Spouse Exemption Inheritance Tax

- MAZ

- Sep 19, 2025

- 20 min read

Understanding Spouse Exemption in UK Inheritance Tax: What Every Taxpayer and Business Owner Must Know in 2025

Imagine this: You're sitting down with your partner, perhaps after years building a life and a business together, worried about what happens to your estate when one of you passes. Naturally, you want to make sure your hard-earned assets go straight to your spouse, free from the dreaded Inheritance Tax (IHT)—a common concern for many UK taxpayers and business owners alike.

Let’s start with a clear answer: Under UK law, transfers of assets between spouses or civil partners are generally exempt from Inheritance Tax—meaning if your estate passes directly to your spouse, IHT won’t bite, regardless of the amount. But, as with most things tax-related, there are important nuances—especially with the reforms effective from April 2025—that could impact how much tax might be payable, particularly for international couples or those with complex residencies.

The Core of Spouse Exemption: What Hasn't Changed

To keep it straightforward, here’s what has stayed consistent over the years for spouse exemption:

● Transfers between spouses or civil partners are exempt from IHT.

● This exemption applies regardless of the size of the estate.

● It only applies if you are legally married or in a civil partnership; unfortunately, living together as "cohabitants" without formal registration offers no such exemption.

● The exemption also applies to gifts made during lifetime between spouses.

Practically speaking, if you’re married to Mary or civil partnered with John, and you leave your assets to them, HMRC will not charge inheritance tax on that transfer. This is a cornerstone relief that helps protect family assets and businesses from tax drains upon death.

What’s New from April 6, 2025? The Long-Term UK Residence Test

Now, here comes the important bit where many get caught out, especially those with cross-border lives or business interests abroad. The game changer for 2025 is how “spouse exemption” relates to residence status rather than the old concept of domicile.

● From 6 April 2025, a person is considered a long-term UK resident for IHT if they have been UK tax resident for at least 10 of the previous 12 tax years before death.

● Full spouse exemption applies only if both spouses meet this long-term residency test. If one spouse has not lived in the UK long enough (e.g., moved recently or spends most time abroad), then the exemption is limited.

● For a non-resident or short-term resident spouse, the exemption is limited to the nil-rate band, currently set at £325,000 for the 2025/26 tax year.

● This new rule replaces the previous reliance on domicile status, simplifying some aspects but complicating others especially for international or blended families.

What does this mean practically? John, who moved to the UK from Australia just five years ago and marries Susan, a lifelong UK resident, won’t enjoy full spouse exemption if he passes assets on to her unless he fulfills the 10-year residency rule.

The Nil-Rate Band and Residence Nil-Rate Band: What You Need to Watch

Even if full exemption isn’t available due to residency, spouses still benefit from important allowances:

Allowance | Amount for 2025/26 | Notes |

Nil-rate band | £325,000 | Standard allowance before IHT applies on the balance |

Residence nil-rate band (RNRB) | £175,000 | Additional allowance when passing a family home to direct descendants |

● The nil-rate band remains frozen at £325,000 for 2025/26.

● The residence nil-rate band, introduced earlier, helps families pass the main residence to children or grandchildren tax-free—potentially up to £500,000 combined with the nil-rate band.

● These bands are transferable between spouses. For example, if the first spouse to die didn’t use all of their nil-rate band, the surviving spouse can claim the unused portion.

But for spouses who do not meet the 10-year UK residence test, the exemption only covers transfers up to £325,000. Amounts above this threshold could be subject to IHT at a rate of 40%.

Real-Life Case: When Residency Rules Trip Business Owners

In my years advising clients across Greater London and the UK, I recently worked with a client, Raj, a successful software entrepreneur originally from India but now UK resident for 6 years. Raj’s partner, Emma, has lived here her whole life.

Raj wanted to transfer his shares in a tech firm to Emma upon his death, expecting the transfer to be IHT free under spouse exemption.

However, because Raj hadn’t yet met the 10-year residency requirement, only the first £325,000 of assets passed exempt; the excess was liable to a hefty IHT bill. This was a shock, as he had always assumed marriage equals full exemption.

The outcome? Raj and Emma engaged in careful estate planning strategies, including trusts and lifetime gifts, to mitigate IHT exposure and align with Raj’s residency timeline.

How Do Business Assets Affect Spouse Exemption?

Business owners must be particularly vigilant because business property reliefs (BPR) interact with spouse exemption and IHT in complex ways:

● Business Property Relief can reduce the value of qualifying business assets by either 50% or 100% for IHT purposes, potentially eliminating tax on businesses passed on death or as lifetime gifts.

● However, BPR does not apply to gifts or transfers between spouses directly because the spouse exemption generally overrides IHT.

● If the spouse exemption is limited by residency rules, BPR can become an essential tool in reducing IHT on transferred business assets.

● Careful timing and ownership structuring is critical; assets must meet qualifying criteria, including length of ownership (usually 2 years) and the nature of the business.

Spouse Exemption Does Not Cover De Facto Partners — Important Warning

I often remind clients who live with partners but are not legally married or civil partners that no spouse exemption applies in those scenarios. This is a common cause of unexpected IHT bills.

The only way to secure IHT exemption is through legal marriage or civil partnership registration.

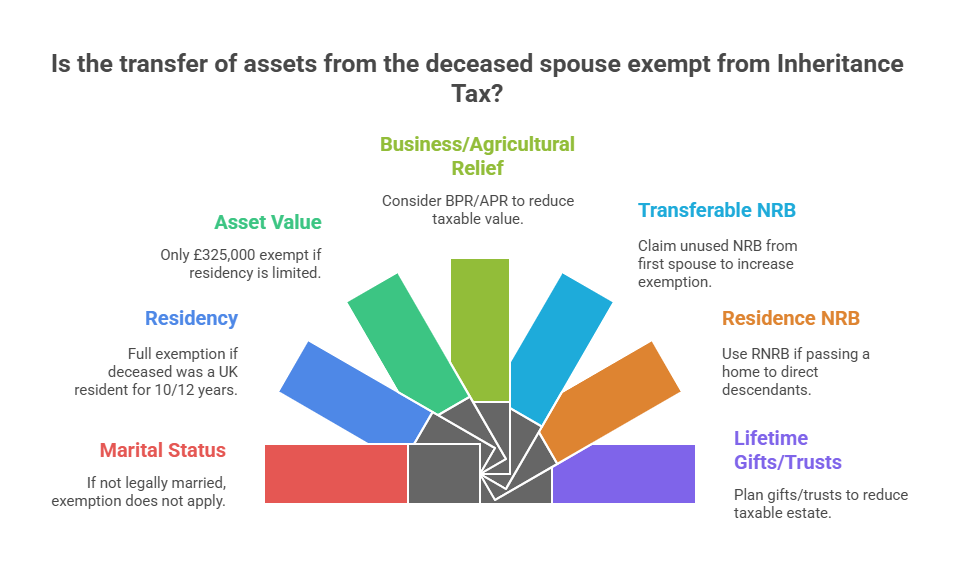

Step-by-Step Quick Check for Spouse Exemption Eligibility in 2025/26

For anyone wondering whether their transfer will be exempt under spouse exemption, run through this checklist:

Are you legally married or in a civil partnership? If no, spouse exemption does NOT apply.

Has the deceased spouse been UK resident for at least 10 of the previous 12 tax years? If yes, full exemption applies.

If not, what is the value of assets transferred? Only the first £325,000 is exempt.

Are there qualifying business or agricultural assets? Consider claims for Business or Agricultural Property Relief if spouse exemption is limited.

Has the nil-rate band been fully used? Check if you can claim transferable nil-rate bands from first spouse’s death.

Is a family home included? Check if Residence Nil Rate Band applies for further relief.

Have you considered lifetime gifts or trusts to reduce the taxable estate? Plan carefully with professional advice.

Summary of 2025/26 Tax Data Relevant to Spouse Exemption

Item | 2025/26 Threshold or Rate |

Nil-rate band (NRB) | £325,000 |

Residence Nil-rate band (RNRB) | £175,000 |

IHT main rate above threshold | 40% |

Minimum UK residence for full spouse exemption | 10 of last 12 tax years |

Business Property Relief (BPR) | 50% or 100% depending on asset type |

UK Inheritance Tax Statistics

How to Verify and Maximise Spouse Exemption Inheritance Tax in the UK: Practical Steps, Case Studies, and Business Owner Insights

Now that we have nailed what spouse exemption is and what's changed in 2025, let’s get practical. Picture this: you’ve just received notice from HMRC or your executor is struggling to figure out how your inheritance tax (IHT) liabilities stack up. What steps should you follow to verify your exemption status, calculate potential tax, and navigate common pitfalls? And what about if you’re a business owner or self-employed managing multiple income streams? Let’s walk through real client-inspired scenarios and practical advice.

Step-by-Step Guide to Checking Your Spouse Exemption IHT Status

None of us loves tax surprises, but here’s how to avoid them step by step:

Confirm marital status or civil partnership status

Your spouse exemption hinges on this basic qualification — cohabiting but unmarried couples must consider other options like trusts or lifetime gifts.

Determine the long-term UK residence status

Assess if both spouses meet the 10 out of 12 tax years UK residency required for full exemption. If unsure, check HMRC residency status via your personal tax account or tax returns from previous years.

Gather estate values and valuations

Collect current valuations of properties, business interests, investments, and other assets that form the estate.

Calculate total value transferred to spouse/civil partner

Confirm how much value is being transferred through lifetime gifts or death, including jointly held properties.

Apply nil-rate band and residence nil-rate bands where applicable

Add £325,000 nil-rate band per estate and £175,000 residence nil-rate band if passing a home to descendants. Check if any unused spouse allowances can be claimed.

Check IHT Business and Agricultural Property Relief eligibility

For business owners or farmers, apply these reliefs to reduce taxable estate portions if spouse exemption is restricted.

Look for any lifetime gifts or trusts affecting taxable value

Review any transfers made during lifetime for chargeable transfers or Potentially Exempt Transfers that might impact the estate.

Calculate potential IHT liability at 40% over thresholds

After applying all exemptions and reliefs, calculate tax due on any excess value above allowance limits.

Real Estate Example: The Youngatheart Allowance Transfer Case

To illustrate the power of spouse exemption and allowance transfer, consider the Youngatheart family from Sussex.

● Mr Youngatheart died in June 2025, leaving all his £1 million estate to Mrs Youngatheart,

● He hadn’t used 40% of his inheritance allowance as some was gifted to their children before death.

● Mrs Youngatheart therefore claims Mr Y’s unused percentage of nil-rate band and residence nil-rate band.

● Mrs Youngatheart benefits from a total allowance of £805,000, significantly increasing their tax-free estate threshold.

● This saved thousands in IHT for the family, showing the value in properly claiming transferable allowances.

Practical Tips for Business Owners Managing Spouse Exemption

Now, let’s think about your situation — if you’re self-employed or a business owner, the rules can feel trickier:

● Valuation challenges: Business valuations can be complex, especially around intangible assets or goodwill. Never rely solely on rough estimates; obtain professional valuations.

● Use of Business Property Relief (BPR): If the spouse exemption is limited due to residency, BPRs are key to shielding business assets. For example, someone owning a 100% eligible business can secure 100% relief, eliminating IHT on that value.

● Timing matters: Assets must meet qualifying criteria for 2 or more years to qualify for BPR. This is a common stumbling block in cases of recent acquisitions or restructuring.

● Watch out for mixed-ownership: If shares or assets are held jointly with non-spouse partners or other businesses, reliefs and exemptions can be reduced or lost.

● Beware of unintended chargeable transfers: Large lifetime gifts to spouses may reduce available nil-rate band upon death, especially if the recipient spouse is a non-long-term UK resident.

Case Study: Freelancer Caught by Overlooked Side Hustle Income and IHT Implications

Take Sarah from Bristol, a graphic designer with a freelance side hustle alongside her salaried job. Over the years, she and her husband amassed assets including jointly owned rental properties in the UK and abroad.

● Sarah assumed full spouse exemption on passing property share to her husband.

● However, unbeknown to her, her husband's UK residence status was borderline, failing the 10-year test.

● The part of the estate exceeding £325,000 was exposed to IHT.

● Additionally, some rental income abroad was never declared properly in her husband's UK tax returns.

● This oversight led to HMRC investigations and unexpected tax bills.

The lesson? Double-check residency statuses and income reporting when multiple revenue streams cross borders or business activities diversify.

Checklist: Common Pitfalls and How to Avoid Them

● Assuming cohabitation equals exemption: Only marriage/civil partnerships apply. Unmarried partners should seek advice for planning trusts or lifetime transfers.

● Ignoring changes in residency test: Review each spouse’s tax residence yearly to confirm exemption eligibility.

● Neglecting nil-rate band transfers: Take advantage of unused allowance transfers to boost tax-free inheritance limits.

● Overlooking business reliefs: Keep business asset qualification under review, especially with ownership changes.

● Failing to consider lifetime gifts: Large gifts to spouses or others may reduce available allowances or impact future IHT.

● Forgetting to report overseas assets and income: Non-disclosure can trigger penalties and additional tax liabilities.

● Not keeping professional valuations: Asset values must be appropriately certified to support relief claims.

How to Use Your HMRC Personal Tax Account to Check Spouse Exemption Status

For a quick verification:

Log into your personal tax account.

Check your residency status under “Check your personal details.”

Review your inheritance tax account for any transferred allowances or exemptions claimed.

Confirm details of recently reported lifetime gifts, trusts, or estate values.

Use the online IHT calculator to get a rough estimate of liabilities, including spouse exemption impact.

Business Owner Insight: Optimal Deduction and Reporting Strategy

In my 18+ years advising business owners, the most successful estate plans are those where:

● Business owners regularly update valuations and plan ownership transfers well in advance.

● They synchronise personal tax planning with corporate strategy, such as adjusting dividends or salary mix.

● Trust structures are employed cautiously for non-spouse beneficiaries to control future tax burdens.

● Close attention is paid to changes in law like the 2025 residency rule, ensuring estate plans remain compliant.

● Plans account for unexpected events — like divorce or remarriage — which can impact allowance transfers or expose hidden liabilities.

Step-by-Step Guide to Checking Your Spouse Exemption Status

Avoid nasty tax surprises by following these steps:

Confirm marital or civil partnership status

Only legal marriage or civil partnerships qualify for spouse exemption. Cohabitants don’t, no matter how long the relationship.

Check long-term UK residence status for both spouses

Assess whether both have been UK residents for at least 10 of the last 12 tax years, which is essential for full exemption. Use your personal tax account or consult prior tax returns for proof.

Gather valuations for the entire estate

Include properties, business interests, investments, cash, and other valuable assets.

Calculate the total value transferred to the spouse

Consider lifetime gifts and transfers on death, including jointly-held assets.

Apply the nil-rate and residence nil-rate bands

The nil-rate band for 2025/26 remains £325,000, with an additional £175,000 residence nil-rate band if a home is transferred to direct descendants. Look for any transferable unused spouse allowances.

Check for potential Business and Agricultural Property Relief (BPR, APR)

If the spouse exemption is limited, these reliefs may reduce taxable business or farm assets.

Review any lifetime gifts or trusts

Lifetime gifts may reduce the nil-rate band available and have implications for IHT.

Calculate the potential IHT liability at 40%

Any assets that exceed available reliefs and allowances are taxed at 40%.

Real Estate Example: The Youngatheart Family Case

Here’s a practical example from Sussex that clients might find instructive:

● Mr Youngatheart passed away in June 2025, leaving an estate valued at £1 million entirely to Mrs Youngatheart.

● Mr Youngatheart had gifted some assets during lifetime to their children, using only 60% of his inheritance tax allowances.

● Mrs Youngatheart claimed the unused 40% of his nil-rate and residence nil-rate bands.

● This increased her tax-free allowance to £805,000 and saved the family thousands in tax.

● This case highlights the importance of correctly claiming unused allowances—a common oversight.

Tips for Business Owners: Navigating Spouse Exemption with Complex Assets

For self-employed individuals and business owners, spouse exemption rules can get thorny:

● Valuations can be complicated: Never rely on guesswork. Professional valuations, especially for intangibles like goodwill, are vital.

● Business Property Relief (BPR) becomes essential: If your spouse exemption is limited (e.g., due to residency), BPR can shield significant business value from IHT.

● Timing is critical: Assets usually need to be owned for at least 2 years to qualify for BPR.

● Watch out for mixed ownership: Shares held jointly with others complicate relief eligibility.

● Be wary of unintended chargeable transfers: Large lifetime gifts to spouses might reduce overall allowances if your spouse lacks full UK residency.

Client Scenario: Side Hustle Overlooked Leads to Tax Trouble

Sarah, a graphic designer in Bristol, combined a salaried role with a freelance business, meanwhile owning rental property with her husband.

● She assumed full spouse exemption would apply on passing property shares to her husband.

● It turned out her husband’s UK residency wasn’t sufficient under the 10-year rule.

● The estate portion exceeding £325,000 was taxed, and undeclared foreign rental income triggered additional investigations.

● Result: unexpected tax bills and penalties.

The key takeaway? Double-check residency rules and ensure overseas incomes and assets are reported accurately.

Checklist: Avoid These Common Spouse Exemption Pitfalls

● Assuming cohabiting partners enjoy exemption—only married or civil partners do.

● Overlooking the 10-year residency test for either spouse.

● Forgetting to claim unused spouse allowances—these can boost tax-free thresholds.

● Neglecting Business Property Relief eligibility for business assets.

● Ignoring lifetime gifts which may decrease available nil-rate bands.

● Failing to report overseas assets and income properly.

● Skipping professional valuations—particularly important for business and property assets.

Using the HMRC Personal Tax Account for Quick Checks

You can quickly verify essential details by:

Logging into your personal tax account.

Checking residency status under your personal details.

Reviewing inheritance tax account summaries for transferred allowances.

Confirming reported gifts, trusts, and estate details.

Using the IHT calculator provided to estimate liabilities with spouse exemption applied.

Business Owner Best Practice: Coordinating Tax and Estate Planning

In over 18 years advising business owners, the best results come from:

● Regularly updating asset valuations.

● Aligning personal and business tax strategies like salary and dividends.

● Employing trusts for non-spouse beneficiaries with care.

● Staying current on law changes—especially residency rules introduced in 2025.

● Planning for life changes: divorce, remarriage, or changing ownership structures.

Advanced IHT Checks and Regional Variations: Spotting Hidden Errors and Key Takeaways for UK Taxpayers and Business Owners

So, you’re getting comfortable with spouse exemption basics and verification steps—brilliant. Now, let’s tackle some advanced real-world wrinkles that often trip people up, especially those juggling multiple income sources or living in Scotland or Wales where tax rules can diverge slightly. We’ll also zoom into common errors and how to avoid costly mistakes, plus round off with a comprehensive summary to make sure you’re armed to the teeth.

What If You Have Multiple Income Sources or Are Self-Employed?

Picture this: Jamie runs a small consultancy business while receiving rental income and pension benefits. Their wife, Laura, has significant savings and investments outside the UK. When Jamie passes away, assessing spouse exemption and the estate’s IHT liability becomes a maze.

Key complexities here:

● Complex estate composition: Estates comprising business assets, UK and overseas properties, pensions, and savings need meticulous valuation.

● Different tax treatments on assets: Pensions are generally outside of IHT, but other assets like rental income properties and shares might not be.

● Reporting challenges: Undeclared overseas income or properties can surface late in estate administration and attract penalties.

● Interaction with spouse exemption: Jamie’s UK residency and that of Laura, plus the nature of their assets, must be carefully analysed to determine how much passes exempt.

The takeaway here is to keep thorough records, get professional valuations, and review each type of income or asset against IHT rules regularly. In my experience, clients managing diverse income streams find that a blended approach, combining spouse exemption with Business Property Relief and strategic gift planning, can optimise tax outcomes.

Scottish and Welsh Inheritance Tax Nuances

If you or your spouse live in Scotland or Wales, keep in mind:

● The Inheritance Tax system is primarily UK-wide, so spouse exemption rules apply similarly.

● However, Scottish Income Tax bands and thresholds differ and do not directly affect IHT rates but do impact overall financial planning.

● Wales has devolved powers over some tax areas, but IHT remains devolved to the UK government, meaning the spouse exemption rules discussed apply uniformly.

● Practical consideration: Estates involving residential properties in Scotland or Wales require checking local valuations and fees, which can affect net inheritance.

In practice, I’ve seen clients unintentionally overlook these regional nuances, causing delays in probate or unexpected fees. Checking with local solicitors familiar with regional probate rules is a must.

Spotting Hidden IHT Errors: What Many Miss

Now, let’s get into some traps I’ve caught firsthand:

● Misinterpreting residence rules: Couples moving between countries frequently often misjudge who qualifies as a “long-term UK resident.” This can lead to partial rather than full spouse exemption and unpleasant tax bills.

● Missed nil-rate band transfers: Executors sometimes fail to claim the unused nil-rate band from the first deceased spouse, sacrificing thousands in potential relief.

● Confusing lifetime gifts: Gifts to spouses made shortly before death can complicate estate valuations and exemption eligibility.

● Overlooking trusts and settlements: Assets held in certain trusts may not benefit from spouse exemption, leading to potential IHT liabilities.

● Failure to report foreign assets: Especially among business owners with international holdings, this can trigger penalties and lost reliefs.

● Assuming pension funds are inert: Some pension deaths trigger tax adjustments, and the interaction with spouse exemption can be complex.

Emergency Tax and High-Income Child Benefit Charge: A Rare Overlap?

Though related to income tax rather than inheritance tax, high-income Child Benefit Charge and emergency tax situations occasionally confuse clients dealing with estate income post-death.

● If the deceased paid emergency tax or had high-income Child Benefit charges, executors must ensure proper tax codes for final income assessments.

● Ensuring these are handled correctly avoids miscalculations that might influence available cash to pay IHT or administer the estate.

Comprehensive Summary of Key Points

Full spouse exemption from IHT applies only if both spouses meet the 10-year UK residence rule.

Without this, exemption is limited to £325,000.

Transfers between married or civil partners are exempt; cohabitants do not qualify.

Proper legal status is crucial.

Unused nil-rate bands, including residence nil-rate bands, can be transferred and significantly increase tax-free thresholds.

Executors must actively claim these allowances.

Business Property Relief can shield business assets when spouse exemption is partial.

Timing and qualifying criteria are essential.

Complex estates with multiple income sources require careful valuation and tax review.

Professional advice is highly recommended.

Scottish and Welsh inhabitants should be aware of regional probate nuances even though IHT rules stay mostly consistent.

Common errors like misjudging residency status or neglecting to claim allowances can lead to unnecessary IHT payments.

Executors must report and value overseas assets properly to avoid penalties and tax exposure.

Lifetime gifts to spouses made shortly before death require careful scrutiny as they impact IHT calculations.

Tax issues like emergency tax or the Child Benefit Charge should be handled properly to avoid affecting estate administration.

FAQs

Q1: Can a spouse exemption be affected if one partner moves abroad temporarily?

A1: Well, it's worth noting that the recent tax rules hinge on a "long-term UK residence" test: you generally need to have been UK tax resident for at least 10 of the last 12 years. So if one spouse moves abroad temporarily and breaks this continuity—say, working overseas for a few years—that spouse exemption could be limited. I had a client who worked abroad for 3 years and unexpectedly saw their spouse exemption capped at £325,000 instead of being unlimited. So it pays to track your residency carefully and plan any overseas moves with inheritance tax in mind.

Q2: Does spouse exemption apply automatically even if the couple is separated but still legally married?

A2: Yes, in most cases the spouse exemption still applies if you're legally married or in a civil partnership, even if separated. However, financial arrangements like separation agreements or court orders can complicate things. Executors should carefully review legal documents to determine which transfers qualify for the exemption. I’ve seen cases where ambiguous separation settlements delayed probate while clarifying exemption eligibility.

Q3: How does spouse exemption work for couples owning property jointly with unequal shares?

A3: This is a commonly overlooked area. If the property is held as “joint tenants” (equal ownership), the entire property typically passes tax-free to the surviving spouse. But with “tenants in common” where shares differ, the smaller ownership portion may not automatically transfer, potentially exposing that part to IHT. A client in Manchester discovered a sizeable tax bill after setting up a buy-to-let incorrectly on a tenants in common basis without considering inheritance implications. Always check your share structure carefully.

Q4: Can spouses claim inheritance tax relief on business assets inherited from each other?

A4: Generally, transfers between spouses are exempt from IHT, so Business Property Relief (BPR) is usually not needed. But if one spouse fails the long-term residence test, the exemption limits apply, and BPR becomes critical. For example, I advised a couple where one spouse recently returned from abroad and didn’t meet residency criteria; BPR saved them thousands on transferred business shares. Planning the timing of ownership transfers can make a big difference here.

Q5: Are lifetime gifts to a spouse exempt from inheritance tax, and what pitfalls should be avoided?

A5: Gifts to a spouse are usually exempt, both lifetime and on death, provided the spouse qualifies under the residence rules. Beware, though: if you make a large gift shortly before death and the spouse isn’t a long-term UK resident, exemption may be limited. A client in Leeds inadvertently triggered a PET charge because the gift exceeded the exemption cap and death followed within seven years. Documenting gifts and residency status meticulously is essential.

Q6: Does spouse exemption apply equally to same-sex married or civil partners?

A6: Absolutely, the law treats married couples and civil partners equally for inheritance tax purposes. So, all spouse exemption benefits apply regardless of gender, provided legal marriage or civil partnership status and residency criteria are met. This equal treatment provides vital clarity and fairness for all couples.

Q7: How can someone quickly check their spouse exemption and inheritance tax allowances with HMRC?

A7: Logging into your personal tax account online is the best starting point. It shows your residency history, gifts, estate details, and transferred unused allowances. I often walk clients through this simple step, enabling them to spot discrepancies early and avoid nasty surprises when dealing with their tax returns or probate.

Q8: What special considerations are there for self-employed individuals regarding spouse exemption and business assets?

A8: Self-employed folks usually have more complicated estates—goodwill, business assets, and irregular income streams. Spouse exemption applies if residency and legal status criteria are met, but qualifying for Business Property Relief on the business assets is crucial if exemption is limited. A graphic designer I advised timed restructuring to secure BPR and reduce estate tax liability significantly. Holding qualifying business assets for at least two years is often a key detail many overlook.

Q9: Does having multiple jobs or income streams affect spouse exemption eligibility?

A9: Not directly. Spouse exemption is based on marriage status and residency, not income from jobs. However, having multiple income streams can complicate proof of residency and make estate valuations trickier. I recommend keeping thorough records, especially for self-employed or contract workers juggling different roles.

Q10: How does pension income intersect with spouse exemption and inheritance tax?

A10: Most pensions aren’t subject to inheritance tax directly, but lump sums or death benefits from certain pension schemes can affect overall estate value. Spouse exemption doesn’t cover pensions per se but reviewing pension beneficiary nominations alongside spouse exemption planning is smart. I often see clients mistakenly think pensions pass tax-free by default—clarifying this can prevent unexpected tax hits.

Q11: What happens if a spouse who is a non-UK resident dies—how does that affect exemption?

A11: The exemption depends on their UK tax residence history. If they have been a long-term UK resident (10 of last 12 years), full spouse exemption applies. If not, the exemption is capped at the nil-rate band for UK assets, and overseas assets may be subject to foreign inheritance taxes. Documenting residence years is critical to support full exemption claims.

Q12: Can others challenge a spouse exemption claim during probate?

A12: Yes, beneficiaries can contest spouse exemption claims especially if there are doubts about residency status or asset valuations. Executors must maintain clear documentation to prove entitlement, or face delays and disputes. I’ve helped clients navigate such challenges by ensuring thorough evidence to HMRC and beneficiaries.

Q13: What are the inheritance tax implications for spouses who remarry later in life?

A13: Remarriage resets your spouse exemption arrangement. Each marriage holds its own exemption potential, so failing to update wills or estate plans after remarriage can cause confusion or lost allowances. I’ve seen clients inadvertently miss out on allowance transfers due to failing to formalise new plans post-remarriage, resulting in surprise tax bills.

Q14: How does spouse exemption work if the deceased did not leave a will?

A14: Intestacy rules usually mean assets pass to the surviving spouse, so exemption applies. But if there are children from prior relationships or other relatives, the division can be more complex, potentially reducing the exemption's effectiveness. Seek professional advice to tidy up intestate estates to avoid unintended IHT costs.

Q15: Do low-value estates still need to worry about spouse exemption rules?

A15: For estates under the nil-rate band (£325,000), inheritance tax isn’t payable regardless of beneficiary status. Still, it’s important to prove marriage status and residency when applying for probate. It’s a common mix-up to assume no paperwork is needed, which can delay proceedings unnecessarily.

Q16: Can cohabiting couples benefit from spouse exemption on inheritance tax?

A16: Unfortunately not. Cohabitants don’t qualify for spouse exemption regardless of relationship length or children. I’ve had shop owners in Birmingham surprised to learn this and advised on wills and trusts to plan better. Legal marriage or civil partnership is key.

Q17: How do emergency tax or income tax underpayments affect estate and spouse exemption?

A17: Income tax and inheritance tax are separate, but unpaid income tax or emergency tax on the deceased’s final tax year can reduce liquid assets needed to pay IHT. Executors must ensure all tax liabilities are settled promptly to avoid cashflow problems and penalties during administration.

Q18: What documents should be prepared to support a spouse exemption claim?

A18: Marriage or civil partnership certificates, proof of long-term UK residence (such as tax returns and utility bills), full estate valuations including business asset assessments, and records of any lifetime gifts are essential. I advise clients to keep these regularly updated to smooth estate administration.

Q19: How often should couples review their estate and spouse exemption plans?

A19: At least annually, or after major life events like moving abroad, changing jobs, or remarriage. Regular reviews allow timely adjustments—something a client in Cornwall did after switching to remote work, which impacted her residency and potential exemptions.

About the Author

Maz Zaheer, AFA, MAAT, MBA, is the CEO and Chief Accountant of MTA and Total Tax Accountants, two premier UK tax advisory firms. With over 15 years of expertise in UK taxation, Maz provides authoritative guidance to individuals, SMEs, and corporations on complex tax issues. As a Tax Accountant and an accomplished tax writer, he is renowned for breaking down intricate tax concepts into clear, accessible content. His insights equip UK taxpayers with the knowledge and confidence to manage their financial obligations effectively.

Disclaimer:

The information provided in our articles is for general informational purposes only and is not intended as professional advice. While we strive to keep the information up-to-date and correct, MTA makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained in the articles for any purpose. Any reliance you place on such information is therefore strictly at your own risk. The graphs may also not be 100% reliable.

We encourage all readers to consult with a qualified professional before making any decisions based on the information provided. The tax and accounting rules in the UK are subject to change and can vary depending on individual circumstances. Therefore, MTA cannot be held liable for any errors, omissions, or inaccuracies published. The firm is not responsible for any losses, injuries, or damages arising from the display or use of this information.

Comments