Outside IR35 Contract

- MAZ

- Sep 5, 2025

- 16 min read

Updated: Sep 11, 2025

What Does ‘Outside IR35’ Mean for Your Take-Home Pay?

Starting with the Basics – What Is ‘Outside IR35’?

Picture this: you’ve landed a new contract worth £80,000 for the 2025/26 tax year. The big question on your mind? Am I inside or outside IR35?

If you’re outside IR35, it means HMRC accepts that you’re a genuine business providing services – not just a disguised employee. That status allows you to be paid via your limited company (often called a PSC – personal service company). You can deduct legitimate business expenses, take income as a mix of salary and dividends, and ultimately keep more of your hard-earned money.

On the flip side, if you’re inside IR35, you’re taxed like an employee under PAYE. That means full income tax and employee National Insurance contributions (NICs), with no scope for dividends or many business deductions.

HMRC explains the concept here: Understand off-payroll working (IR35).

The April 2025 Shift – Contractors Back in Control

For years, many medium and large companies had to decide if contractors fell inside or outside IR35. But since April 2025, the rules shifted again.

Now, more companies count as “small” for IR35 purposes, based on three thresholds:

● Turnover: £15 million or less

● Balance sheet total: £7.5 million or less

● Number of employees: 50 or fewer

If the company you work with is small under these rules, then you – the contractor – are responsible for determining your own IR35 status, not the client.

You can check the official thresholds here: Off-payroll working rules: contractor responsibilities.

How Much More Do You Actually Keep?

Let’s put some numbers on the table.

For 2025/26, the income tax rates remain frozen (Income Tax rates and bands):

● Personal allowance: £12,570 (phased out if income > £100,000)

● Basic rate: 20% on income up to £50,270

● Higher rate: 40% on income £50,271 to £125,140

● Additional rate: 45% on income above £125,140

And the National Insurance contributions (NICs) for 2025/26 are:

● Employees: 8% on earnings between £12,570 and £50,270, then 2% above that

● Self-employed (Class 4): 6% between £12,570 and £50,270, then 2% above that (National Insurance rates and categories)

Here’s a simple comparison for someone earning £80,000 via a limited company:

Scenario | Inside IR35 (PAYE) | Outside IR35 (Ltd Company) |

Gross income | £80,000 | £80,000 |

Income Tax & NICs | ~£26,000 | ~£18,000 (mix of salary + dividends) |

Take-home pay | ~£54,000 | ~£62,000 |

Figures rounded for illustration. Actual liability depends on expenses, dividend strategy, pension contributions, and any other income.

See HMRC’s Check employment status for tax (CEST) tool if you’re unsure where you fall.

Real-Life Case: When One Client Reclaimed Thousands

A few months after April 2025, I had a client – let’s call her Amelia from Bristol – who’d been working on a long-term IT project. For two years, the client (a mid-sized software firm) had deemed her inside IR35, deducting PAYE tax.

When the April 2025 changes came in, that firm suddenly qualified as a “small” company. Responsibility shifted back to Amelia. We carefully reviewed her contract and working practices. She clearly had substitution rights, provided her own equipment, and bore financial risk. We concluded she was outside IR35.

Result? She switched to drawing dividends via her company, immediately improving her take-home pay. Even better, she was able to claim a tax refund for overpayments in the final months of 2024/25 by filing an amended Self Assessment tax return.

This is a perfect example of why contractors need to stay alert – HMRC won’t automatically correct these things for you.

Checklist – Is Your Contract Really Outside IR35?

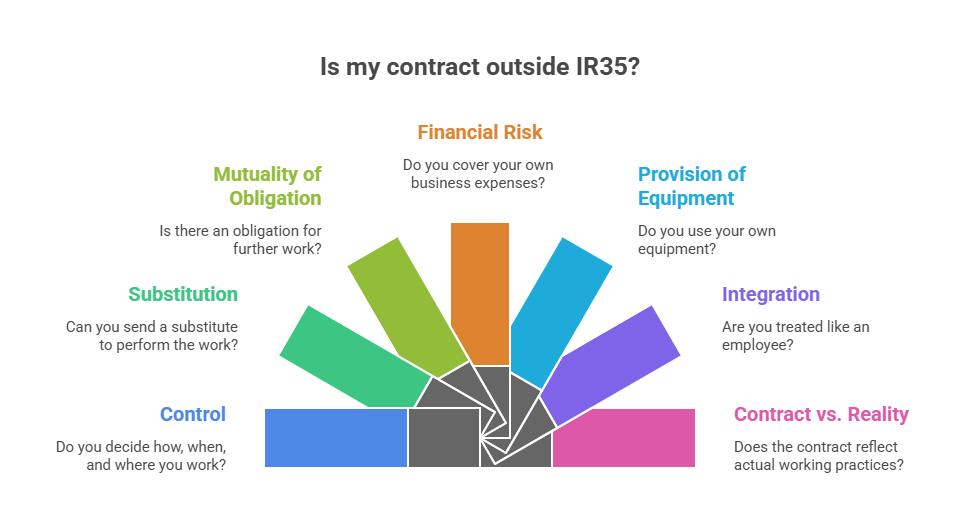

Being “outside IR35” isn’t just about what your contract says – it’s about how you actually work day-to-day. HMRC looks at several factors:

Control: Do you decide how, when, and where you work?

Substitution: Can you send someone else in your place?

Mutuality of obligation: Can you turn down work, and can the client choose not to offer it?

Financial risk: Do you cover your own expenses, insurance, or costs?

Provision of equipment: Do you use your own laptop, software, or tools?

Integration: Are you treated like an employee (staff meetings, benefits, holiday pay)?

Contract vs. reality: Does actual practice match the written contract?

These aren’t tick-box tests – HMRC will weigh them together.

You can cross-check using the official CEST tool to generate a determination.

Why This Matters More in 2025/26

None of us likes a tax surprise. But with frozen tax thresholds until 2028, more contractors are being dragged into higher-rate tax without even noticing. That makes the difference between being inside and outside IR35 even more significant this year.

For example:

● Inside IR35 at £60,000 income might mean ~£40,000 net after PAYE.

● Outside IR35 with a limited company, you might see closer to ~£46,000.

That £6,000 gap isn’t small change – it’s the difference between paying down your mortgage quicker or funding next summer’s family holiday.

So, while HMRC’s rules can feel like wading through treacle, staying on top of them can pay serious dividends – literally.

IR35 UK Impact Analysis

Checking Your IR35 Status Step by Step

Why Step-by-Step Matters in 2025

None of us loves tax admin, but here’s the truth: with the April 2025 IR35 shift, contractors now shoulder more of the responsibility for proving they’re outside IR35. And when HMRC comes knocking, “I thought I was fine” won’t cut it.

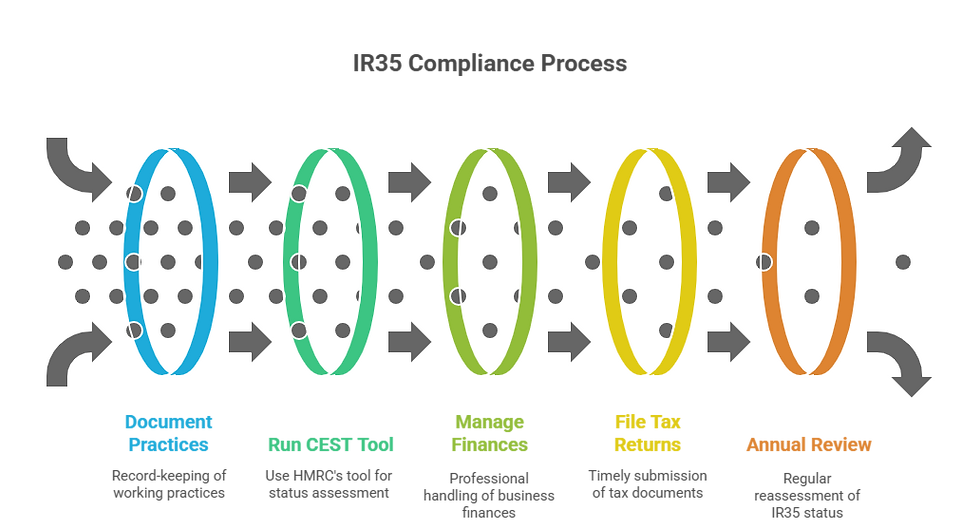

That’s why having a structured process – from reviewing your contract to cross-checking with HMRC’s own tools – is essential. I’ll walk you through a practical, repeatable method you can apply to your own situation.

Step 1: Review Your Written Contract Carefully

Start with the basics – your contract. Think of it like a map: it shows where you’re supposed to be going, even if day-to-day life takes detours.

Look for:

● Substitution clauses: Can you send a qualified replacement if you’re unavailable?

● Control: Does the client dictate hours, methods, or place of work?

● Termination terms: Are you tied to notice periods like employees?

If you spot employee-like language (“normal working hours”, “holiday entitlement”), that’s a red flag.

HMRC guidance is here: Check employment status for tax (CEST).

Step 2: Compare Contract with Reality

Be careful here – I’ve seen clients trip up when their day-to-day reality didn’t match the paperwork. For example, one client’s contract said she could substitute another contractor, but the firm refused when she tried during maternity leave.

HMRC will always look at working practices, not just words on paper.

The official position: Off-payroll working rules for contractors.

Step 3: Use HMRC’s Online Tool – But Don’t Stop There

The CEST tool is HMRC’s own checker. It asks you a series of questions about your contract, control, substitution rights, and financial risk, then gives a determination.

Now, here’s the catch:

● If your answers aren’t accurate, the result is meaningless.

● It doesn’t cover every possible nuance.

I often tell clients: use CEST, but also document your reasoning. Keep notes, emails, and evidence that back up your answers. If HMRC queries you years later, having that paper trail is gold.

Step 4: Keep Financial Records That Prove You’re a Business

Outside IR35 means you’re running a genuine business. So act like one.

That means:

● Separate business bank account for your limited company.

● Invoices issued to clients.

● Business insurance (professional indemnity, public liability).

● Company expenses documented and receipted.

When HMRC reviews cases, these details help prove you’re not a disguised employee.

Step 5: File Correctly – PAYE vs Self Assessment

Here’s where the numbers bite.

● If inside IR35: You’ll usually be paid via PAYE, with tax and NICs deducted before you see the money. You may still need to file a Self Assessment return if you have other income.

● If outside IR35: You’ll pay yourself via your company – typically a small salary (through PAYE) plus dividends. The company must file Corporation Tax returns and company accounts. You’ll also file a personal Self Assessment return.

I’ve seen cases where contractors thought being outside IR35 meant “no tax return needed” – not true. If you take dividends, they must be declared.

How Multiple Income Sources Complicate Things

Now let’s add a layer of real-world complexity. Few of us have just one source of income these days.

Example 1: Contractor plus Rental Income

Take Daniel from Leeds. He earns £70,000 via his limited company (outside IR35) and £12,000 in rental profits from a flat. His dividend planning needed careful adjustment, because the rental income pushed more of his dividends into the higher rate band.

HMRC covers property income here: Tax on rental income.

Example 2: Contractor plus Side Hustle

Sophie from Cardiff does contract work outside IR35 but also runs an Etsy craft business on the side. That extra £8,000 profit required her to register for Self Assessment and pay Class 2 and Class 4 NICs in addition to her company tax.

This is where contractors often miss tax. Unreported side hustles are a common reason for HMRC letters years later.

Differences Across the UK: Scotland and Wales

Don’t overlook regional quirks.

● Scotland: In 2025/26, higher earners face steeper rates (42%, 45%, and 48%). That means contractors outside IR35 who rely heavily on dividends will pay significantly more if resident in Scotland. Official info: Scottish Income Tax.

● Wales: Wales uses the same bands as England for now, but has power to vary them. Always check annually: Income Tax in Wales.

So, if you’re based in Glasgow vs Cardiff, your outside IR35 take-home could differ by thousands.

Rare Scenarios You Can’t Ignore

In practice, contractors run into messy situations. Here are three I’ve dealt with recently:

Emergency tax codes: A contractor took on a short PAYE role alongside their limited company. HMRC slapped them with a temporary emergency code, over-taxing by nearly £1,200. They reclaimed it via Check your Income Tax for the current year.

High Income Child Benefit Charge (HICBC): A contractor earning £60,000 outside IR35 forgot his wife was claiming Child Benefit. HMRC later clawed back £1,000+. This kicks in once income >£50,000: Child Benefit tax charge.

IR35 review letters: Another contractor received an HMRC “nudge letter” asking them to confirm status. Because we’d kept CEST outputs and detailed working practice notes, we responded swiftly, and the case was closed with no adjustments.

Checklist: Staying Outside IR35 in Practice

Here’s a practical checklist to keep yourself safe:

● Review your contract before signing.

● Document working practices (emails, project briefs, substitution offers).

● Run the CEST tool and save results.

● Keep finances professional (separate account, insurance, invoices).

● File both company and personal returns on time.

● Re-check your position annually, especially if contracts change.

● Watch out for regional tax variations (Scotland/Wales).

● Track all other income sources to avoid underpayments.

● Correct emergency tax codes promptly via your personal tax account.

● Flag child benefit issues early if income creeps above £50,000.

UK IR35 Tax Calculator 2025

Running Your Own Business Outside IR35 – Maximising the Benefits

Why Contractors Choose the Limited Company Route

Now, let’s think about your situation – if you’re outside IR35, chances are you’ll be trading through your own limited company. Why? Because it opens the door to:

● Drawing income as a mix of salary and dividends

● Claiming legitimate business expenses

● Contributing tax-efficiently to a pension

● Building up reserves for investment or future contracts

It’s not about “dodging” tax – it’s about structuring your affairs fairly under the law. HMRC recognises the difference between an employee and a genuine business.

Official guidance: Set up a limited company.

Case Study: Pension Contributions as a Tax Shield

Take Marcus, a project manager in Manchester. His company earned £110,000 in 2025/26. Instead of pulling out the full amount as salary/dividends, he directed £20,000 into an employer pension contribution.

● Without the pension: a large chunk of his dividends would have been taxed at 32.5% (higher rate).

● With the pension: the company deducted it as an expense, reducing Corporation Tax, and Marcus boosted his retirement pot with no personal tax hit.

This is one of the most effective strategies for contractors – but only works if you’re genuinely outside IR35 and in control of your company’s finances.

More info: Tax on your private pension contributions.

Common Expense Deductions That Contractors Overlook

Running your business outside IR35 means you can claim back a variety of wholly and exclusively business costs. But in my years advising contractors, I’ve noticed people either under-claim (leaving money on the table) or over-claim (risking an HMRC enquiry).

Legitimate expenses often include:

● Professional indemnity insurance

● Accounting and legal fees

● Business travel and accommodation (not ordinary commuting)

● Software and equipment

● Training courses directly relevant to your trade

See HMRC’s guide: Expenses if you’re self-employed.

Be careful here: I once had a client try to claim their family holiday to Spain as “market research”. That kind of stretch rarely ends well!

When Contractors Get It Wrong – An HMRC Dispute

A real example: Julia, a marketing consultant in London, insisted she was outside IR35. But her contract showed fixed hours, no substitution rights, and the client even provided her laptop. HMRC reviewed her case, reclassified her as inside IR35, and raised a tax bill of nearly £15,000 covering two years.

The lesson? You can’t just declare yourself outside IR35 because it’s convenient. Your working practices must genuinely reflect independence.

HMRC case reference: Off-payroll working rules: contractor responsibilities.

Balancing Multiple Roles – Director and Employee

Some contractors wear two hats: running their company outside IR35 and holding a part-time PAYE role elsewhere.

In these cases:

● The PAYE job will already deduct tax through the payroll.

● The limited company income still needs reporting separately via Self Assessment.

● You may need to check your tax code to ensure it reflects both roles properly.

I’ve seen people accidentally double-use their personal allowance, creating underpayments HMRC claws back later.

Advanced Pitfall: The High-Income Child Benefit Charge

We touched on this earlier, but it’s worth repeating because it trips up so many business owners. If your income (salary + dividends) goes over £50,000 and you or your partner receive Child Benefit, HMRC can claw it back via the High Income Child Benefit Charge.

More info: Child Benefit tax charge.

One client, Raj from Birmingham, didn’t realise his dividends pushed him over the threshold. He faced a £1,400 backdated charge – a painful surprise. Don’t let that be you.

Using Your Personal Tax Account to Stay on Top

In practice, the easiest way to keep tabs is via HMRC’s personal tax account. Here you can:

● Check your income tax paid this year

● Correct tax code errors

● Claim refunds for overpayments

● View National Insurance contributions

I always advise contractors to log in at least quarterly. It’s free, takes minutes, and can prevent costly errors down the line.

Building a Safety Net – Why Reserves Matter

Another overlooked benefit of operating outside IR35 is flexibility. Unlike an employee, you can choose not to extract all profits immediately. Leaving money in your company acts as a buffer for lean months, tax planning, or future investment.

For example, one of my clients delayed taking dividends until the following tax year, keeping their income just under the higher-rate threshold. That simple timing decision saved over £3,000 in tax.

This flexibility simply isn’t available if you’re taxed inside IR35 under PAYE.

Summary of Key Points

Outside IR35 means you’re a genuine business, not taxed as an employee – giving you control over how income is drawn.

April 2025 changes shifted responsibility back to contractors for many “small” client engagements.

Income tax bands remain frozen until 2028, making tax planning more important than ever.

CEST tool results must reflect reality – contracts alone aren’t enough if working practices contradict them.

Multiple income sources complicate tax bands; side hustles or rental income can push dividends into higher rates.

Scotland and Wales have different tax regimes, meaning location affects your take-home pay.

Common pitfalls include emergency tax codes and the High Income Child Benefit Charge – both can create surprise liabilities.

Legitimate business expenses lower taxable profits, but only if they are wholly and exclusively for business.

Pension contributions via your company are highly tax-efficient, often reducing Corporation Tax and higher-rate dividend charges.

Maintaining records and reserves protects you – HMRC may investigate years later, so documentation and cautious planning are your best defence.

FAQs

Q1: Can someone be outside IR35 on a contract but still have PAYE income from a separate part-time job without messing up their tax?

A1: Well, it’s worth noting that mixed income is common — the key is keeping streams clean. The PAYE job is taxed through payroll; the outside-IR35 contract runs via the limited company with salary/dividends. In my experience with clients, the trap is a duplicated Personal Allowance or the wrong tax code on the side job. A quick check of codes and declaring dividends on Self Assessment usually sorts it. If you’ve overpaid because of an emergency code, a simple correction and year-end reconciliation can trigger a refund.

Q2: Does living in Scotland but contracting remotely for an English client change someone’s outside-IR35 tax outcome?

A2: In practice, residence drives the Income Tax rates, not where the client is. So a contractor living in Scotland can be outside IR35 and still face Scottish rates on their salary/dividends position overall. I’ve seen folks surprised when their take-home drops versus England/Wales — it’s not IR35 changing, it’s the regional banding interacting with dividends and any PAYE salary.

Q3: Could someone be outside IR35 and still get hit with the High Income Child Benefit Charge?

A3: Absolutely — that charge looks at each partner’s “adjusted net income,” and dividends count. I often see higher earners who think “I’m outside IR35, so I’m fine” and then tip over the threshold because of a chunky dividend late in the year. A neat fix is timing: calibrate dividends and consider pension contributions from the company to manage that threshold.

Q4: If a client is newly classed as ‘small’, does the contractor automatically become outside IR35?

A4: Not automatically. The “small” status usually shifts who makes the status decision, not the decision itself. The contractor still has to stand up the outside-IR35 position with real-world working practices — control, substitution, financial risk. I’ve had cases where a client became “small,” but the contractor’s day-to-day still looked like employment, so the outcome remained inside.

Q5: How should someone split salary and dividends when they’re safely outside IR35 but also repaying a student loan?

A5: In my experience, the key is remembering student loan deductions bite on PAYE salary, not dividends. Many contractors under-estimate repayments when they push more through salary. A smoother plan is a modest salary (to cover NI credits and practicality) and the rest as dividends — then factor the cash-flow impact of any student loan deductions in payroll so there are no nasty surprises.

Q6: What happens to travel and subsistence claims if a contractor is outside IR35 but on a long assignment?

A6: Think of the 24-month rule like a timer. If a location is expected to become a long-term base, those travel and subsistence costs stop being allowable. I’ve seen people keep claiming after the expectation clearly tipped beyond that window. The practical move is to review the assignment length every quarter and document when expectations change — that file note often saves headaches later.

Q7: Can someone switch an umbrella engagement mid-year to a limited company outside IR35 and still keep things tidy?

A7: Yes, but timing and paperwork matter. Umbrella income is PAYE and will appear on a P60; your limited company income sits separately. The year-end Self Assessment pulls it together. The gotcha I see is unpaid holiday or umbrella fees near the switch date and forgetting to close out any benefits or advances. Keep final umbrella payslips, reconcile them, and ring-fence your company bank from day one.

Q8: Does a contractor need to worry about Managed Service Company (MSC) rules if they’re outside IR35 and using a popular accountant?

A8: Caution is wise. Being outside IR35 doesn’t immunise you from MSC risk if the provider crosses the line into controlling how you pay yourself. In practice, use an adviser who advises — not one that dictates uniform salary/dividend templates or takes a cut linked to your income. I’ve defended enquiries where the provider’s marketing looked too prescriptive; governance and independence won the day.

Q9: Can overseas clients complicate outside-IR35 status if the work is performed from the UK?

A9: The tax residence and where the work is performed often drive UK tax exposure, not where the invoice is sent. I’ve seen UK-based contractors working for EU or US clients; they were still squarely in UK tax, and IR35 analysis hinged on control, substitution, etc. Watch contractual jurisdiction, PE risks for the client (rare at contractor level), and VAT place-of-supply rules separately from IR35.

Q10: How should someone handle pension contributions when they’re outside IR35 and close to higher-rate tax?

A10: In my experience, employer contributions from the company are the simplest lever: they reduce company profits and help manage income thresholds personally. Just ensure contributions are justifiable for the business and within annual allowance limits. The common mistake is mixing personal and employer contributions without tracking carry-forward — easy to fix with a simple pension log and board minute.

Q11: What if a contractor is outside IR35 but the agency insists on “right of first refusal” for all future work — is that a red flag?

A11: It can be. One-sided clauses that bind you like an employee (exclusivity or sweeping non-competes) can undercut the independence narrative. I’ve negotiated softer wording for clients — e.g., limits by sector or time — and paired it with evidence of marketing to other clients. The paper trail showing you actively seek and win other work helps if HMRC tests business-on-own-account.

Q12: Can someone claim a refund if an incorrect emergency code over-taxed their short PAYE stint before moving to outside IR35?

A12: It’s a common mix-up, but here’s the fix: correct the code promptly and let payroll adjust, or reconcile through year-end. I’ve seen quick refunds when people update details early rather than waiting. Keep the P45/P60 and payslips; they’re the proof. If there’s also dividend income later in the year, the Self Assessment ties everything together so refunds don’t go missing.

Q13: How do student loan and postgraduate loan repayments interact with dividends for someone outside IR35?

A13: Dividends don’t trigger loan deductions through payroll, but they still affect the income thresholds for overall liability in your return. The surprise comes when higher dividends lift your repayment rate at filing time. My tip: run a mid-year check using your actual dividends to date, not just salary, so you’re setting aside enough cash.

Q14: Are CIS subcontractors ever outside IR35, or does CIS make it irrelevant?

A14: They can be outside IR35, but CIS and IR35 answer different questions. CIS is about how tax is withheld in construction; IR35 is about whether the engagement looks like employment. I’ve seen subcontractors with solid indicators of independence — substitution, own tools, pricing control — sitting outside IR35. The pitfall is relying on CIS deductions alone as “proof”; HMRC will still examine working practices.

Q15: What if a contract is outside IR35 but the client insists on fixed working hours and using their laptop?

A15: That’s where reality can bite. Fixed hours and client-provided kit don’t automatically put you inside, but stack enough of those factors and the picture skews employee-like. The practical approach is to rebalance: outcomes-based milestones, documented control over “how” you deliver, and a genuine substitution mechanism. I’ve turned borderline cases around with a change in Statement of Work rather than a total rewrite.

About the Author

Maz Zaheer, AFA, MAAT, MBA, is the CEO and Chief Accountant of MTA and Total Tax Accountants, two premier UK tax advisory firms. With over 15 years of expertise in UK taxation, Maz provides authoritative guidance to individuals, SMEs, and corporations on complex tax issues. As a Tax Accountant and an accomplished tax writer, he is renowned for breaking down intricate tax concepts into clear, accessible content. His insights equip UK taxpayers with the knowledge and confidence to manage their financial obligations effectively.

Disclaimer

The content in our articles is offered for general informational purposes only and should not be construed as professional advice. Although we aim to ensure the information is current and accurate, MTA provides no guarantees—express or implied—regarding the completeness, precision, reliability, appropriateness, or accessibility of the website, its content, products, services, or associated visuals for any use. Any dependence on this information is undertaken solely at your own risk. Additionally, the graphs presented may not be entirely dependable.

Comments