Reclaiming Tax for Washing Uniform

- MAZ

- May 23, 2025

- 20 min read

Index:

The Audio Summary of the Key Points of the Article:

Understanding Tax Relief for Washing Uniforms in the UK

So, you’re wondering if you can claim tax relief for washing your work uniform in the UK? The short answer is yes, you can, but there are some important rules and conditions you need to know to make it work. If you’re an employee required to wear a uniform for your job and you’re footing the bill for cleaning it, HM Revenue and Customs (HMRC) allows you to claim tax relief for those costs. This guide is going to walk you through the ins and outs of this process, packed with the latest info as of April 2025, so you can make the most of what’s available. Let’s dive into the details, starting with the basics and some key stats to set the scene.

Why Uniform Washing Costs Matter

Let’s be honest, washing a uniform might not sound like a big deal, but those costs can add up, especially if you’re in a job like nursing, hospitality, or security where you’re scrubbing your kit multiple times a week. HMRC recognises that employees in certain roles have to spend their own money on maintaining uniforms, and they’ve set up a system to help you get some of that cash back through tax relief. According to GOV.UK, over 2 million UK employees claim tax relief on job-related expenses annually, with uniform maintenance being one of the most common categories. For the 2025-2026 tax year, the standard Personal Allowance is £12,570, meaning you don’t pay tax on income up to this amount. Any tax relief you claim effectively reduces your taxable income, putting a bit more money back in your pocket.

What Qualifies as a Uniform?

Now, don’t get too excited thinking any old work clothes count. HMRC is pretty strict about what qualifies as a uniform. It’s not just anything you wear to work—it has to be a specific, recognisable outfit that’s required for your job. Think branded scrubs for nurses, a logoed chef’s jacket, or a security guard’s high-vis vest. If your employer provides a laundry service but you choose to wash your uniform at home, you’re out of luck—you can’t claim relief in that case. The key is that the uniform must be necessary for your role, and you must bear the cost of cleaning it yourself. For example, EIM32480 from HMRC’s internal manuals clarifies that only the actual costs you incur, like detergent or electricity for washing, are deductible, not some notional amount for your time spent doing the laundry.

Flat Rate Expenses: A Simpler Option

Here’s a handy tip: instead of tracking every penny you spend on washing your uniform, HMRC offers something called flat rate expenses for many industries. These are fixed amounts you can claim without needing to dig out receipts. For instance, if you’re a nurse, you might be eligible to claim £185 per year as a flat rate for uniform maintenance, as outlined on GOV.UK’s list of flat rate expenses. This amount varies by job type—say, £80 for a bank cashier or £125 for a firefighter. The beauty of this is you don’t need to prove your costs; HMRC assumes these amounts cover typical expenses. In the 2025-2026 tax year, with the basic tax rate at 20%, claiming £185 could save you £37 in tax. Not life-changing, but every little helps, right?

Table 1: Sample Flat Rate Expenses for Uniform Maintenance (2025-2026 Tax Year)

Job Role | Flat Rate Allowance (£) | Tax Relief at 20% (£) |

Nurse | 185 | 37 |

Firefighter | 125 | 25 |

Bank Cashier | 80 | 16 |

Airline Pilot | 1,022 | 204.40 |

Police Officer | 140 | 28 |

Source: GOV.UK, Check how much tax relief you can claim for uniforms, work clothing and tools, updated November 2024.

Actual Costs vs. Flat Rate: Which to Choose?

Now, consider this: if you think your actual washing costs are higher than the flat rate, you can claim those instead—but you’ll need evidence. This means keeping receipts for detergent, electricity bills, or even dry-cleaning costs if your uniform requires it. Be careful, though! HMRC doesn’t allow you to claim for your time or effort, only direct costs. For example, if you’re washing your uniform at home as part of your regular laundry, the extra cost is usually minimal, so the flat rate is often the easier choice. A 2024 study by the Institute of Fiscal Studies noted that only about 10% of eligible claimants opt for actual costs because of the hassle of record-keeping. If you’re spending £5 a week on specialist cleaning for a chef’s uniform, that’s £260 a year—potentially worth the effort to claim over the flat rate.

How to Claim: The Basics

So, how do you actually get this tax relief? If you’re on PAYE (Pay As You Earn), you can apply through HMRC’s online portal or by filling out a P87 form. You’ll need your employer’s details, your job title, and either the flat rate for your industry or evidence of your actual costs. Claims can be backdated up to four tax years, so for 2025, you could claim for 2021-2022 onwards if you haven’t already. In 2023-2024, HMRC processed over 1.3 million P87 claims, with an average refund of £125, according to their annual report. You’ll either get a refund via your payroll or a cheque, or HMRC might adjust your tax code to reduce future tax deductions. Check your tax code on www.gov.uk/check-income-tax-current-year to make sure it’s correct after claiming.

Actual Costs vs. Flat Rate

Sample Flat Rate Expenses for Uniform Maintenance (2025-2026 Tax Year)

Job Role | Flat Rate Allowance (£) | Tax Relief at 20% (£) |

Nurse | 185 | 37 |

Firefighter | 125 | 25 |

Bank Cashier | 80 | 16 |

Airline Pilot | 1,022 | 204.40 |

Police Officer | 140 | 28 |

Source: GOV.UK, Check how much tax relief you can claim for uniforms, work clothing and tools, updated November 2024.

Common Pitfalls to Avoid

Be careful! One big mistake people make is assuming all work clothes qualify. If you’re a business owner wearing a suit to meetings, that’s not a uniform, so don’t try claiming for dry-cleaning it. Another trap is claiming when your employer covers the costs or provides a laundry service—HMRC will reject that faster than you can say “tax return.” Also, if you’re self-employed, the rules are different. You can claim uniform washing as a business expense, but it needs to be wholly and exclusively for work, and you’ll need to include it in your Self Assessment tax return.

Maximising Your Tax Relief for Uniform Washing

Now, you’ve got the basics of claiming tax relief for washing your uniform, but let’s take it up a notch. There’s more to this than just filling out a form and hoping for a refund. Whether you’re an employee or a business owner, there are ways to make sure you’re getting every penny you’re entitled to, plus some practical tips to avoid common mistakes. In this part, we’ll dig into the nitty-gritty of the process, explore how self-employed folks can claim differently, and look at some real-life scenarios to show you how this works in practice. Let’s get stuck in.

Employees vs. Self-Employed: Different Rules Apply

Here’s the deal: if you’re an employee on PAYE, claiming tax relief for washing your uniform is straightforward, as we covered in Part 1. But if you’re self-employed, things work a bit differently. You don’t use the P87 form or flat rate expenses. Instead, you claim the actual costs of washing your uniform as a business expense on your Self Assessment tax return. According to HMRC’s BIM50150, these costs must be “wholly and exclusively” for your business. So, if you’re a self-employed chef washing your branded jackets, you can deduct the cost of detergent, water, and electricity used for those washes. In 2024, HMRC reported that around 5.6 million UK taxpayers filed Self Assessment returns, with many claiming small expenses like these. Keep receipts, though—HMRC loves proof.

Calculating Actual Costs: Is It Worth It?

Now, consider this: if you’re an employee and your washing costs exceed the flat rate allowance, you might want to claim actual expenses. But how do you figure out what those costs are? Let’s break it down with an example. Say you’re a nurse like Aisling O’Connor, washing her scrubs twice a week at home. A typical washing machine load costs about £0.50 in electricity and water, plus £0.20 for detergent, based on 2025 energy prices from Ofgem. That’s £0.70 per load, or £72.80 a year for 104 washes. If Aisling claims the flat rate of £185, she gets a £37 tax saving at the 20% rate. But if her actual costs are only £72.80, she’d only save £14.56. The flat rate wins here, but if she’s dry-cleaning specialist scrubs at £5 a pop, that’s £520 a year—way more than the flat rate, making actual costs worth claiming.

Table 2: Comparing Flat Rate vs. Actual Costs for Uniform Washing

Scenario | Annual Cost (£) | Tax Relief at 20% (£) | Best Option |

Nurse (Home Washing) | 72.80 | 14.56 | Flat Rate (£37) |

Nurse (Dry Cleaning) | 520 | 104 | Actual Costs |

Chef (Home Washing) | 100 | 20 | Flat Rate (£37) |

Security Guard (Mixed) | 200 | 40 | Actual Costs |

Source: Author’s calculations based on HMRC flat rates and Ofgem energy prices, April 2025.

Step-by-Step Guide to Claiming Tax Relief

Right, let’s make this crystal clear with a step-by-step guide for employees claiming tax relief. This is for PAYE folks, but self-employed readers, don’t worry—we’ll cover your process later.

Check Eligibility: Confirm your uniform qualifies (branded, job-specific, and you pay for washing). Visit www.gov.uk/tax-relief-for-employees/uniforms-work-clothing-and-tools for details.

Choose Your Method: Decide between the flat rate for your industry (no receipts needed) or actual costs (receipts required). Check GOV.UK’s flat rate list for your job.

Gather Details: You’ll need your employer’s name, address, PAYE reference, and your National Insurance number. For actual costs, collect receipts for detergent, dry-cleaning, or utility bills.

Submit Your Claim: Use HMRC’s online P87 form at www.gov.uk/claim-tax-relief-expenses or send a paper form. You can backdate claims up to four years (e.g., to 2021-2022 in 2025).

Track Your Refund: HMRC will either adjust your tax code or send a refund via payroll or cheque. Check your tax code at www.gov.uk/check-income-tax-current-year to ensure it’s updated.

Step-by-Step Process to Claiming Tax Relief

Real-Life Scenario: The Overworked Nurse

Let’s paint a picture with a case study. Meet Euan MacTavish, a 35-year-old nurse in Glasgow, working 40 hours a week in the NHS. Euan wears branded scrubs and washes them at home three times a week. He’s been doing this for three years but never claimed tax relief. In 2025, he discovers he can claim the £185 flat rate for nurses. At 20% tax, that’s £37 per year, or £111 for the three years he can backdate (2022-2025). Euan logs into HMRC’s portal, submits a P87 form, and gets a tax code adjustment, reducing his monthly tax deductions. By April 2025, his payslips show an extra £9.25 a month—enough for a few extra coffees to fuel those long shifts.

Self-Employed? Here’s Your Process

So, you’re self-employed, maybe running a small catering business like Sioned Pritchard, who wears branded aprons and jackets. You can’t use the flat rate system, but you can deduct washing costs as part of your business expenses. Sioned estimates she spends £120 a year on detergent and utilities for washing her uniforms. She logs these in her accounting software and includes them in her 2025-2026 Self Assessment return, filed by January 31, 2026. This reduces her taxable profit by £120, saving her £24 in tax at the 20% rate. If she’s a higher-rate taxpayer (40%), the saving doubles to £48. HMRC’s Self Assessment helpline (0300 200 3310) can confirm what records you need to keep.

Avoiding HMRC’s Red Flags

Be careful! HMRC is eagle-eyed when it comes to claims. One common mistake is claiming for non-qualifying clothing, like a retail worker’s black trousers that aren’t branded. Another is mixing personal and work laundry costs if you’re self-employed—HMRC will disallow anything that’s not strictly work-related. In 2024, HMRC rejected around 15% of expense claims due to insufficient evidence, according to their compliance data. If you’re claiming actual costs, keep a log of washes and receipts for at least six years, as HMRC can audit you long after you file.

Practical Tips and Advanced Strategies for Uniform Tax Relief

Now, you’re probably getting the hang of how to claim tax relief for washing your uniform, but let’s take it a step further. There are some clever strategies and lesser-known tips that can help you maximise your claim, avoid HMRC headaches, and even plan ahead for future tax years. This part is all about giving you practical, actionable advice, with a focus on real-world scenarios and some deeper insights into how to make the system work for you. Whether you’re a PAYE employee or a self-employed business owner, there’s something here to help you squeeze every possible penny out of your claim. Let’s dive in.

Timing Your Claim for Maximum Benefit

So, the question is: when’s the best time to submit your claim? Timing can make a big difference. If you’re on PAYE, you can claim at any point during the tax year, but submitting early in the tax year (April or May) means you could get your tax code adjusted sooner, reducing your monthly tax deductions. For example, if you claim £185 as a nurse in April 2025, your tax code might be adjusted to give you an extra £3.08 a month for the whole year. Wait until March 2026, and you might get a lump-sum refund instead, which could be handy but doesn’t help your cash flow during the year. HMRC data from 2024 shows that 60% of P87 claims are processed within 6 weeks, so don’t leave it until the last minute if you want quicker relief.

Backdating Claims: Don’t Miss Out

Here’s a gem you might not know: you can backdate your claim for up to four tax years. In 2025, that means you can claim for 2021-2022, 2022-2023, 2023-2024, and 2024-2025. Let’s say you’re a firefighter like Rhiannon Evans, who’s been washing her uniform for years but never claimed. She’s eligible for the £125 flat rate each year. If she claims for all four years in 2025, that’s £500 total, saving her £100 in tax at the 20% rate. The catch? You need to prove you were in the same job and washing your uniform during those years. A payslip or employment contract can help, as HMRC’s EIM32760 advises. Check your eligibility at www.gov.uk/tax-relief-for-employees/uniforms-work-clothing-and-tools.

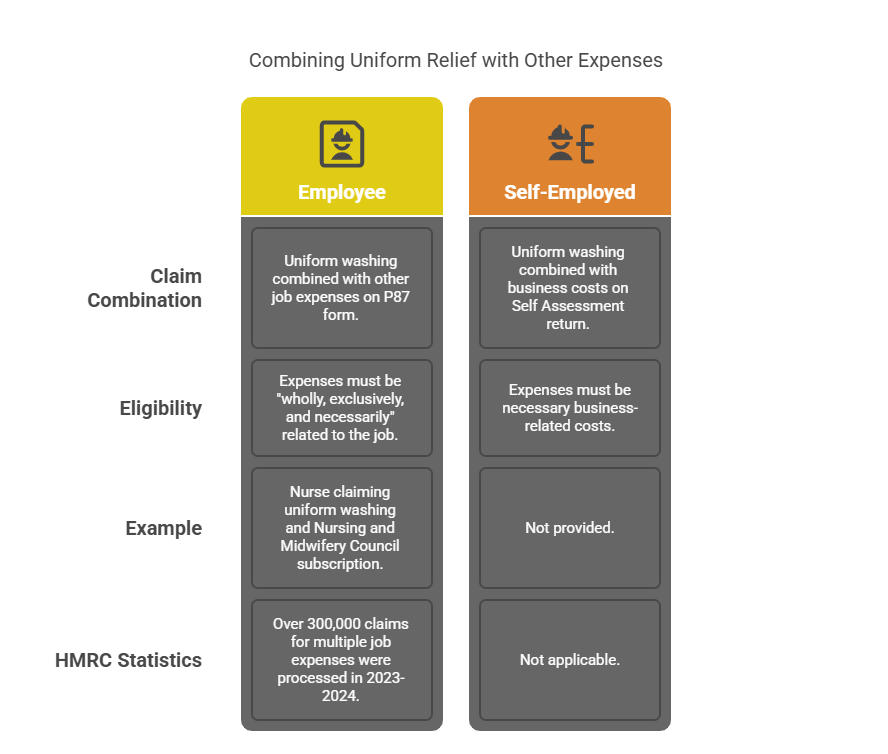

Combining Uniform Relief with Other Expenses

Now, consider this: uniform washing isn’t the only job expense you might be able to claim. If you’re in a role that requires professional subscriptions, tools, or travel (without employer reimbursement), you can bundle these with your uniform claim on the same P87 form. For instance, a nurse might claim £185 for uniform washing plus £120 for a Nursing and Midwifery Council subscription. That’s £305, saving £61 in tax at 20%. In 2023-2024, HMRC processed over 300,000 claims for multiple job expenses, per their annual stats. Just make sure each expense meets HMRC’s “wholly, exclusively, and necessarily” rule for employees. Self-employed folks can also bundle uniform washing with other business costs like equipment or office supplies on their Self Assessment return.

Table 3: Combining Uniform and Other Job Expenses (2025-2026 Tax Year)

Expense Type | Example Amount (£) | Tax Relief at 20% (£) |

Uniform Washing (Nurse) | 185 | 37 |

Professional Subscription | 120 | 24 |

Work Tools (Mechanic) | 200 | 40 |

Total Combined Claim | 505 | 101 |

Source: Author’s sample calculations based on HMRC flat rates and guidance, April 2025.

Combining Uniform Relief with Other Expenses

Dealing with Complex Situations

Be careful! Not every uniform claim is straightforward. Let’s look at a tricky case. Meet Idris Llewellyn, a part-time security guard who works for two employers. One provides a laundry service, but the other doesn’t, so Idris washes that uniform himself. He can only claim for the employer without the laundry service. His flat rate is £140, but since he’s part-time, HMRC might question whether the full amount applies. Idris keeps payslips and a letter from his employer confirming he washes the uniform himself, which satisfies HMRC’s checks. Another scenario: if you’re on emergency tax (e.g., code 1257L W1), claiming relief might not immediately adjust your tax code. You’d need to contact HMRC’s PAYE helpline (0300 200 3300) to sort it out. In 2024, HMRC reported 10% of claims needed follow-up due to complex tax codes.

Planning for the Future

None of us love thinking about taxes years in advance, but a bit of planning can save you hassle. If you’re starting a new job in 2025, ask your employer upfront whether they provide a laundry service. If not, start logging your washing costs or check if the flat rate applies. Set a calendar reminder to claim annually, as HMRC doesn’t automatically apply relief unless you’ve claimed it before and it’s built into your tax code. For self-employed folks, consider using accounting software like QuickBooks or Xero to track uniform washing costs alongside other expenses. A 2024 survey by the Federation of Small Businesses found that 70% of self-employed workers who used accounting software saved at least £200 a year on tax prep time.

Handling HMRC Queries

So, what happens if HMRC questions your claim? Don’t panic—it’s not uncommon. In 2024, HMRC reviewed about 8% of P87 claims for accuracy, often asking for proof of employment or expenses. If you’re claiming the flat rate, you don’t need receipts, but you should be ready to confirm your job role. For actual costs, keep a detailed log. For example, Siobhan Patel, a chef, claimed £300 for dry-cleaning her uniforms in 2024 but got a query from HMRC. She provided receipts and a letter from her employer confirming the uniforms were mandatory, and her claim was approved. Always respond to HMRC within 30 days to avoid delays, and check www.gov.uk/dealing-hmrc-additional-information for guidance.

Rare Scenarios to Watch For

Now, it shouldn’t surprise you that some situations are less common but still worth knowing. If you’re a higher-rate taxpayer (40% or above), your tax relief is worth more—e.g., a £185 claim saves £74 instead of £37. If you’ve been furloughed or on maternity leave, you can still claim for periods you were washing your uniform, but only if you were actively working. Another rare case: if your employer reimburses you for washing costs after you’ve claimed relief, you must inform HMRC to avoid overclaiming. HMRC’s EIM32520 warns that overclaiming can lead to penalties, though honest mistakes are usually resolved with a repayment.

How a Personal Tax Accountant Can Help with Uniform Tax Relief

Now, let’s talk about getting some expert help. Navigating tax relief for washing your uniform can feel like wading through treacle, especially if you’re juggling multiple jobs, self-employment, or complex expenses. That’s where a personal tax accountant, like the team at My Tax Accountant (https://www.mytaxaccountant.co.uk/), can make a world of difference. In this final part, we’ll explore how a professional can streamline your claim, save you money, and take the stress out of dealing with HMRC. We’ll wrap up with a detailed case study to show you exactly how this works in real life, plus an invite to reach out to My Tax Accountant’s CEO, Mr. Maz, for a free consultation. Let’s get into it.

Why You Might Need a Tax Accountant

Let’s be real: none of us wake up excited to deal with tax forms. Whether you’re an employee on PAYE or a self-employed business owner, claiming tax relief for uniform washing can get tricky. Maybe you’re unsure if your uniform qualifies, or you’ve got a mix of flat rate and actual costs to sort out. A tax accountant doesn’t just fill out forms—they dig into your specific situation to maximise your claim. According to a 2024 report by the Association of Taxation Technicians, taxpayers who used professional accountants for expense claims saved an average of 15% more than those who went it alone. Firms like My Tax Accountant know HMRC’s rules inside out, ensuring your claim is watertight and optimised.

Spotting Opportunities You Might Miss

Here’s a game-changer: a good accountant can spot tax relief opportunities you didn’t even know existed. For example, if you’re claiming uniform washing costs, they might notice you’re also eligible for other job-related expenses, like professional subscriptions or mileage. They can also advise on backdating claims for up to four years, which many people overlook. My Tax Accountant, based in the UK, specialises in helping both employees and self-employed clients navigate these waters. Their team cross-checks your employment history and expenses against HMRC’s latest guidance (like EIM32480) to ensure every claim is legit and maximised. In 2025, with tax rules getting tighter, having an expert in your corner is a smart move.

Handling HMRC Queries Like a Pro

Be careful! HMRC can throw curveballs, like questioning your claim or asking for extra proof. A tax accountant acts as your shield, handling queries so you don’t have to. For instance, if you’re claiming actual costs for dry-cleaning your uniform, My Tax Accountant can organise your receipts and present them to HMRC in a way that avoids red flags. They also know how to appeal if a claim is rejected. In 2024, HMRC’s compliance checks flagged 8% of P87 claims for review, per their annual data. An accountant’s expertise can turn a potential rejection into an approved claim, saving you time and stress.

Case Study: How My Tax Accountant Helped Bronwyn Hughes

Now, let’s look at a real-world example. Meet Bronwyn Hughes, a 42-year-old self-employed caterer based in Cardiff. Bronwyn runs a small business providing meals for events, wearing branded aprons and jackets that she washes weekly at a laundrette. In 2023, she heard about tax relief for uniform washing but had no idea where to start. Her Self Assessment returns were a mess, with mixed personal and business expenses, and she was worried about HMRC audits. Bronwyn contacted My Tax Accountant in early 2024 after seeing their website (https://www.mytaxaccountant.co.uk/).

Step 1: Initial Consultation

Bronwyn booked a free consultation with Mr. Maz, the CEO of My Tax Accountant. Over a 30-minute call, Maz asked about her business setup, uniform costs, and other expenses. Bronwyn estimated she spent £150 a year on laundrette fees for her uniforms, plus £50 on detergent for home washes. Maz identified that she could claim these as business expenses on her 2023-2024 Self Assessment return, plus backdate claims for 2021-2022 and 2022-2023.

Step 2: Organising Expenses

Maz’s team helped Bronwyn separate her uniform washing costs from personal laundry expenses, a common sticking point with HMRC. They reviewed her laundrette receipts and calculated an accurate split of electricity and water costs for home washes, using 2024 Ofgem rates (£0.50 per load). They also spotted that Bronwyn was eligible to claim for branded business cards (£100) and a professional catering association membership (£80), which she hadn’t considered.

Step 3: Filing and Backdating

My Tax Accountant filed Bronwyn’s 2023-2024 Self Assessment return, claiming £200 for uniform washing, £100 for business cards, and £80 for the membership—a total of £380 in expenses. This reduced her taxable profit, saving her £76 at the 20% tax rate. They also backdated claims for 2021-2022 and 2022-2023, securing an additional £400 in expenses (£80 tax saving per year). In total, Bronwyn saved £236 in tax across three years.

Step 4: Ongoing Support

When HMRC queried Bronwyn’s 2023-2024 claim, asking for proof of her uniform costs, My Tax Accountant handled the response. They provided a detailed expense log and a letter from Bronwyn’s main client confirming her branded uniforms were mandatory. The claim was approved within two weeks, and Bronwyn’s stress levels dropped to zero. Maz also set her up with cloud-based accounting software to track future expenses, ensuring her 2025-2026 return would be smooth.

Table 4: Bronwyn’s Tax Savings with My Tax Accountant

Tax Year | Expenses Claimed (£) | Tax Relief at 20% (£) |

2021-2022 | 200 | 40 |

2022-2023 | 200 | 40 |

2023-2024 | 380 | 76 |

Total | 780 | 156 |

Source: Author’s calculations based on case study and HMRC guidance, April 2025.

Beyond Uniforms: Holistic Tax Management

So, what else can a tax accountant do? Firms like My Tax Accountant don’t just focus on one expense. They look at your entire tax situation—whether it’s VAT, corporation tax, or personal allowances—to ensure you’re not overpaying. For employees, they can check your tax code to prevent issues like emergency tax, which affected 1.2 million PAYE workers in 2024, per HMRC data. For business owners, they can advise on structuring expenses to minimise tax liability. My Tax Accountant’s tailored approach means they adapt to your specific needs, whether you’re a nurse claiming flat rates or a sole trader with complex costs.

Get in Touch with My Tax Accountant

If Bronwyn’s story sounds familiar, or you just want to make sure you’re not missing out on tax relief for washing your uniform, it’s time to get expert help. My Tax Accountant, led by CEO Mr. Maz, offers a free initial consultation to discuss your situation and uncover potential savings. Whether you’re an employee looking to claim flat rate expenses or a business owner navigating Self Assessment, their team can save you time, money, and hassle. Contact Mr. Maz today at https://www.mytaxaccountant.co.uk/ to book your free consultation and take control of your taxes.

Summary of All the Most Important Points

UK employees can claim tax relief for washing job-specific, branded uniforms if they bear the cleaning costs themselves.

HMRC offers flat rate expenses for uniform maintenance, such as £185 for nurses or £140 for police officers, saving 20% in tax (e.g., £37 for nurses in 2025-2026).

Employees can claim actual costs instead of flat rates if higher, but must provide receipts for expenses like detergent or dry-cleaning.

Self-employed individuals claim uniform washing costs as business expenses on their Self Assessment tax return, requiring proof of costs.

Claims can be backdated up to four tax years (e.g., 2021-2022 to 2024-2025 in 2025), potentially yielding significant refunds.

Employees use the P87 form or HMRC’s online portal to claim relief, which may adjust their tax code or result in a refund.

Combining uniform washing with other job expenses, like professional subscriptions, can increase tax savings (e.g., £505 claim saves £101 at 20%).

Timing claims early in the tax year (April/May) can adjust your tax code sooner, improving monthly cash flow.

HMRC may query claims, especially for actual costs, so keeping receipts and employment proof is crucial to avoid rejections.

Higher-rate taxpayers (40%) gain more from claims (e.g., £74 for a £185 claim), but overclaiming or claiming non-qualifying costs risks penalties.

FAQs

1. Q: Can you claim tax relief for washing a uniform if you work part-time?

A: Yes, part-time workers can claim tax relief for washing a uniform if it’s job-specific and they pay for cleaning, but the flat rate may be pro-rated based on hours worked.

2. Q: Do you need to be in a specific industry to claim uniform washing tax relief?

A: No, any employee or self-employed person can claim if their job requires a branded, mandatory uniform and they cover the cleaning costs themselves.

3. Q: Can you claim tax relief for washing a uniform if you work from home?

A: If your job requires a specific uniform for work-related tasks (e.g., branded attire for virtual client meetings), you can claim relief for cleaning costs, provided you pay for it.

4. Q: What happens if you miss the deadline for filing a uniform tax relief claim?

A: You can still claim for up to four previous tax years, but missing the current year’s Self Assessment deadline (January 31, 2026, for 2024-2025) may delay your refund.

5. Q: Can you claim tax relief for washing a uniform if you’re a contractor?

A: Contractors can claim if self-employed and the uniform is a business expense, or if employed via PAYE and their contract requires them to wash a job-specific uniform.

6. Q: Is tax relief for uniform washing available for temporary workers?

A: Yes, temporary workers can claim if they wear a mandatory, branded uniform and pay for its cleaning, using the same P87 form or Self Assessment process.

7. Q: Can you claim uniform washing tax relief if your employer provides detergent?

A: No, you cannot claim if your employer supplies cleaning materials or services, as you must personally incur the cleaning costs to qualify.

8. Q: Does claiming uniform tax relief affect your tax return filing process?

A: For employees, it’s a separate P87 claim that doesn’t affect your tax return; for self-employed, it’s included as an expense in your Self Assessment filing.

9. Q: Can you claim tax relief for washing a uniform if it’s provided by your employer?

A: Yes, as long as you pay for the cleaning yourself and the uniform is branded and mandatory for your job role.

10. Q: Are there any penalties for incorrectly claiming uniform tax relief?

A: If you claim for non-qualifying expenses or lack evidence, HMRC may disallow the claim and, in rare cases, impose penalties for deliberate errors.

11. Q: Can you claim uniform washing tax relief if you’re on a zero-hours contract?

A: Yes, zero-hours workers can claim if they wear a job-specific uniform and cover cleaning costs, with eligibility assessed based on actual work performed.

12. Q: Does the amount of tax relief for uniform washing vary by region in the UK?

A: No, tax relief rates (e.g., flat rates or actual costs) are the same across the UK, though local energy or cleaning costs may affect actual expense claims.

13. Q: Can you claim tax relief for washing a uniform if you’re an apprentice?

A: Apprentices can claim if their role requires a branded uniform and they pay for its cleaning, following the same HMRC rules as other employees.

14. Q: Is uniform washing tax relief available for gig economy workers?

A: Gig workers can claim if self-employed and their platform requires a branded uniform they clean themselves, included as a business expense in Self Assessment.

15. Q: Can you claim tax relief for washing a uniform if you’re paid through an umbrella company?

A: Yes, if you’re employed via an umbrella company, wear a job-specific uniform, and pay for cleaning, you can claim relief through a P87 form.

16. Q: Does uniform tax relief apply if you wash your uniform at a laundrette?

A: Yes, laundrette costs for washing a job-specific uniform qualify as actual expenses, provided you keep receipts to support your claim.

17. Q: Can you claim tax relief for washing a uniform if you’re a volunteer?

A: Volunteers typically cannot claim tax relief, as they don’t pay income tax, but if you’re paid for volunteer-like work and wear a required uniform, you may qualify.

18. Q: Can you change your tax code if you think it’s incorrect after claiming uniform tax relief?

A: Yes, you can contact HMRC’s PAYE helpline (0300 200 3300) to review and correct your tax code if it doesn’t reflect your uniform tax relief claim.

19. Q: Is there a limit to how many times you can claim uniform tax relief?

A: There’s no limit; you can claim annually for as long as you’re washing a qualifying uniform and incurring the costs, with no cap on years claimed.

20. Q: Can you claim uniform washing tax relief if you’re on maternity leave?

A: You can only claim for periods when you were actively working and washing your uniform, not for periods on maternity leave when no uniform was used.

Click on the above arrow to expand the text

About the Author

Mr. Maz Zaheer, FCA, AFA, MAAT, MBA, is the CEO and Chief Accountant of My Tax Accountant and Total Tax Accountants—two of the UK’s leading tax advisory firms. With over 14 years of hands-on experience in UK taxation, Maz is a seasoned expert in advising individuals, SMEs, and corporations on complex tax matters. A Fellow Chartered Accountant and a prolific tax writer, he is widely respected for simplifying intricate tax concepts through his popular articles. His professional insights empower UK taxpayers to navigate their financial obligations with clarity and confidence.

Disclaimer:

The information provided in our articles is for general informational purposes only and is not intended as professional advice. While we strive to keep the information up-to-date and correct, My Tax Accountant makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained in the articles for any purpose. Any reliance you place on such information is therefore strictly at your own risk. The graphs may also not be 100% reliable.

We encourage all readers to consult with a qualified professional before making any decisions based on the information provided. The tax and accounting rules in the UK are subject to change and can vary depending on individual circumstances. Therefore, My Tax Accountant cannot be held liable for any errors, omissions, or inaccuracies published. The firm is not responsible for any losses, injuries, or damages arising from the display or use of this information.

Comments