UK Dividend Withholding Tax

- MAZ

- Aug 30, 2025

- 15 min read

Updated: Sep 11, 2025

Why There’s Almost No Withholding Tax on UK Dividends—And What You Must Still Watch

The Short Answer, First

In plain terms—you generally won’t see any withholding tax deducted from dividends paid in the UK. Most dividends come to you gross. The exception lies with Property Income Distributions (PIDs) from UK Real Estate Investment Trusts (UK-REITs), which are paid after 20% tax is deducted at source GOV.UK+1.

Picture This: Your Dividend Statement

Picture this: You open your email, expecting a tidy dividend credit, only to see HMRC has already deducted tax. Surprising? That’s usually only if your income came through a REIT as a PID. I’ve seen clients scratch their heads at that till we walked through the distinction—so it’s worth flagging straight away.

What the 2025/26 Rates and Thresholds Actually Look Like

Let’s get the key figures front and centre:

That table is your go-to tax snapshot—straight from the horse’s mouth (i.e., GOV.UK). In my experience advising clients across London and Manchester, most misunderstandings stem from not realising how small that dividend allowance is now, or how it eats into their total taxable income.

Why Tax Withholding Isn’t Common—and How PIDs Interrupt That Rule

None of us loves surprises—particularly when a payment shows up lower than expected. Here's why:

● Typical dividends (e.g., from a company you’ve invested in) are paid in full. You’re responsible for any tax due, via PAYE adjustment or Self Assessment, rather than paying it upfront.

● REIT PIDs? These are the exception. Property Income Distributions are taxed at source—20% withheld—because they count, in the shareholder’s hands, as property income not as dividends GOV.UK+1.

Take the case of “James in Leeds”, for example—he owned shares in a UK-REIT and expected a clean dividend. Instead, HMRC had already slipped 20% off the top. Once we reviewed the PID vs normal dividend distinction in HMRC’s manual, the confusion cleared—PID, property income, separate business, separate treatment.

The Tax Creep You May Not Realise

Here’s something even seasoned investors miss:

● The £500 dividend allowance (down from £1,000 only a couple of years ago) means far more people now pay tax on even modest dividend income GOV.UK.

● Meanwhile, personal allowances and thresholds remain frozen—that £12,570 personal allowance isn’t increasing, nor is the basic rate limit (£37,700)—so the higher rate band kicks in at £50,270 GOV.UK+1.

Imagine a freelance graphic designer earning £30k salary and £5k in dividends. That £500 allowance barely saves you—everything above and even part of it might be liable at 8.75%, while pushing you closer to a higher-rate bracket.

Quick Real-World Scenario

Let me tell you about Sarah from Manchester—a small business owner. She earned a £40k salary and received £2k in ordinary dividends. Here’s how it plays out, using HMRC’s framework:

Total income = £42,000; Personal Allowance = £12,570 —> Taxable income = £29,430.

On dividends: first £500 tax-free. That leaves £1,500 taxable at 8.75%.

She got no withholding at payment—because those were standard dividends, not PIDs. We used HMRC’s “Tax on dividends” tool (check how much tax you pay on dividends) to double-check GOV.UK.

In conditions like this, you won’t see ‘tax deducted’ on your statement. It just quietly lands on your end-of-year bill if you're not checking in time.

Why This Context Matters for You (and What to Watch For)

Let’s be clear: there’s usually no withholding on UK dividends, so you must be proactive about tax accuracy. Watch especially for:

● Dividend income creeping above £500.

● Your total income clocking into the higher/additional rate bands.

● Mixed-income scenarios (salary + dividends + side hustle).

● PIDs from REITs hitting unexpectedly tax-deducted amounts.

When those flags appear, it’s not just numbers—it’s money and planning at stake.

UK Tax Statistics Dashboard

Making Sense of Your Dividend Tax Bill—For Employees, Freelancers & Directors

None of Us Loves Tax Surprises

None of us loves tax surprises, but the truth is, dividend income has a habit of sneaking into places you don’t expect. Maybe it’s your employer-run share scheme, maybe it’s a side investment, maybe it’s dividends from your own limited company. In all these cases, the same rules apply: you must work out if you owe HMRC more than what’s already been covered in PAYE—and act on it.

Step-by-Step: Checking if You Owe Tax on Dividends

Add up all your income:

○ Salary, wages, pensions, self-employment, rental income—everything taxable.

○ HMRC has a tool to help you check your total income tax liability (gov.uk).

Deduct your Personal Allowance (£12,570):

○ Frozen until 2028, so it won’t rise with inflation (gov.uk).

Apply the £500 dividend allowance:

○ Anything above £500 is taxable (gov.uk).

Work out which tax band you fall into:

○ Up to £50,270 = basic rate (8.75% on dividends).

○ £50,271–£125,140 = higher rate (33.75%).

○ Over £125,140 = additional rate (39.35%).

○ If your income exceeds £100k, remember your Personal Allowance tapers away £1 for every £2 over that limit (gov.uk).

Check if you need to tell HMRC:

○ If your dividend income is more than £10,000, you must file a Self Assessment return (gov.uk).

○ Under £10,000, HMRC may adjust your tax code instead.

Employees with Dividend Income

Picture this: You’re an employee on PAYE, you get a monthly salary, and then you receive £2,500 in dividends from your shareholdings.

● Your employer won’t adjust PAYE for dividends—it’s not their job.

● If the dividends are under £10,000, you can ring HMRC or use your Personal Tax Account to ask them to change your tax code, so the tax is collected through PAYE automatically (gov.uk).

● If they’re over £10,000, you’ll need to register for Self Assessment and complete a tax return (gov.uk).

Tip from the trenches: I once had a client in Birmingham who ignored a £15k dividend on top of her £45k salary. She thought her employer’s PAYE had covered “everything.” HMRC caught it two years later, slapped interest and penalties on top. Don’t let that be you—always cross-check with your P60 and dividend vouchers.

Self-Employed Individuals

Now, let’s think about your situation—if you’re self-employed. You’re already filing a Self Assessment return every year. Adding dividend income here is simpler, but there are pitfalls:

● Your self-employment profits and your dividends are stacked together for income tax purposes. That means dividends could tip you into a higher band.

● Example: A freelance IT consultant with £48k profits and £2k dividends. That £2k pushes part of the income into higher-rate territory, so some of those dividends get taxed at 33.75% instead of 8.75%.

● The Self Assessment form has a specific section for dividend income, and you’ll need your dividend vouchers to fill it out accurately (gov.uk).

Case in point: A client in Bristol once overlooked £3k of dividends because “it was only a side pot.” When we corrected his Self Assessment, the system showed £1k underpaid tax, plus late interest. Small slips can get expensive.

Directors of Limited Companies

This is where things get especially real. Most small business owners in the UK pay themselves a small salary plus dividends. Here’s what you need to know:

● Dividends are paid from post-tax company profits—after Corporation Tax. So you’re taxed twice in effect: once at the company level, then personally.

● You must hold a board meeting and issue a dividend voucher—even if you’re the only director/shareholder (gov.uk).

● The tax treatment is the same: £500 allowance, then 8.75% / 33.75% / 39.35% depending on your income band.

● Be careful here, because I’ve seen clients trip up by declaring dividends without checking if profits were sufficient. If HMRC thinks it’s a disguised salary, you could face penalties.

Example: Tom, a director in Manchester, took £9k salary and £40k dividends. His tax breakdown:

● £12,570 Personal Allowance offsets the £9k salary and part of the dividends.

● First £500 of dividends tax-free.

● The rest (£37,930) taxed mostly at 8.75% (within the basic band).

● Result: a tidy, tax-efficient extraction, but only because we planned it carefully with accurate records.

Special Situations You Might Face

● Scottish/Welsh taxpayers: The income tax bands on salary are different, but dividend rates are still UK-wide. So your dividends are layered after your regional income tax. See Scottish rates and Welsh rates.

● High-Income Child Benefit Charge (HICBC): If your total income exceeds £50k (salary + dividends + other), you may need to repay part or all of your Child Benefit (gov.uk).

● Emergency tax codes: Sometimes HMRC adjusts PAYE codes mid-year to “catch” dividend liability. Always check your code looks right (gov.uk).

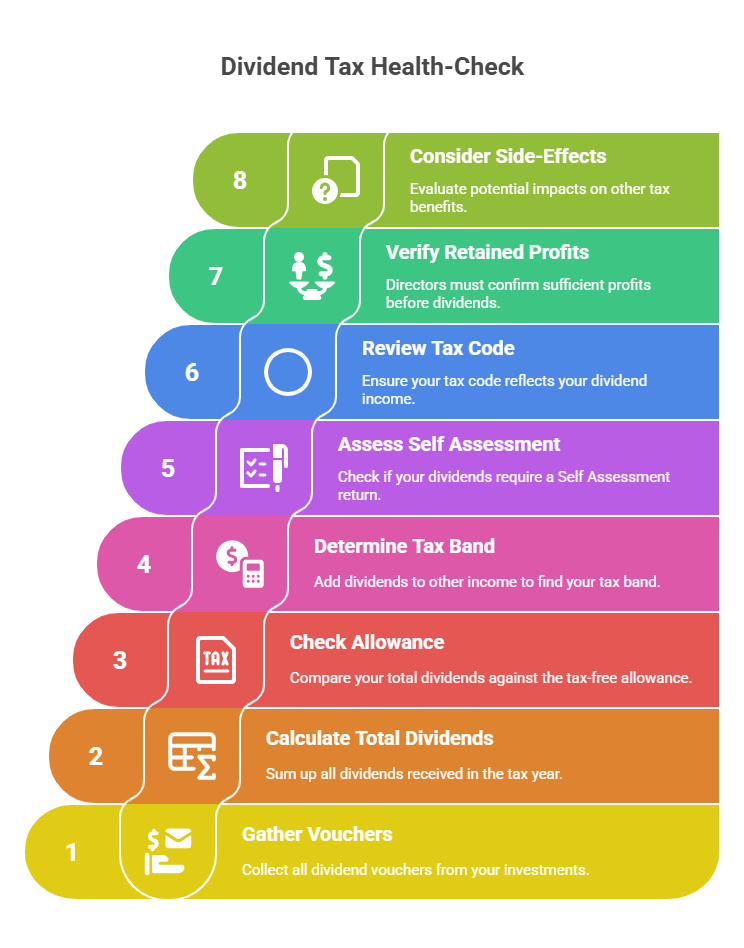

Quick Checklist: Dividend Tax Health-Check

Here’s a simple annual checklist you can run through (I give this to all my clients):

Gather all dividend vouchers from companies you hold shares in.

Add up total dividends received in the tax year.

Check against the £500 allowance.

Add this figure to your salary/profits to check which band(s) apply.

Confirm if total dividends exceed £10,000 → Self Assessment required.

Log into your Personal Tax Account to check if HMRC already adjusted your tax code.

If you’re a director, confirm your company had enough retained profits before issuing dividends.

Consider side-effects like HICBC or loss of Personal Allowance if you’re over £100k.

Bringing It All Together

By now, you should see how dividend tax isn’t just about one flat rate—it’s a sliding puzzle, depending on your income mix, your location, and how proactive you are in reporting. Employees, self-employed workers, and directors all face slightly different processes, but the key is don’t assume it’s being handled automatically.

Advanced Dividend Scenarios & How a Tax Accountant Can Help You

When Dividends Do Face Withholding – REIT Property Income Distributions

Now, here’s the twist: although the UK doesn’t generally withhold tax on dividends, Property Income Distributions (PIDs) from Real Estate Investment Trusts (REITs) are different.

● PIDs are treated as property income in your hands, not as dividends.

● That’s why REITs must deduct 20% tax at source before paying you (gov.uk – Investment Funds Manual).

● If you’re entitled to gross payment (for example, a UK pension fund or certain corporate investors), you can apply to receive PIDs without withholding by completing the right forms with the REIT.

Client story: A landlord client of mine in Reading was shocked when his £1,000 PID turned up as only £800. We explained that it wasn’t an error, but the 20% deduction. He later reclaimed part of this under his Self Assessment because his overall tax band meant the effective liability was lower.

Tip: Always check whether your “dividend” is actually a PID. The paperwork from REITs should label it clearly.

What If You’ve Overpaid or Underpaid?

Be careful here, because I’ve seen clients trip up when they assume the withheld 20% is the final tax. It isn’t always.

● If you’re a basic rate taxpayer, the 20% deduction might exceed what you actually owe. You’ll need to claim a refund via Self Assessment (gov.uk – claim a tax refund).

● If you’re a higher or additional rate taxpayer, the 20% won’t cover your full liability—you’ll need to pay the balance.

One of my clients in Glasgow, who combined a £60k salary with hefty REIT holdings, ended up owing an extra £3,000 because the PIDs only had 20% deducted while her effective rate on that slice was 33.75%.

How Multiple Income Sources Can Push You Into Higher Bands

Now, let’s think about your situation if you’ve got income from multiple pots—salary, dividends, rental, savings. It’s the stacking effect that matters:

● Dividends are always taxed after non-savings income (salary, trading profits, rental).

● This means even modest dividends can fall into the higher rate if your other income has already used up the basic rate band.

Example worksheet scenario:

● Salary: £49,000

● Dividends: £5,000

● Tax result: The £49k salary eats up nearly the entire basic rate band. So most of the £5,000 dividends are taxed at 33.75%, not 8.75%.

That’s why I tell clients: don’t just look at dividends in isolation—always layer them onto your total picture.

Regional Variations and Hidden Traps

You might wonder: does it matter if you’re in Scotland or Wales? For dividends, the rates are the same UK-wide. But your salary tax bands differ in Scotland, which affects how much of your income is left before dividends get pushed into higher bands (gov.uk – Scottish income tax, gov.uk – Welsh income tax).

Another overlooked trap: If your total income tips over £50,000, Child Benefit clawback (the High Income Child Benefit Charge) kicks in (gov.uk). I’ve seen this shock many families where dividend income unexpectedly nudged them over the line.

Spotting Errors Early – Emergency Codes and PAYE Adjustments

Sometimes HMRC will try to adjust your PAYE tax code mid-year if you declare dividend income. It’s meant to “collect the tax sooner”, but I’ve seen it create emergency codes and double-taxation headaches. Always check your code matches reality using the HMRC tax code checker.

How a Tax Accountant Can Help You with Dividend Withholding Tax

This is where professional guidance makes a real difference. In my 18+ years advising UK taxpayers and small businesses, here’s what I often do for clients:

● Clarify dividend vs PID confusion: Making sure clients know why 20% was withheld and how to reclaim or settle up.

● Run multi-income simulations: Mapping out how dividends interact with salary, rental, and savings so there are no shocks at year-end.

● Spot coding errors: Reviewing PAYE codes that over- or under-collect dividend tax.

● Plan efficient director remuneration: Structuring salary/dividend mixes to minimise exposure while staying HMRC-compliant.

● Handle HMRC correspondence: If there’s a mismatch, we manage the letters, appeals, and interest charges so clients aren’t left stressed.

● Keep ahead of frozen allowances: Helping clients prepare for the real-world effect of allowances stuck until 2028—tax creep is real.

Often, the real value isn’t just “doing the sums”—it’s peace of mind that no stone’s left unturned.

Summary of Key Points

UK dividends usually have no withholding tax, except for PIDs from REITs, which are taxed at 20% at source.

○ Ordinary dividends are paid gross, and you settle tax via PAYE adjustment or Self Assessment.

The dividend allowance is just £500 in 2025/26, meaning many more taxpayers are caught.

Dividend tax rates remain at 8.75%, 33.75%, and 39.35%, applied after the allowance and on top of other income.

REIT Property Income Distributions are the key exception, with 20% deducted at source, but this may over- or under-collect depending on your tax band.

If dividends exceed £10,000, you must file a Self Assessment return; under £10,000, HMRC can sometimes adjust your tax code.

Multiple income sources can push dividends into higher tax bands, so always assess your full income stack, not just dividends alone.

Scottish and Welsh taxpayers pay the same dividend rates, but different salary tax bands affect when dividends fall into higher brackets.

High-Income Child Benefit Charge applies if your total income exceeds £50,000—including dividends.

PAYE tax codes can be adjusted for dividend income, but mistakes can create emergency codes; always check your code against HMRC guidance.

Professional advice adds value by preventing errors, reclaiming overpaid PID tax, and planning efficient dividend strategies—all while reducing stress.

FAQs

Q1: Can someone working part-time and receiving small dividends still trigger Self Assessment?

A1: Well, it's worth noting that even modest dividends can nudge you into needing a Self Assessment return. If your dividend income, combined with part-time salary, pushes your total untaxed income above the £10,000 reporting threshold, you’ll need to file. I’ve had clients working a few hours each week and receiving small dividends from a personal investment—together they crossed that line without them noticing, and HMRC quietly sent a notice to file.

Q2: Can someone reclaim 20 % withheld on a REIT distribution if their overall tax rate is lower?

A2: In my experience with clients, the key is that REIT PID withholding isn’t always final. If the 20 % deducted exceeds your actual tax liability for that income slice, you can reclaim the difference via Self Assessment. I helped a retiree client reclaim a chunk of a PID tax deduction because the rest of his income fell into basic rate territory—he got money back he didn’t expect.

Q3: Can someone change their tax code if dividend income wasn’t captured by PAYE?

A3: Absolutely—and that’s a frequent fix I suggest. If your dividends are under £10,000, you can ask HMRC to adjust your tax code to spread the tax over payday deductions instead of lumping it into a SA return. I once guided a client with mixed income through this; updating the tax code saved them from a large one-off bill at the end of the year.

Q4: Can someone working remotely for a London-based company but living in Scotland have a different dividend tax outcome?

A4: It’s a common mix-up, but here’s the fix: dividend tax rates are UK-wide, so there's no difference. What changes is your salary tax bands—Scotland’s bands are different, affecting how much of your total income is taken before dividends come into play. I’ve seen remote workers assume they’re being taxed wrong, only to find the regional salary bands shifted the balance—not the dividend treatment.

Q5: Can someone with multiple income streams accidentally lose their dividend allowance?

A5: Quite possibly—especially when juggling self-employment, rental income, and dividends. If your other income eats up your Personal Allowance, the remaining dividend allowance disappears faster in terms of tax relief. I had a case in Bristol where a client’s graphic design profits fully used the PA, so their modest dividend was taxed in full—there was no slack left for that £500 slice.

Q6: Can someone simplify calculating dividend tax across salary, self-employed income, and side gigs?

A6: In my practice, I encourage clients to make a stacking chart: list salary first, then self-employed profits, then side hustle earnings, and finally dividends. That way you can see exactly when each element hits the next tax band. It’s a simple worksheet trick, but it stops surprises and shows exactly how your dividend slices are taxed.

Q7: Can someone be hit by the High-Income Child Benefit Charge unknowingly due to dividends?

A7: It’s more common than you’d think. Once your total income—salary plus dividends—goes over £50,000, that child benefit starts clawing back. I’ve seen families in Leeds where dividends delivered through ISAs weren’t considered, but dividends held outside toppled the threshold—and they were puzzled by the letter from HMRC next Summer.

Q8: Can someone avoid emergency tax glitches when having a salary and dividend taken via PAYE adjustment?

A8: Yes, by being proactive. I always advise clients to log into their Personal Tax Account after requesting a tax code change for dividends. That way they can confirm the new code has taken effect. It’s subtle, but it helps avoid emergency codes that over-collect until the system corrects itself.

Q9: Can someone using dividend income inside an ISA avoid tax issues entirely?

A9: Quite so—dividends inside a Stocks & Shares ISA are completely tax-free. Many clients don’t appreciate how strong this wrapper is. One pensioner client wrapped modest dividend funds into her ISA just before year-end and saved a tidy amount of tax that otherwise would have counted against her £500 allowance.

Q10: Can someone transfer shares to their spouse to maximise dividend allowances?

A10: Indeed, that’s a strategic move often underused. If one partner isn’t using their dividend allowance, transferring income-producing shares (via gift, not sale) may free up tax space. I carried this out for a couple where one partner was retired with little income—suddenly unused allowances got used, and tax bills reduced.

Q11: Can someone receive dividends through an offshore trust and face withholding surprises?

A11: This is a thorny one—but yes, offshore structures can result in unexpected withholding or double taxation. Oftentimes clients don’t realise that HMRC may treat distributions differently, triggering PAYE-like withholding. Always check the trust’s terms and seek advice before assuming the tax treatment.

Q12: Can someone adjust their dividend strategy if they’re tipped into the 60 % tax taper band?

A12: Smart question. If your total income is creeping over £100k, causing your Personal Allowance to taper, small dividend adjustments can make a big difference. I advised a client to reduce their dividend drawings slightly—and defer some income—so they stayed just below the taper cliff and saved thousands in effective marginal tax.

Q13: Can someone mix employment and freelance income and misjudge which band dividends fall into?

A13: Oh, definitely. The order matters: salary eats into PA first, then freelance/self-employed profits, then dividends slide in. I had a client who thought their freelance income remained taxed at the freelance rate—but dividends came in and were taxed at higher-rate because of the stacking order. That chart always helps!

Q14: Can someone on a pension plus dividends still get a tax refund?

A14: In my experience, yes. Many retirees assume dividends under the allowance don’t matter. But if pension income used up only part of the PA, the allowance might partially apply to dividends. That mismatch occasionally results in small refunds—especially when a PID was over-withheld earlier in the year.

Q15: Can someone correct a dividend error from a wrong Self Assessment entry after the deadline?

A15: Yes—but you must act fast. You can amend your return up to 12 months after the filing deadline. I had a contractor client in Manchester who entered dividends incorrectly and missed a refund opportunity. Once identified, he submitted an amendment and got tax back within weeks.

About the Author

Maz Zaheer, AFA, MAAT, MBA, is the CEO and Chief Accountant of MTA and Total Tax Accountants, two premier UK tax advisory firms. With over 15 years of expertise in UK taxation, Maz provides authoritative guidance to individuals, SMEs, and corporations on complex tax issues. As a Tax Accountant and an accomplished tax writer, he is renowned for breaking down intricate tax concepts into clear, accessible content. His insights equip UK taxpayers with the knowledge and confidence to manage their financial obligations effectively.

Disclaimer:

The information provided in our articles is for general informational purposes only and is not intended as professional advice. While we strive to keep the information up-to-date and correct, MTA makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained in the articles for any purpose. Any reliance you place on such information is therefore strictly at your own risk. The graphs may also not be 100% reliable.

I’ve been using placebet777.net for a while, and what stands out to me is the variety of games. There are plenty of slots, but also table games and live casino options that keep things interesting. The promotions are a nice touch too—I like the weekly cashback and tournaments, which add some excitement beyond just the welcome bonus. I also had to contact customer support once, and they replied quickly in Italian, which made the process much easier for me.