HMRC's Cest Tool

- MAZ

- Aug 9, 2025

- 14 min read

Updated: Sep 11, 2025

The Audio Summary of the Key Points of the Article:

Understanding the HMRC CEST Tool and Its Role in IR35 Compliance

What Is the HMRC CEST Tool and Why Should You Care?

Now, if you’re a contractor or a business owner hiring freelancers, you’ve probably stumbled across the term “CEST” while grappling with tax rules. The Check Employment Status for Tax (CEST) tool, hosted on GOV.UK, is HMRC’s free online tool designed to determine whether a worker should be classified as employed or self-employed for tax and National Insurance contributions (NICs). It’s a cornerstone of IR35 compliance, helping you figure out if off-payroll working rules apply to a contract. Getting this right is crucial—misclassify a worker, and you could face hefty tax bills or penalties. In 2025, with HMRC pushing for 90% digital interactions by 2030, CEST is more relevant than ever for simplifying tax compliance.

The tool asks a series of questions about the working relationship—things like who controls the work, whether the worker can send a substitute, and if they bear financial risk. Based on your answers, CEST spits out a determination: “employed,” “self-employed,” or, in about 20% of cases, “unable to determine.” HMRC promises to stand by CEST’s results, provided your inputs are accurate and align with their guidance. But, as we’ll see, that promise comes with caveats.

How Does IR35 Fit Into This?

Let’s get to grips with IR35, because CEST exists to tackle its complexities. IR35, or the off-payroll working rules, was introduced to stop workers from using personal service companies (PSCs) to dodge taxes by posing as self-employed when they’re effectively employees. Since April 2021, medium and large private sector businesses (and all public sector ones) must determine the IR35 status of their contractors. If a worker is “inside IR35,” they’re treated as an employee for tax purposes, meaning PAYE and NICs apply. If “outside IR35,” they’re self-employed, handling their own taxes via Self Assessment.

For the 2025/26 tax year, IR35 rules apply to businesses with an annual turnover above £10.2 million, a balance sheet total over £5.1 million, or more than 50 employees. Small businesses are exempt, leaving the contractor’s PSC to determine status. CEST is HMRC’s go-to tool for making these calls, but it’s not mandatory—you can use other methods, though HMRC’s backing makes CEST appealing.

What’s New with CEST in 2025?

Now, it shouldn’t surprise you that HMRC tweaks CEST periodically to keep it user-friendly. The latest update, rolled out on 30 April 2025, focused on simplifying the tool’s language, adding guidance links, and improving usability without changing its core logic. HMRC moved CEST to the OCELOT platform in October 2023, making it easier to update, and the 2025 revision added pre-requisite questions and clarified wording to reduce ambiguity.

Importantly, HMRC confirmed that previous “outside IR35” results from before the update still stand, so you don’t need to rerun old assessments unless the contract has changed.

This update aligns with HMRC’s broader digital transformation roadmap, aiming for 90% digital interactions by 2030. For example, CEST now integrates better with HMRC’s online services, like the Personal Tax Account, where you can check your tax code or allowances. However, critics argue the update is a “functionality facelift” rather than a fix for CEST’s deeper flaws, like its high “undetermined” rate.

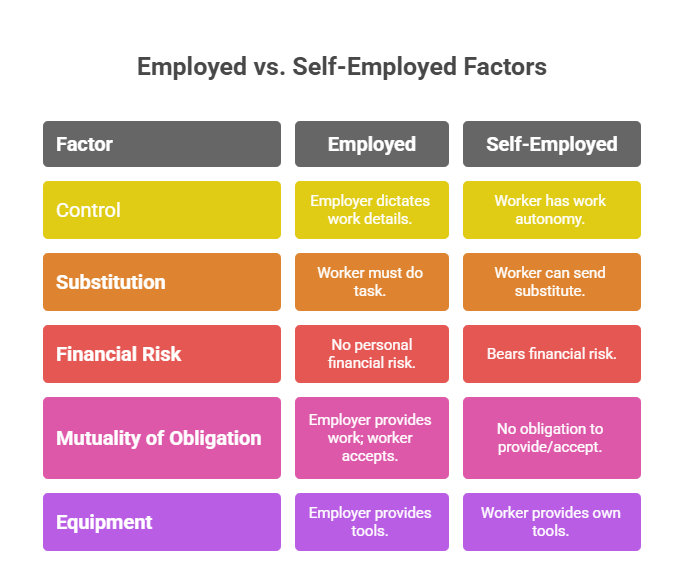

Employed vs. Self-Employed: Key Factors CEST Considers

So, how does CEST decide if you’re employed or self-employed? It hinges on factors like control, substitution, and financial risk. Here’s a table breaking down the main criteria, based on HMRC’s Employment Status Manual (ESM11000):

Factor | Employed | Self-Employed |

Control | Employer dictates how, when, and where work is done | Worker has autonomy over work methods and schedule |

Substitution | Worker must perform the task personally | Worker can send a substitute |

Financial Risk | No personal financial risk (e.g., fixed salary) | Bears risk (e.g., unpaid invoices, equipment costs) |

Mutuality of Obligation | Employer must provide work; worker must accept | No obligation to provide or accept work |

Equipment | Employer provides tools/equipment | Worker provides own tools/equipment |

These factors stem from case law, like the 2023 PGMOL v HMRC case, which clarified mutuality of obligation. For instance, if a contract labels you as self-employed but the client controls your hours and tasks, CEST might deem you “inside IR35.”

Case Study: Ewan’s Freelance Dilemma

Consider this: Ewan, a freelance graphic designer in Manchester, takes a six-month contract with a marketing agency in 2025. The agency uses CEST to assess his status. Ewan works remotely, sets his own hours, and uses his own laptop, but the contract requires him to attend weekly meetings and follow strict project guidelines. CEST returns an “employed” result, placing Ewan inside IR35. This means the agency deducts PAYE and NICs, reducing his take-home pay. Frustrated, Ewan wonders if he can challenge the result or adjust the contract to reflect true self-employment.

Using the HMRC CEST Tool Effectively: Practical Tips and Pitfalls

How Do You Actually Use the CEST Tool?

Right, let’s get practical: using the CEST tool isn’t rocket science, but it’s not a quick click-and-done job either. The Check Employment Status for Tax (CEST) tool, available on GOV.UK, is designed to be user-friendly, guiding you through a series of questions about your working relationship. You’ll need details about the contract, working practices, and responsibilities. It takes about 10-15 minutes if you’re prepared. The tool is anonymous, doesn’t store your data, and provides a downloadable PDF result, which is handy for record-keeping.

To start, you answer questions about the worker’s role, such as whether they can send a substitute, how much control the client has, and whether they bear financial risk. The April 2025 update added pre-requisite questions to clarify the context, like whether the worker operates through a personal service company (PSC). Be ready with contract documents or a clear understanding of the working arrangement, as vague answers lead to vague results—more on that later.

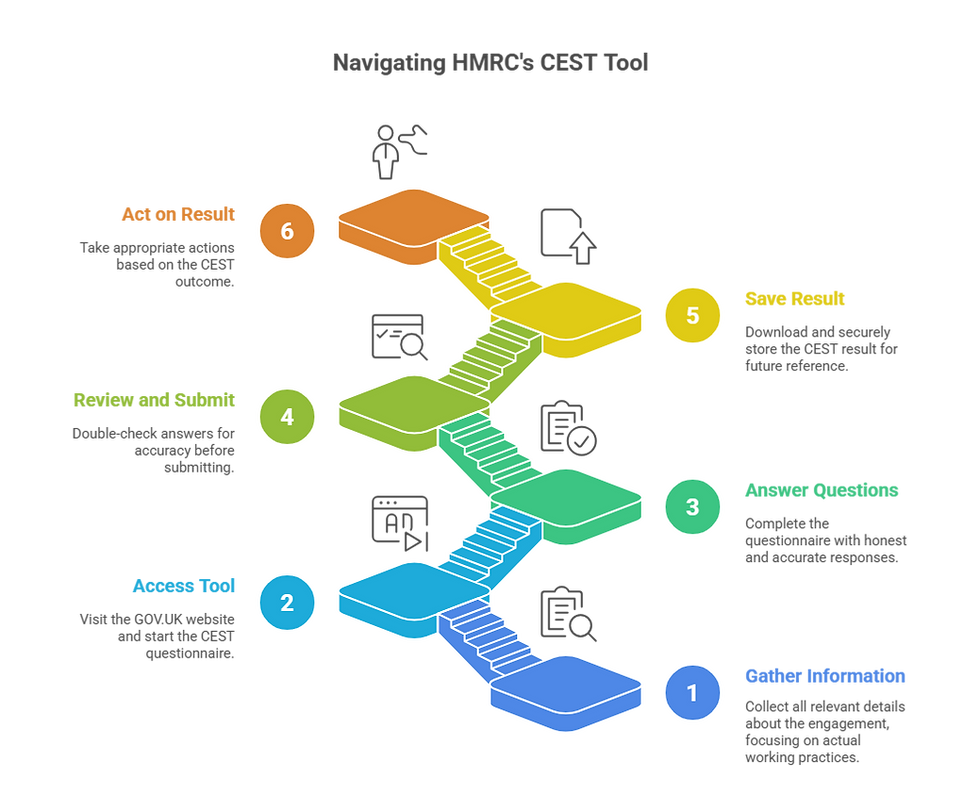

Step-by-Step Guide to Navigating CEST

So, you’re ready to tackle CEST? Here’s a step-by-step guide to make it as smooth as possible:

Gather Your Information: Before starting, review the contract and actual working practices. Note details like who sets the worker’s schedule, whether they provide their own equipment, and if they can refuse work.

Access the Tool: Visit GOV.UK and click “Start Now.” No login is required.

Answer Pre-Requisite Questions: Confirm whether the worker is an individual, PSC, or agency worker, and if the engager is public or private sector.

Complete the Questionnaire: Answer questions honestly, focusing on the reality of the working relationship, not just the contract’s wording. For example, if the contract says “self-employed” but the client micromanages tasks, reflect that.

Review and Submit: Double-check your answers for accuracy. Submit to get a result: “employed,” “self-employed,” or “unable to determine.”

Save the Result: Download the PDF output, which includes a unique reference number. Keep this for HMRC audits or disputes.

Act on the Result: If “inside IR35,” ensure PAYE and NICs are deducted. If “outside,” the worker handles their own taxes via Self Assessment. If “undetermined,” seek professional advice.

This guide assumes you’re entering accurate data. HMRC’s stance, per their 2025 guidance, is that they’ll stand by CEST outcomes if inputs reflect the true arrangement and align with the Employment Status Manual (ESM11000).

What Are the Common Mistakes to Avoid?

Now, here’s where things can go pear-shaped: many users trip up because they rush or misinterpret CEST’s questions. One big mistake is entering what the contract says rather than what actually happens. For instance, a contract might allow substitution, but if the client insists on the worker personally doing the job, you must reflect that reality. HMRC audits focus on actual practices, not just paperwork.

Another pitfall is vagueness. If you select “don’t know” too often, CEST is more likely to return an “undetermined” result—about 20% of cases, according to HMRC’s 2024 data. This leaves you in limbo, forcing you to either reassess or hire a tax advisor. Also, don’t assume CEST covers all scenarios; it doesn’t account for complex cases like umbrella companies or niche industries. For example, a 2024 case involving a freelance animator showed CEST struggled with creative roles where control and substitution are ambiguous.

What Are CEST’s Limitations?

Be careful! CEST isn’t a magic bullet. Critics, including tax bodies like the Chartered Institute of Taxation, point out its flaws. For one, it doesn’t consider all case law factors, like “mutuality of obligation” in depth, despite the 2023 PGMOL v HMRC case clarifying its importance. The tool’s binary approach—employed or self-employed—can oversimplify complex arrangements, leading to that pesky 20% “undetermined” rate.

Another issue is its lack of nuance for niche sectors. Take Fiona, a freelance costume designer in London’s theatre industry in 2025. Her contract involves short-term projects with high autonomy, but she works on-site with provided materials. CEST might lean toward “employed” due to the equipment factor, ignoring her broader self-employed status across multiple clients. Similarly, workers under umbrella companies—where a third party handles payroll—often get unclear results because CEST isn’t designed for such setups.

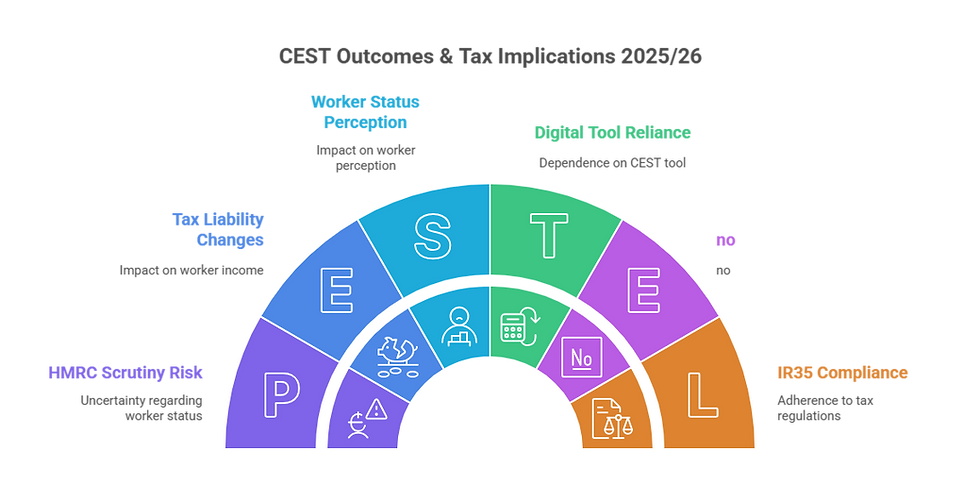

Here’s a table summarising CEST outcomes and their tax implications for the 2025/26 tax year:

CEST Outcome | Tax Implication | Action Required |

Employed (Inside IR35) | PAYE and NICs deducted by engager. Worker taxed as employee. | Engager withholds tax/NICs; worker may lose tax flexibility. |

Self-Employed (Outside IR35) | Worker handles taxes via Self Assessment. No PAYE/NICs by engager. | Worker files taxes, claims expenses. Check GOV.UK. |

Unable to Determine | No clear status. Risk of HMRC scrutiny. | Seek professional advice or reassess contract. |

How Can You Handle Niche Scenarios?

Now, consider this: if you’re in a less straightforward industry—like creative, tech, or consultancy—CEST can feel like it’s missing the mark. For example, a 2024 HMRC review noted that CEST struggles with gig economy workers, where short-term contracts blur the line between employed and self-employed. If you’re a business owner hiring a sound engineer for a one-off festival, CEST might not capture the temporary nature of the gig.

To navigate this, document everything meticulously—contracts, emails, and work schedules. If CEST gives an “undetermined” result, consult a tax advisor familiar with your sector. You can also use HMRC’s helpline (0300 200 3300) for guidance, though response times in 2025 average 10-15 minutes due to high demand. For umbrella company workers, consider bypassing CEST and seeking a specialist, as the tool doesn’t account for intermediary payroll structures.

Case Study: Ayesha’s Consultancy Conundrum

Let’s look at Ayesha, an IT consultant in Bristol operating through her PSC in 2025. Her client, a large tech firm, runs CEST and gets an “undetermined” result because Ayesha’s contract allows substitution, but she’s never used it, and the client provides some software. The firm, wary of HMRC penalties (which can reach 100% of unpaid tax), insists on treating her as inside IR35, docking PAYE. Ayesha disputes this, believing her autonomy and multiple clients prove self-employment. She contacts a tax advisor, who reviews her working practices and negotiates contract tweaks to clarify her status. This highlights the importance of accurate inputs and professional backup when CEST falls short.

This part arms you with practical know-how to use CEST effectively and dodge common errors. Next, we’ll wrap up with key takeaways and strategies for mastering IR35 compliance.

Key Takeaways for Mastering CEST and IR35 Compliance

What Are the Most Critical Points to Remember?

So, the question is: how do you wrap your head around the CEST tool and IR35 without losing the plot? After diving deep into the tool’s mechanics and quirks, here are the 10 most important points to keep in your back pocket. Each one is designed to help you navigate tax compliance with confidence, whether you’re a contractor or a business owner.

The CEST tool, found on GOV.UK, determines if a worker is employed or self-employed for tax and NICs purposes, critical for IR35 compliance.

IR35 rules apply to medium and large businesses in 2025/26, defined as those with turnover above £10.2 million, balance sheet over £5.1 million, or more than 50 employees.

CEST’s April 2025 update improved usability with clearer questions and OCELOT platform integration, but didn’t change its core logic, so old “outside IR35” results remain valid.

Accurate inputs reflecting actual working practices—not just contract wording—are essential for reliable CEST results, as HMRC audits focus on reality.

CEST considers factors like control, substitution, and financial risk, drawn from case law like the 2023 PGMOL v HMRC case, to assess employment status.

About 20% of CEST results are “undetermined,” requiring professional advice or contract reviews to avoid HMRC scrutiny.

Niche industries, like creative or gig economy roles, may get inaccurate CEST outcomes due to the tool’s limited nuance for complex arrangements.

If CEST deems a worker “inside IR35,” the engager must deduct PAYE and NICs; “outside IR35” means the worker handles taxes via Self Assessment.

Document all working arrangements meticulously—contracts, emails, schedules—to support CEST results or defend against HMRC disputes.

HMRC’s digital transformation, aiming for 90% digital interactions by 2030, makes CEST a key part of streamlined tax compliance, integrated with tools like the Personal Tax Account.

How Can You Challenge a CEST Result?

Now, if CEST hands you a result you don’t agree with, don’t panic—it’s not the final word. Let’s say you’re like Ewan from our earlier case study, stuck with an “inside IR35” label despite feeling self-employed. First, double-check your inputs. Did you accurately reflect the working relationship? If you overstated the client’s control or forgot to mention your right to send a substitute, rerun the tool with corrected answers.

If the result still feels off, you can challenge it by gathering evidence of your self-employed status—think invoices, multiple client contracts, or proof of financial risk (e.g., unpaid work or equipment costs). Contact HMRC’s helpline (0300 200 3300) to discuss, but be prepared for wait times, as 2025 data shows averages of 10-15 minutes. Alternatively, a tax advisor can review your case, especially for complex setups like umbrella companies. In 2024, HMRC handled 1,200 IR35 disputes, with 60% resolved in favour of the taxpayer when evidence was robust, per their annual report.

Why Does CEST Fit Into HMRC’s Bigger Picture?

Let’s zoom out for a moment: CEST isn’t just a standalone tool; it’s part of HMRC’s push to digitise tax by 2030. With 90% of interactions expected to be digital, tools like CEST and the Personal Tax Account (check your tax code at GOV.UK) are streamlining compliance. This shift saves time but also puts pressure on you to get things right digitally. For instance, HMRC’s Making Tax Digital (MTD) initiative, mandatory for VAT-registered businesses since 2019, will extend to income tax by 2027, meaning accurate CEST use could tie into your broader digital tax obligations.

However, the digital push has critics. A 2024 survey by the Federation of Small Businesses found 45% of contractors worry about CEST’s oversimplification, especially in creative sectors. If you’re in a niche field, like Fiona the costume designer, consider supplementing CEST with professional advice to ensure your digital tax records align with HMRC’s expectations.

Case Study: Rhys’ Gig Economy Struggle

Consider Rhys, a freelance sound technician in Cardiff working on short-term festival gigs in 2025. His client, a small events company exempt from IR35 rules, uses CEST and gets an “undetermined” result due to the gig’s temporary nature and mixed control factors. Rhys, operating through his PSC, believes he’s self-employed, as he works for multiple clients and provides his own equipment. He hires a tax advisor who compiles evidence—contracts from three festivals and receipts for his sound gear—to argue his case. The advisor negotiates with the client to clarify the contract, securing an “outside IR35” status on a second CEST run. This saves Rhys from PAYE deductions, boosting his take-home pay. Rhys’ story shows how persistence and documentation can turn a tricky CEST result into a win.

This final part ties together the essentials, giving you clear, actionable insights to master CEST and stay on the right side of IR35. Keep these points handy, and you’ll be better equipped to navigate the tax maze with confidence.

FAQs

Q1: What is the purpose of HMRC’s CEST tool?

A1: The CEST tool helps determine whether a worker should be classified as employed or self-employed for tax and National Insurance contributions, primarily to ensure compliance with IR35 off-payroll working rules.

Q2: Who needs to use the CEST tool?

A2: Contractors, freelancers, and businesses hiring workers through personal service companies or intermediaries use the CEST tool to assess IR35 status, especially for medium and large businesses.

Q3: Is the CEST tool mandatory for IR35 compliance?

A3: No, using the CEST tool is not mandatory; businesses and contractors can use other methods to determine IR35 status, but HMRC supports CEST results if inputs are accurate.

Q4: How long does it take to complete the CEST tool?

A4: Completing the CEST tool typically takes 10-15 minutes, depending on how well-prepared the user is with contract and working practice details.

Q5: Does the CEST tool store user data?

A5: The CEST tool is anonymous and does not store user data, but it generates a downloadable PDF result with a unique reference number for record-keeping.

Q6: Can the CEST tool be used for all types of contracts?

A6: The CEST tool is designed for most contractor engagements but may struggle with complex arrangements, such as those involving umbrella companies or niche industries.

Q7: What happens if the CEST tool returns an “undetermined” result?

A7: An “undetermined” result means the tool cannot classify the worker’s status, and users should seek professional tax advice or review the contract for clarity.

Q8: How accurate is the CEST tool in determining IR35 status?

A8: The CEST tool is accurate when inputs reflect the actual working relationship, but its 20% “undetermined” rate and limited nuance for complex cases can reduce reliability.

Q9: Can a CEST result be used as evidence in an HMRC audit?

A9: Yes, HMRC will stand by a CEST result during an audit if the inputs accurately reflect the working arrangement and align with their guidance.

Q10: Does the CEST tool apply to small businesses?

A10: Small businesses, with turnover below £10.2 million, balance sheet under £5.1 million, and fewer than 50 employees, are exempt from IR35, so the contractor’s PSC typically uses CEST.

Q11: Can a worker challenge a CEST “inside IR35” result?

A11: A worker can challenge an “inside IR35” result by reviewing inputs for accuracy, gathering evidence of self-employment, and consulting HMRC or a tax advisor.

Q12: How does the CEST tool handle substitution clauses in contracts?

A12: The tool assesses whether a worker can genuinely send a substitute to perform the work, focusing on whether this right is exercised in practice, not just stated in the contract.

Q13: What role does “control” play in the CEST tool’s assessment?

A13: Control is a key factor; if the client dictates how, when, and where the work is done, the CEST tool is more likely to classify the worker as employed.

Q14: Can the CEST tool be used for public sector contracts?

A14: Yes, the CEST tool applies to public sector contracts, where engagers are responsible for determining IR35 status for all workers, regardless of business size.

Q15: How does the CEST tool affect a worker’s take-home pay?

A15: An “inside IR35” result means PAYE and NICs are deducted by the engager, reducing take-home pay, while “outside IR35” allows the worker to manage taxes and potentially claim expenses.

Q16: Is professional advice necessary if using the CEST tool?

A16: Professional advice is not always necessary but is recommended for complex cases or “undetermined” results to ensure compliance and avoid penalties.

Q17: Can the CEST tool be used for gig economy workers?

A17: The CEST tool can be used for gig economy workers, but its binary approach may not fully capture the temporary or flexible nature of such roles, leading to unclear results.

Q18: How does the CEST tool integrate with Making Tax Digital?

A18: While not directly linked, the CEST tool aligns with HMRC’s digital transformation, complementing tools like the Personal Tax Account for streamlined tax compliance.

Q19: What are the penalties for incorrect IR35 status using CEST?

A19: Incorrect IR35 status can lead to HMRC penalties, including up to 100% of unpaid tax, interest, and potential investigations, depending on the case’s severity.

Q20: Can a CEST result be reused for similar contracts?

A20: A CEST result can be reused for similar contracts if the working arrangements remain unchanged, but any material changes require a new assessment.

About the Author

Maz Zaheer, AFA, MAAT, MBA, is the CEO and Chief Accountant of MTA and Total Tax Accountants, two premier UK tax advisory firms. With over 15 years of expertise in UK taxation, Maz provides authoritative guidance to individuals, SMEs, and corporations on complex tax issues. As a Tax Accountant and an accomplished tax writer, he is renowned for breaking down intricate tax concepts into clear, accessible content. His insights equip UK taxpayers with the knowledge and confidence to manage their financial obligations effectively.

Disclaimer:

The information provided in our articles is for general informational purposes only and is not intended as professional advice. While we strive to keep the information up-to-date and correct, MTA makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained in the articles for any purpose. Any reliance you place on such information is therefore strictly at your own risk. The graphs may also not be 100% reliable.

We encourage all readers to consult with a qualified professional before making any decisions based on the information provided. The tax and accounting rules in the UK are subject to change and can vary depending on individual circumstances. Therefore, MTA cannot be held liable for any errors, omissions, or inaccuracies published. The firm is not responsible for any losses, injuries, or damages arising from the display or use of this information.

Comments