee NICs, no income tax, and the company pays employer NICs on only £7,570 (£12,570 minus £5,000 threshold) at 15% – about £1,135.50. If your company qualifies for the full £10,500 Employment Allowance (most do, except sole-director with no other employees), employer NICs drop to zero.

Quick Salary Impact Table for 2026/27 (Single Director Company)

Salary Level | Personal Tax/NIC | Company Employer NIC (before Allowance) | Net Cost to Company | Notes |

£5,000 | £0 | £0 | £5,000 | No qualifying year for state pension |

£6,500 | £0 | £225 | ~£6,725 | Minimum for NIC credit (LEL £6,396) |

£12,570 | £0 | £1,135.50 | ~£13,705 | Uses full personal allowance; often optimal if Allowance covers NIC |

Be careful here – I've seen clients push salary higher thinking it "saves tax," but with 15% employer NICs, it rarely does unless you have multiple employees to absorb the Allowance.

Dividends: Still the Go-To for Most Directors

Dividends remain popular because no NICs apply, and rates are lower than income tax.

You can only pay dividends from retained profits after corporation tax. The first £500 is tax-free, then taxed at your marginal rate.

Dividend Tax Rates 2026/27

Tax Band | Rate on Dividends > £500 |

Basic (up to £50,270 total income) | 8.75% |

Higher (£50,271-£125,140) | 33.75% |

Additional (>£125,140) | 39.35% |

Example: Company profits £100,000 (at 25% CT = £25,000 tax, £75,000 left). Director takes £12,570 salary (assuming Allowance covers NIC), then dividends £62,430 to fill basic band.

Total take-home: High 80s%, far better than pure salary.

In my years advising, involving a spouse or civil partner with unused allowances can double effectiveness – alphabet shares make this easy.

Pension Contributions: The Tax Triple Win

None of us loves thinking about retirement when the business is booming, but company pension contributions are often the most efficient extraction method.

The company gets full corporation tax relief (19-25%), no employer NICs, and contributions grow tax-free. Annual allowance £60,000 (or relevant earnings), plus carry forward.

For higher earners, this avoids the 60% effective tax trap when personal allowance tapers.

Hypothetical: Tom, London director, £150,000 profits. Instead of dividends (pushing him into additional rate), company contributes £40,000 to SIPP. Saves ~£10,000 CT, no NICs, and Tom gets higher/additional rate relief effectively.

I've had clients build £500k+ pots this way while slashing current tax.

Other Methods: Loans, Benefits, Expenses, and Wind-Up

● Director's Loans: Repay tax-free if credit balance. Overdrawn? 33.75% s455 tax if not repaid in 9 months (refundable later).

● Benefits in Kind: Company car? Taxable (2% for EV). Private health? Often worth it, but Class 1A NIC at 15%.

● Expenses: Reimburse mileage (45p/mile first 10,000) tax-free.

● On Wind-Up: If closing, Members' Voluntary Liquidation can treat reserves as capital – CGT at 20% (or 14% with BADR if qualifying), often better than dividends.

The big question: Which combination for you? In 2025/26, with higher employer NICs, lean towards lower salary, higher dividends/pensions.

Optimising Your Mix: Real-World Calculations and Common Pitfalls for 2026/27

So, the big question on your mind might be: "What's the optimal salary/dividend split now employer NICs are 15%?"

Let's run numbers for typical scenarios.

Scenario 1: £60,000 Profit Company (19% CT)

Company pays CT £11,400, £48,600 left.

Option A: Salary £12,570 (Allowance covers NIC), dividends £48,600.

Personal tax: Dividends use remaining PA £0, £500 tax-free, rest basic rate 8.75% ≈ £4,209.

Take-home ≈ £56,961 (95% efficient).

Option B: All dividends (salary £0).

Saves company NIC, but lose PA – worse.

Pension £20,000: Reduces CT by £3,800, powerful add-on.

Scenario 2: £150,000 Profit (25% CT)

Higher NIC impact.

Optimal often £12,570 salary + pensions to stay basic/higher band + dividends.

Pitfall I've seen: Directors ignoring tapered annual allowance over £260,000 adjusted income.

Family Involvement and Advanced Tactics

If married, issue shares to lower-tax spouse.

Example: Sarah and Mike, both shareholders. Split dividends – use two £12,570 PA + two £500 allowances.

Saves thousands.

Rent home office: Company pays £6/week tax-free, or higher if justified.

Electric car: 2% BIK – cheap motoring.

Losses: When Extraction Goes Wrong

Overdraw loan without planning? 33.75% tax.

Pay illegal dividend? Personal tax + company penalties.

I've rescued clients from these – always document.

Your Personal Extraction Worksheet

Grab a pen – quick checklist:

Company profits before extraction? ____

Desired take-home? ____

Other income? ____

Spouse allowances available? Y/N

Pension goals? ____ contribution planned

Rough calc: Aim salary £9,100-£12,570, pensions first for high profits, dividends rest.

Consult professional – rules nuanced.

Your Options to Every Way To Extract Money From Your Ltd.

Advanced Strategies and Planning for 2026 Changes

Now, let's think longer-term.

From April 2026, dividend rates rise 2pp – basic 10.75%, higher 35.75%.

Consider accelerating dividends before then.

Pensions even more attractive.

For sale? Retain profits for BADR (14% CGT from 2025).

In my practice, best results from annual review.

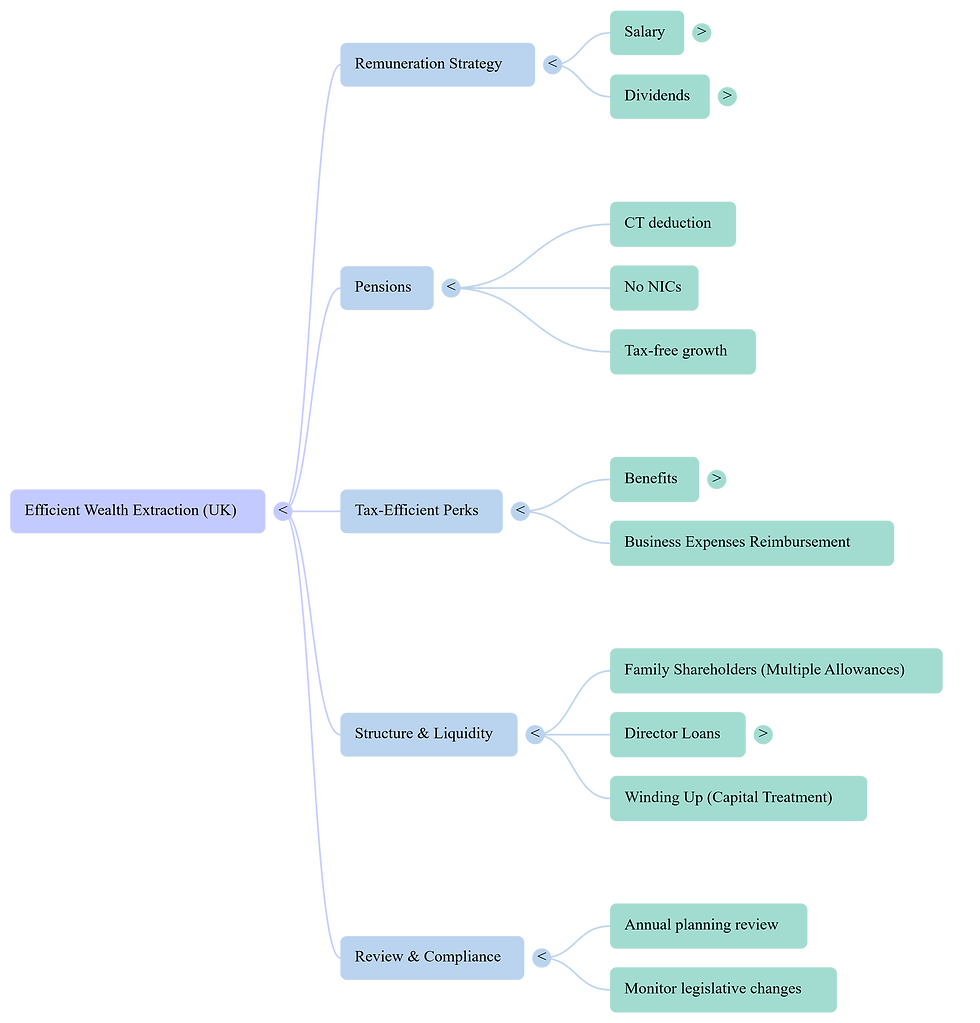

Summary of Key Points

Salary up to £12,570 often optimal, especially with Employment Allowance covering NICs.

Dividends remain efficient despite low £500 allowance – no NICs.

Pension contributions provide triple tax relief: CT deduction, no NICs, tax-free growth.

Employer NIC rise to 15% makes higher salaries costlier for small companies.

Involve family shareholders to multiply allowances.

Director loans useful short-term but risky if overdrawn.

Benefits like EV cars or health insurance can be low-tax perks.

Expenses reimbursement tax-free if business-related.

On wind-up, capital treatment often beats income tax.

Review annually – upcoming 2026 dividend hikes make planning urgent.

FAQS

Q1: What happens if a director accidentally pays an illegal dividend from a limited company?

A1: Well, it's a common worry I've heard from clients over the years – declaring a dividend when retained profits aren't quite there. In practice, HMRC treats it as an overdrawn director's loan, triggering the s455 corporation tax charge at 33.75% if not repaid within nine months of the year-end. I've helped several owners in the Midlands rectify this by waiving the dividend or repaying quickly, often reclaiming the tax later. The key is spotting it early through proper interim accounts.

Q2: Can a limited company director claim the Employment Allowance after the 2025 National Insurance changes?

A2: In my experience advising sole-director companies, the big shift in 2025 was the Employment Allowance rising to £10,500 with the £100,000 cap removed – fantastic news for most. However, if you're the only employee, you still can't claim it against your own salary NICs. I've seen multi-director setups or those hiring part-timers suddenly wipe out their entire employer NIC bill.

Q3: How does involving a spouse as a shareholder affect profit extraction in a family limited company?

A3: Picture this: a client couple in Bristol running a consultancy – by issuing shares to the lower-earning spouse, they effectively doubled their personal allowances and £500 dividend allowances. It turned one basic rate band into two, saving thousands annually. Just ensure genuine involvement to avoid HMRC challenges; alphabet shares make it straightforward.

Q4: Is it worth charging rent to a limited company for using a home office as a director?

A4: Absolutely, and it's one of those overlooked gems. Many directors I advise reimburse the flat £6 weekly rate tax-free, but if properly justified with room usage calculations, you can charge market rent – deductible for the company, often tax-efficient overall. One retail owner client saved noticeably by formalising a licence agreement.

Q5: What are the tax implications of providing an electric company car to a director in 2025/26?

A5: With the benefit-in-kind rate still at a low 2% for pure EVs, it's often a no-brainer for higher earners. No fuel benefit either if fully electric. I've had tech director clients switch from cash dividends, slashing their personal tax while the company claims capital allowances – far better than a fossil fuel car at higher rates.

Q6: How can a director repay an overdrawn loan account without triggering extra tax?

A6: The trick is timing – repay before the nine-month deadline to avoid s455 tax entirely, or use a dividend waiver if profits allow (crediting the loan). Bed-and-breakfasting rules catch quick redraws, so plan properly. A manufacturing client once used bonus salary to clear it, getting CT relief.

Q7: Can a limited company make pension contributions for a director over the £60,000 annual allowance?

A7: Yes, via carry forward from the previous three years if unused allowance exists – I've helped high-profit directors contribute £100k+ in one go, gaining full corporation tax relief. Just watch the tapered allowance if adjusted income exceeds £260,000; it's a powerful deferral tool.

Q8: What happens if a director forgets to issue dividend vouchers for payments taken?

A8: It's a paperwork slip I've rescued many from – without vouchers and board minutes, HMRC may reclassify as salary, hitting with backdated NICs and penalties. Retroactive vouchers can sometimes fix it if contemporaneous, but better to set up a simple template system from the start.

Q9: Is reimbursing mileage at 45p per mile still fully tax-free for directors in 2025/26?

A9: Yes, for the first 10,000 business miles, then 25p – no NICs or tax if properly logged. Clients with fieldwork, like surveyors, extract thousands this way annually. Advisory fuel rates for company cars work similarly if reclaiming fuel.

Q10: How does closing a limited company affect extracting remaining profits tax-efficiently?

A10: Through Members' Voluntary Liquidation, reserves often qualify as capital distribution, taxed at CGT rates (up to 20%, or 14% with Business Asset Disposal Relief if conditions met) – usually beating dividend tax. I've guided retiring owners to far lower effective rates than ongoing extraction.

Q11: Can a director extract money tax-free by selling shares back to the company?

A11: In certain cases, yes – a share buyback can treat proceeds as capital, potentially with BADR at 14%. But strict rules apply: not wholly for tax avoidance, and company must have distributable reserves. It's niche but saved substantial tax for one exiting minority shareholder client.

Q12: What if a limited company has accumulated losses – can directors still pay dividends?

A12: No, dividends require distributable profits after all prior losses – a pitfall I've seen trip up growing firms post-startup dips. Offset current profits first; sometimes restructuring or relief claims help unlock reserves.

Q13: Is private health insurance a tax-efficient benefit for directors?

A13: The company pays premium (CT deductible), but it's a taxable benefit with Class 1A NIC at 15%. For many, the convenience outweighs the cost, especially families – one consultant client found it net positive versus personal policy.

Q14: How do director loans over £10,000 affect personal tax?

A14: If not at official interest rate, HMRC imputes a benefit-in-kind, taxed personally, plus company Class 1A. Charging at least the official rate (around 2-3%) avoids this – simple to document.

Q15: Can a limited company contribute to a director's personal ISA or other investments?

A15: No, that's not allowable – would be treated as a distribution or benefit. Stick to pensions for tax-relieved growth; direct investments trigger full tax/NICs.

About the Author

Maz Zaheer, AFA, MAAT, MBA, is the CEO and Chief Accountant of MTA and Total Tax Accountants, two premier UK tax advisory firms. With over 15 years of expertise in UK taxation, Maz provides authoritative guidance to individuals, SMEs, and corporations on complex tax issues. As a Tax Accountant and an accomplished tax writer, he is renowned for breaking down intricate tax concepts into clear, accessible content. His insights equip UK taxpayers with the knowledge and confidence to manage their financial obligations effectively.

Disclaimer:

The information provided in our articles is for general informational purposes only and is not intended as professional advice. While we strive to keep the information up-to-date and correct, MTA makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained in the articles for any purpose. Any reliance you place on such information is therefore strictly at your own risk. The graphs may also not be 100% reliable.

We encourage all readers to consult with a qualified professional before making any decisions based on the information provided. The tax and accounting rules in the UK are subject to change and can vary depending on individual circumstances. Therefore, MTA cannot be held liable for any errors, omissions, or inaccuracies published. The firm is not responsible for any losses, injuries, or damages arising from the display or use of this information.

Comments