HMRC Fit and Proper Test

- MAZ

- Aug 7, 2025

- 15 min read

Updated: Sep 11, 2025

The Audio Summary of the Key Points of the Article:

Understanding the HMRC Fit and Proper Test and Who It Impacts

What Is the HMRC Fit and Proper Test?

Now, let’s get straight to the point: the HMRC Fit and Proper Test is a critical check designed to ensure that certain businesses and their key players are trustworthy enough to operate without facilitating money laundering or terrorist financing. It’s part of the UK’s anti-money laundering (AML) framework, specifically under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 (MLR 2017). If you’re running a money service business (MSB) like a currency exchange or a trust or company service provider (TCSP), this test is non-negotiable. HMRC uses it to vet the suitability of your business’s beneficial owners, officers, and managers—collectively called BOOMs—before granting registration.

Think of it like a background check for your business’s moral compass. It’s not about whether you’re a whiz at accounting or have an MBA; it’s about ensuring you and your team aren’t likely to let your business be a conduit for dodgy dealings. As of February 2025, HMRC clarified that failing this test means your business won’t be registered, and even after registration, ongoing checks ensure compliance.

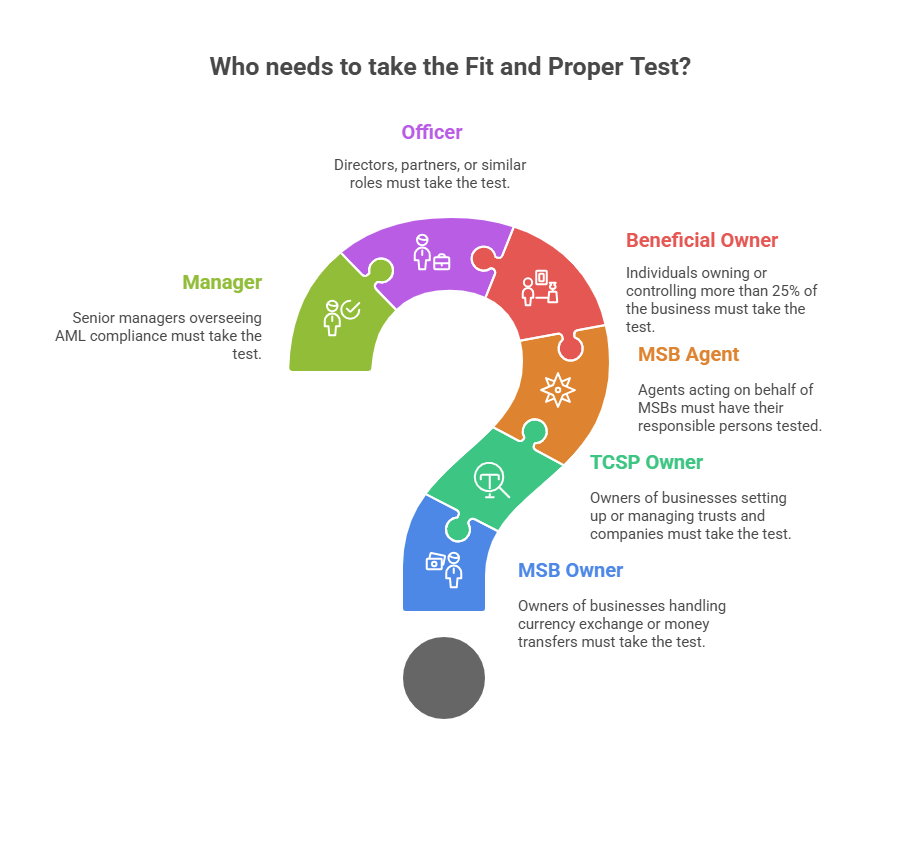

Who Needs to Take the Fit and Proper Test?

So, who exactly is in HMRC’s spotlight? The Fit and Proper Test applies primarily to MSBs and TCSPs. Let’s break it down:

● Money Service Businesses (MSBs): These include businesses handling currency exchange, money transfers, or cheque cashing. For example, if you run a small bureau de change in London or a remittance service, you’re on the hook.

● Trust or Company Service Providers (TCSPs): These are firms that set up or manage trusts, form companies, or act as nominees for others. Think of a business that helps set up offshore companies or manages trusts for clients.

● Agents of MSBs: If your business acts as an agent for an MSB (e.g., a corner shop offering money transfer services), your responsible persons must also pass the test.

Now, it’s not just the business itself—HMRC zooms in on the BOOMs:

● Beneficial Owners: Anyone owning or controlling more than 25% of the business.

● Officers: Directors, partners, or those in similar roles.

● Managers: Senior managers or nominated officers overseeing AML compliance.

Other sectors, like estate agents, art market participants, or high-value dealers, face separate HMRC approval checks, not the Fit and Proper Test. If you’re unsure whether your business falls under this, check the HMRC guidance on money laundering supervision.

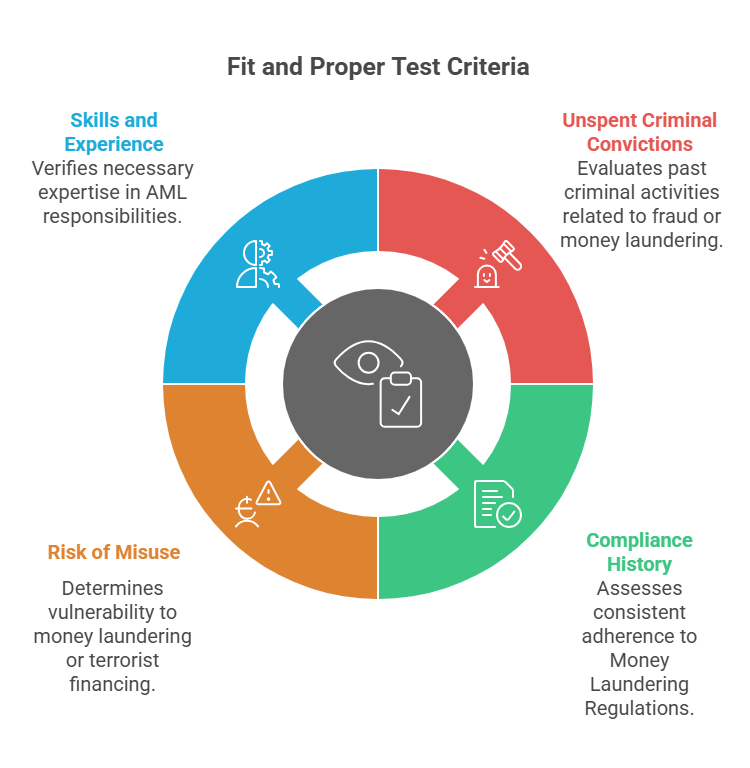

What Does the Test Actually Check?

Now, you might be wondering what HMRC is digging into. The Fit and Proper Test isn’t a pop quiz on tax law—it’s about your integrity and compliance history. Here’s what HMRC assesses:

● Unspent Criminal Convictions: Any unspent convictions listed in Schedule 3 of MLR 2017 (e.g., fraud, money laundering, or terrorist financing) result in an automatic fail. For example, a conviction for tax evasion from three years ago, if still unspent, is a dealbreaker.

● Compliance History: HMRC looks at whether you or your business have consistently failed to meet MLR 2017 requirements, like having proper risk assessments or policies. A single slip-up might not sink you, but a pattern of non-compliance could.

● Risk of Misuse: They evaluate whether your business could be vulnerable to money laundering or terrorist financing. This includes checking your business plan and policies.

● Skills and Experience: You don’t need a degree in finance, but you must show you can handle AML responsibilities. For instance, a nominated officer needs to understand how to spot suspicious transactions.

Be careful! Providing false or misleading information during the test can lead to prosecution, so transparency is key. If you’re unsure what to disclose, contact HMRC directly through their helpline.

Table 1: Key Criteria for the HMRC Fit and Proper Test (2025)

Criteria | Details | Impact on Test |

Unspent Convictions | Convictions under Schedule 3 (e.g., fraud, money laundering) | Automatic failure if unspent |

Compliance with MLR 2017 | History of adhering to AML regulations | Consistent non-compliance may lead to failure |

Risk of Money Laundering | Business’s vulnerability to misuse for criminal activities | High risk increases likelihood of failure |

Skills and Experience | Ability to manage AML responsibilities | Must demonstrate adequate knowledge; lack thereof may lead to additional scrutiny |

How Much Does It Cost and When Do You Pay?

Let’s talk money. As of July 2025, the Fit and Proper Test costs £700 per person, a sharp rise from the previous £150, reflecting HMRC’s increased scrutiny of AML compliance. You pay this fee when applying for registration or adding new BOOMs post-registration. The good news? You only pay once per person, not annually, unless a new BOOM joins your business. Additionally, there’s a £400 one-off application fee for AML supervision registration and a £400 premises fee, up from £300. These costs can add up, especially for small businesses with multiple BOOMs, so budget accordingly.

For example, if you’re a sole trader setting up a currency exchange with yourself as the sole BOOM, you’re looking at £1,100 (£700 test + £400 application fee). If you’ve got three BOOMs, that’s £2,500 (£700 × 3 + £400). Failing to plan for these costs could delay your registration, so it’s worth setting aside funds early.

Case Study: A Small Business’s Brush with the Test

Consider this: Priya, a Birmingham-based entrepreneur, wanted to start a money transfer service in 2024. She applied for HMRC registration, paid the £700 fee for herself as the beneficial owner, and submitted her business plan. HMRC flagged an issue—not a criminal conviction, but a lack of robust AML policies. Priya hadn’t conducted a proper risk assessment, which raised red flags about her business’s vulnerability to money laundering. After revising her policies with help from an AML consultant, she resubmitted and passed. This shows how critical it is to have your ducks in a row before applying.

Navigating the HMRC Fit and Proper Test and Staying Compliant

How Do You Apply for the Fit and Proper Test?

Now, let’s get into the nitty-gritty of actually applying for the HMRC Fit and Proper Test. The process isn’t as daunting as it sounds, but it does require careful preparation. You’ll need to register your business for anti-money laundering (AML) supervision through the HMRC online services portal. As part of this, each beneficial owner, officer, or manager (BOOM) must complete the MLR101 form, which is HMRC’s way of assessing whether you pass the Fit and Proper Test.

The MLR101 form asks for personal details, business roles, and any relevant convictions or compliance issues. You’ll also need to submit a business plan showing how you’ll prevent money laundering—think risk assessments, customer due diligence (CDD) processes, and staff training. As of February 2025, HMRC has tightened its scrutiny, so incomplete forms or vague business plans can lead to delays or outright rejection. Once submitted, HMRC typically takes 45 days to process your application, though complex cases can take longer.

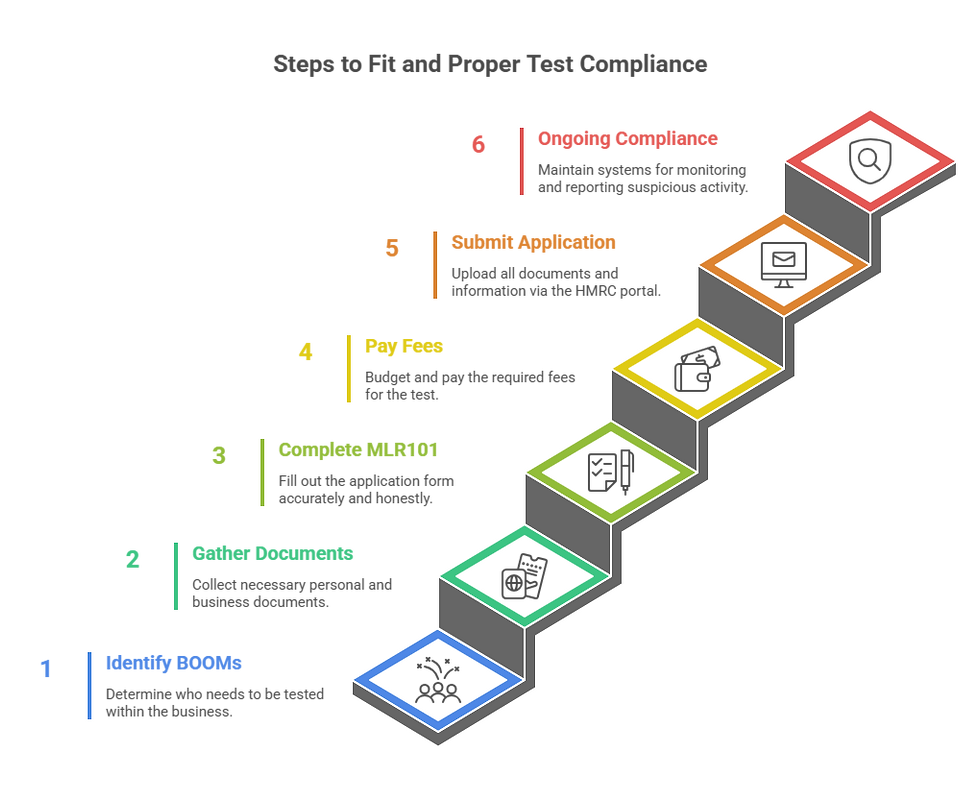

Step-by-Step Guide: Preparing for the Fit and Proper Test

So, how do you make sure you’re ready? Here’s a practical step-by-step guide to help you ace the test:

Check Who Needs to Be Tested: Identify all BOOMs in your business. For a small MSB, this might just be you, but for larger setups, list all directors, partners, or managers.

Gather Documentation: Collect personal details for each BOOM, including proof of identity (e.g., passport) and address. You’ll also need your business’s AML policies and risk assessment.

Complete the MLR101 Form: Fill out the form accurately, disclosing any unspent convictions or compliance issues. Honesty is critical—HMRC cross-checks with criminal and tax records.

Pay the Fees: Budget £700 per BOOM, plus the £400 application fee and £400 premises fee. Pay through the HMRC portal to avoid delays.

Submit and Follow Up: Upload everything via the HMRC online portal and keep an eye on your email for updates or requests for more information.

Prepare for Ongoing Compliance: Once approved, set up systems to monitor transactions and report suspicious activity to stay compliant.

Be careful! Missing a step or rushing the form can lead to rejection, costing you time and money. If you’re unsure, consider hiring an AML consultant to review your application.

What Happens If You Fail the Test?

None of us wants to think about failing, but it’s worth knowing what happens if things don’t go your way. If a BOOM fails the Fit and Proper Test, HMRC will refuse your business’s AML registration, meaning you can’t legally operate as an MSB or TCSP. Common reasons for failure include unspent convictions listed in Schedule 3 of MLR 2017 (e.g., fraud or money laundering) or a history of non-compliance, like failing to file tax returns on time repeatedly.

If you fail, HMRC will notify you in writing, explaining the reasons. You can appeal within 30 days, but you’ll need to provide new evidence—like proof that a conviction is spent or updated AML policies.

For example, in 2024, a Manchester-based TCSP failed because one director had an unspent fraud conviction from 2020. They appealed successfully by showing the conviction was unrelated to AML risks and strengthened their compliance framework. Appeals are reviewed case-by-case, so don’t lose hope if you think HMRC got it wrong.

Table 2: Common Reasons for Failing the Fit and Proper Test (2025)

Reason for Failure | Example | How to Mitigate |

Unspent Convictions | Fraud conviction from 2021, still unspent | Check conviction status; wait until spent or appeal with legal advice |

Non-Compliance History | Repeated failure to file VAT returns | Address past issues and document improved compliance processes |

Inadequate AML Policies | No risk assessment or CDD procedures | Develop robust policies with professional help before applying |

High-Risk Business Model | Business plan lacks safeguards against money laundering | Include detailed risk assessments and monitoring systems in your application |

How Can Small Businesses Budget for the Costs?

Let’s talk about the elephant in the room: the costs. For small businesses or sole traders, the £700 per BOOM fee, plus the £400 application and premises fees, can feel like a punch to the wallet. In 2025, these costs have risen due to HMRC’s increased focus on AML enforcement, so planning is crucial.

Here’s a quick breakdown for a small MSB with two BOOMs:

● Fit and Proper Test: £700 × 2 = £1,400

● Application Fee: £400

● Premises Fee: £400

● Total: £2,200

Now, consider this: If you’re a sole trader, you might only face £1,100, but unexpected rejections (requiring resubmission) could add another £700 per BOOM. To manage this, set aside funds early, perhaps by allocating a portion of your startup budget to compliance costs. Some businesses also explore grants or loans for small business compliance, though these are rare. Consulting an accountant to streamline your application can save you from costly mistakes.

Staying Compliant After Passing the Test

So, you’ve passed the test—congratulations! But don’t pop the champagne just yet. HMRC doesn’t just approve you and walk away; they keep tabs on your business through ongoing supervision. This means regular checks to ensure you’re following MLR 2017, like conducting customer due diligence, monitoring transactions, and reporting suspicious activities to the National Crime Agency (NCA).

For example, in 2023, a London-based currency exchange was fined £10,000 for failing to update its risk assessment after expanding services. To avoid this, invest in AML software to track transactions and train your staff regularly. HMRC’s guidance on ongoing compliance is a goldmine for setting up these systems.

Case Study: Ongoing Compliance Challenges

Now, picture this: Sanjay, a Leeds-based MSB owner, passed the Fit and Proper Test in 2024 and started his money transfer business. Six months in, HMRC conducted a spot check and found his customer due diligence records were incomplete. Sanjay hadn’t verified the identities of high-value clients, a red flag for money laundering risks. He avoided a fine by quickly implementing a digital CDD system and retraining his team, but it was a wake-up call. This shows that passing the test is just the start—staying compliant is an ongoing commitment.

Key Takeaways for Mastering the HMRC Fit and Proper Test

How Can You Ensure a Smooth Application Process?

Now, let’s make this crystal clear: getting through the HMRC Fit and Proper Test isn’t just about filling out forms—it’s about showing HMRC you’re serious about keeping your business clean. Preparation is everything. Before you even start the application, double-check that all your beneficial owners, officers, and managers (BOOMs) have no unspent convictions listed in Schedule 3 of the Money Laundering Regulations 2017. If there’s even a hint of a past issue, like a tax-related penalty, disclose it upfront on the MLR101 form. HMRC values transparency, and hiding something they’ll likely uncover through their checks could sink your application.

Also, your business plan needs to be rock-solid. This means having a detailed risk assessment that identifies potential money laundering risks specific to your operations—say, high-value cash transactions in a currency exchange—and clear policies for customer due diligence (CDD). For instance, a sole trader running a cheque-cashing service might outline how they verify client identities using photo ID and utility bills. As of February 2025, HMRC has been rejecting applications with generic or incomplete plans, so tailor yours to your business.

What Are the Long-Term Implications for Your Business?

So, you’ve passed the test—great! But what does this mean for the long haul? Being approved for AML supervision means your business is now under HMRC’s radar, with regular checks to ensure you’re sticking to the rules. This isn’t a one-and-done deal. You’ll need to keep records of all transactions, train staff on spotting suspicious activity, and file Suspicious Activity Reports (SARs) with the National Crime Agency if something feels off.

For example, a 2024 case in Bristol saw a small trust service provider lose its registration after failing to report a suspicious transaction involving a client funneling large sums through multiple accounts. The lesson? Invest in compliance early—whether it’s AML software or a nominated officer who knows the ropes. This not only keeps HMRC happy but also protects your business from fines, which can reach £10,000 or more for serious breaches in 2025.

Table 3: Ongoing Compliance Requirements Post-Test (2025)

Requirement | Description | Consequences of Non-Compliance |

Customer Due Diligence (CDD) | Verify client identities and monitor high-risk transactions | Fines up to £10,000 or deregistration for repeated failures |

Suspicious Activity Reporting | Report suspicious transactions to the NCA within 7 days | Penalties or prosecution for failure to report |

Staff Training | Regular AML training for all relevant employees | Increased scrutiny during HMRC audits; potential fines |

Record-Keeping | Maintain transaction and CDD records for at least 5 years | Fines or loss of registration for incomplete records |

Can You Appeal a Failed Test, and Should You?

Be careful! Failing the Fit and Proper Test isn’t the end of the road, but it’s a serious setback. If HMRC rejects your application, they’ll send a detailed letter outlining why—maybe a BOOM has an unspent conviction or your AML policies were too vague. You have 30 days to appeal, and it’s worth considering if you believe the decision was unfair.

Take the case of Aisha, a Cardiff-based MSB owner in 2023. Her application was rejected because HMRC flagged a minor tax filing delay from two years prior as a compliance issue.

Aisha appealed, providing evidence of corrected filings and a robust AML framework, and won her case. The key? She acted fast, gathered solid evidence, and worked with a compliance consultant to strengthen her appeal. If you’re in a similar boat, don’t delay—contact HMRC and consider professional advice to boost your chances.

How Do Costs Impact Small Businesses Over Time?

Now, consider this: The upfront costs of the Fit and Proper Test—£700 per BOOM, £400 application fee, and £400 premises fee—are just the start. Small businesses, especially sole traders or startups, need to factor in ongoing compliance costs. These might include annual staff training (around £500-£1,000 for a small team), AML software subscriptions (£200-£1,500 per year), and potential consultant fees if you need expert help.

For instance, a 2025 survey by HMRC showed that small MSBs spend an average of £2,000 annually on AML compliance post-registration. To manage this, consider budgeting a fixed monthly amount—say, £200—to cover these expenses. If cash flow is tight, explore free HMRC webinars on AML compliance to keep costs down while staying informed.

Case Study: A Sole Trader’s Compliance Journey

Picture this: Imran, a sole trader in Manchester, launched a money transfer service in 2024. He passed the Fit and Proper Test after paying £1,100 in fees and submitting a detailed business plan. But six months later, during an HMRC audit, he was flagged for not documenting CDD for a few high-value clients. Imran avoided a fine by quickly implementing an affordable AML software tool (£300/year) and attending a free HMRC compliance workshop. His story highlights the importance of staying proactive—passing the test is just the beginning of your AML journey.

Summary of the Most Important Points

The HMRC Fit and Proper Test is mandatory for money service businesses (MSBs) and trust or company service providers (TCSPs) to ensure they’re not vulnerable to money laundering.

Beneficial owners, officers, and managers (BOOMs) must pass the test, which checks for unspent convictions and compliance history.

The test costs £700 per BOOM, plus a £400 application fee and £400 premises fee as of July 2025.

A robust business plan with AML policies and risk assessments is critical to passing the test.

Failing the test prevents AML registration, halting your ability to operate legally, but you can appeal within 30 days.

Ongoing compliance involves customer due diligence, staff training, and reporting suspicious activities to the NCA.

Small businesses should budget for both upfront and ongoing AML compliance costs, averaging £2,000 annually.

Incomplete or misleading MLR101 forms can lead to rejection or prosecution, so transparency is key.

HMRC conducts regular audits post-registration to ensure continued adherence to MLR 2017.

Professional advice or AML software can help small businesses navigate the test and stay compliant.

FAQs

Q1: What types of businesses require the HMRC Fit and Proper Test?

A1: The test applies to money service businesses (MSBs) such as currency exchanges, money transfer services, and cheque-cashing businesses, as well as trust or company service providers (TCSPs) that manage trusts or form companies.

Q2: Is the Fit and Proper Test required for sole traders?

A2: Yes, sole traders running an MSB or TCSP must pass the test if they are a beneficial owner, officer, or manager, though they may only need to submit one MLR101 form for themselves.

Q3: Can a business operate without passing the Fit and Proper Test?

A3: No, businesses subject to AML supervision cannot legally operate without HMRC registration, which requires all BOOMs to pass the test.

Q4: How long does it take for HMRC to process the Fit and Proper Test?

A4: HMRC typically takes 45 days to process the test, but complex cases or incomplete applications may take longer.

Q5: What documents are needed to apply for the Fit and Proper Test?

A5: Applicants need to submit the MLR101 form, proof of identity, proof of address, a business plan with AML policies, and a risk assessment.

Q6: Can a business appeal a failed Fit and Proper Test?

A6: Yes, businesses can appeal within 30 days of receiving a rejection, providing new evidence to address HMRC’s concerns.

Q7: Does the Fit and Proper Test apply to employees?

A7: No, the test only applies to beneficial owners, officers, and managers (BOOMs), not general employees.

Q8: What happens if a BOOM leaves the business after passing the test?

A8: If a BOOM leaves, the business must notify HMRC and may need to submit a new MLR101 form for any replacement BOOM, along with the £700 fee.

Q9: Are there exemptions from the Fit and Proper Test?

A9: There are no exemptions for MSBs or TCSPs, though certain sectors like accountants or legal professionals may face different HMRC approval checks.

Q10: Can a business reapply after failing the Fit and Proper Test?

A10: Yes, businesses can reapply after addressing the reasons for failure, such as updating AML policies or resolving compliance issues, but they must pay the fees again.

Q11: How does HMRC verify information in the Fit and Proper Test?

A11: HMRC cross-checks applicant details against criminal records, tax compliance history, and other government databases.

Q12: Is the Fit and Proper Test a one-time requirement?

A12: The test is required once per BOOM during initial registration, but new BOOMs or significant business changes may trigger additional tests.

Q13: Can a foreign national pass the Fit and Proper Test?

A13: Yes, foreign nationals can pass if they meet the criteria, though HMRC may request additional documentation to verify their compliance history.

Q14: Does a failed test affect other business operations?

A14: Failing the test only prevents AML-supervised activities (e.g., money transfers), not unrelated business operations, but it may harm the business’s reputation.

Q15: What training is required for AML compliance after passing the test?

A15: Businesses must provide regular AML training to staff handling transactions, focusing on customer due diligence and spotting suspicious activities.

Q16: Can a business use a third-party consultant for the Fit and Proper Test?

A16: Yes, hiring an AML consultant can help prepare applications and ensure compliance, though businesses remain responsible for the information submitted.

Q17: How does HMRC monitor businesses after the test?

A17: HMRC conducts audits, spot checks, and reviews of transaction records to ensure ongoing compliance with AML regulations.

Q18: What are the penalties for non-compliance after passing the test?

A18: Penalties can include fines up to £10,000, deregistration, or prosecution for serious breaches like failing to report suspicious activities.

Q19: Can a business pass the test without a formal business plan?

A19: No, a detailed business plan with AML policies and risk assessments is mandatory to demonstrate compliance readiness.

Q20: Is the Fit and Proper Test fee refundable if the application is rejected?

A20: No, the £700 per BOOM fee, £400 application fee, and £400 premises fee are non-refundable, even if the application is rejected.

About the Author

Maz Zaheer, AFA, MAAT, MBA, is the CEO and Chief Accountant of MTA and Total Tax Accountants, two premier UK tax advisory firms. With over 15 years of expertise in UK taxation, Maz provides authoritative guidance to individuals, SMEs, and corporations on complex tax issues. As a Tax Accountant and an accomplished tax writer, he is renowned for breaking down intricate tax concepts into clear, accessible content. His insights equip UK taxpayers with the knowledge and confidence to manage their financial obligations effectively.

Disclaimer:

The information provided in our articles is for general informational purposes only and is not intended as professional advice. While we strive to keep the information up-to-date and correct, MTA makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained in the articles for any purpose. Any reliance you place on such information is therefore strictly at your own risk. The graphs may also not be 100% reliable.

We encourage all readers to consult with a qualified professional before making any decisions based on the information provided. The tax and accounting rules in the UK are subject to change and can vary depending on individual circumstances. Therefore, MTA cannot be held liable for any errors, omissions, or inaccuracies published. The firm is not responsible for any losses, injuries, or damages arising from the display or use of this information.

Comments