Tax Free Trading Allowance

- MAZ

- Jul 25, 2025

- 16 min read

The Audio Summary of the Key Points of the Article:

Understanding the Tax-Free Trading Allowance in 2025

What Is the Tax-Free Trading Allowance?

So, you’ve heard about this “tax-free trading allowance” and you’re wondering what it’s all about? Let’s break it down. The trading allowance, introduced by HMRC in 2017, is a tax exemption that lets you earn up to £1,000 per tax year from self-employment or casual income without paying tax or reporting it to HMRC. For the 2025/26 tax year (6 April 2025 to 5 April 2026), this allowance remains at £1,000, as confirmed by GOV.UK. It’s designed for sole traders, freelancers, or those with side hustles like selling crafts online, dog walking, or tutoring.

This allowance applies to your gross income—that’s the total money you earn before deducting any expenses. If your gross trading income is £1,000 or less, you get “full relief,” meaning no tax and no need to file a Self Assessment tax return. If it’s over £1,000, you can use “partial relief” to deduct £1,000 from your taxable income, but you’ll need to register with HMRC and file a tax return.

Who Can Claim the Trading Allowance?

Now, let’s talk about who qualifies. The trading allowance is for individuals, not partnerships or companies. Whether you’re a full-time sole trader or moonlighting with a side gig, you can use it. For example, if you’re a teacher earning £30,000 a year through PAYE and make £800 selling handmade jewellery online, you can claim the allowance against that £800. It’s automatic if your gross trading income is £1,000 or less—no need to notify HMRC unless you have other reasons to file a tax return (e.g., claiming losses or benefits).

Be careful! You can’t use the allowance if your income comes from:

● A partnership where you or a connected person are partners.

● An employer or their spouse/civil partner.

● A company you control.

Also, if you’re in the Rent a Room Scheme, you can’t use the trading allowance for income from letting a room in your home. Keep records of all income, even if it’s under £1,000, as HMRC may ask for proof.

How Does the Trading Allowance Work with Other Allowances?

Here’s a question I get a lot: can you combine the trading allowance with other tax breaks? The good news is, yes, you can often pair it with the property allowance (also £1,000 for 2025/26) and the Personal Allowance (£12,570 for 2025/26). If you earn £800 from freelancing and £900 from renting a property, you can claim both allowances, keeping both income streams tax-free. The Personal Allowance then covers other income, like your salary, up to £12,570 before tax kicks in GOV.UK.

But there’s a catch. If you claim the trading allowance, you can’t deduct actual business expenses or capital allowances for that trade. So, if you’re a graphic designer with £2,000 in expenses, you’ll need to decide whether claiming expenses or the £1,000 allowance saves you more tax. We’ll dive into this choice later with a practical example.

What Types of Income Qualify for the Allowance?

Now, you might be wondering what counts as “trading income.” It’s not just about running a full-blown business. The allowance covers:

● Self-employment: Income from sole trading, like freelancing or selling goods.

● Casual services: Think babysitting, gardening, or tutoring.

● Online platforms: Selling on Etsy, eBay, or Vinted, as long as you intend to make a profit.

● Miscellaneous income: Irregular earnings, like penalty fees from late-paying clients.

For example, if you earn £600 from selling homemade candles and £400 from occasional dog walking, your total gross trading income is £1,000—fully covered by the allowance. But if you add £200 from selling old equipment, you’re over the limit and must register for Self Assessment.

Why Was the Trading Allowance Introduced?

Let’s take a step back. Why did HMRC create this allowance? It’s all about simplifying taxes for small earners. Before 2017, anyone with self-employed income had to register with HMRC, even for tiny amounts. The allowance cuts red tape for side hustlers and casual earners, letting them keep more money without the hassle of tax returns. In 2025, with 33% of UK adults considering a side hustle (per Enterprise Nation’s 2025 Start Up Ambition Report), this relief is a lifeline for those testing the entrepreneurial waters.

It’s not just about convenience. The allowance supports the growing gig economy, where people juggle multiple income streams. For instance, a 2024 HMRC report noted that 300,000 taxpayers benefit from the allowance annually, with 90,000 avoiding tax returns entirely due to low earnings.

Table 1: Trading Allowance Eligibility and Limits (2025/26 Tax Year)

Criteria | Details |

Allowance Amount | £1,000 per tax year (6 April 2025 – 5 April 2026) |

Eligible Income | Self-employment, casual services, online sales (with profit intent) |

Ineligible Income | Partnership income, employer-related income, Rent a Room Scheme income |

Full Relief | Gross income ≤ £1,000: No tax, no Self Assessment required |

Partial Relief | Gross income > £1,000: Deduct £1,000 from taxable income, file tax return |

Record-Keeping | Mandatory, even for income below £1,000, in case HMRC requests proof |

Combination with Other Allowances | Can be used with £1,000 property allowance and £12,570 Personal Allowance |

Why You Might Need to Register for Self Assessment Anyway

Hold on a second! Even if your income is under £1,000, you might still need to register with

HMRC. Why? If you want to:

● Claim Tax-Free Childcare or Maternity Allowance based on self-employed income.

● Pay voluntary Class 2 National Insurance contributions to qualify for state benefits.

● Carry forward a trading loss to offset future taxes.

For example, Bronwyn, a part-time tutor in Cardiff, earns £900 from online classes in 2025. She doesn’t need to file a tax return, but she registers voluntarily to pay Class 2 NICs (£3.45 weekly for 2025/26) to boost her state pension eligibility. Registering is easy via GOV.UK using a Government Gateway account.

How Does the Allowance Affect Universal Credit?

Here’s a curveball for some: the trading allowance doesn’t apply to Universal Credit calculations. If you claim UC, you must report your actual income and expenses, not the allowance-adjusted amount. Let’s say Ewan, a delivery driver in Glasgow, earns £1,200 from gigs and claims the £1,000 allowance, leaving £200 taxable income. For UC, he reports the full £1,200 minus actual expenses (e.g., £500 for fuel), so his UC payment is based on £700 profit. This nuance can catch people out, so always double-check with your UC work coach.

Maximising the Tax-Free Trading Allowance

Should You Claim the Trading Allowance or Actual Expenses?

Now, here’s where things get interesting. If your gross trading income exceeds £1,000, you face a choice: claim the £1,000 trading allowance or deduct your actual business expenses. This decision can make a big difference to your tax bill, so let’s break it down. The trading allowance is a flat £1,000 deduction from your taxable income, but you can’t claim any expenses or capital allowances alongside it. If your expenses are high, you might save more by claiming them instead.

For example, let’s say Aisha, a freelance photographer in Bristol, earns £15,000 in 2025/26 and has £4,000 in expenses (equipment, travel, software). If she claims the trading allowance, her taxable income is £14,000 (£15,000 - £1,000). With actual expenses, it’s £11,000 (£15,000 - £4,000). Assuming she’s in the 20% basic rate tax band, the tax saving is £800 (20% of £4,000) with expenses versus £200 (20% of £1,000) with the allowance. Expenses win here, but if her costs were only £800, the allowance would be the better choice.

How Do You Decide Between Allowance and Expenses?

So, the question is: how do you pick the right option? It’s all about crunching the numbers. If your expenses are less than £1,000, the trading allowance usually makes sense—it’s simpler and guarantees a £1,000 deduction. If your expenses exceed £1,000, calculate your tax liability both ways. Here’s a quick checklist to help:

● List all allowable expenses: Include costs like materials, travel, advertising, or home office expenses (e.g., a portion of your broadband or electricity).

● Compare tax outcomes: Use your gross income minus either the allowance or expenses to find your taxable profit.

● Consider record-keeping: The allowance requires minimal paperwork, while expenses need detailed records and receipts.

For instance, if you’re a dog walker with £900 in expenses (pet supplies, fuel), the allowance saves you more tax and hassle. But if you’re a graphic designer spending £2,000 on software and a new laptop, claiming expenses is likely better. Always keep records, as HMRC can audit you even if you claim the allowance GOV.UK.

Table 2: Trading Allowance vs. Actual Expenses (Example for 2025/26)

Scenario | Trading Allowance | Actual Expenses |

Gross Income | £15,000 | £15,000 |

Deduction | £1,000 (Allowance) | £4,000 (Expenses) |

Taxable Income | £14,000 | £11,000 |

Tax at 20% (Basic Rate) | £2,800 | £2,200 |

Savings | £200 | £800 |

Record-Keeping | Minimal | Detailed receipts |

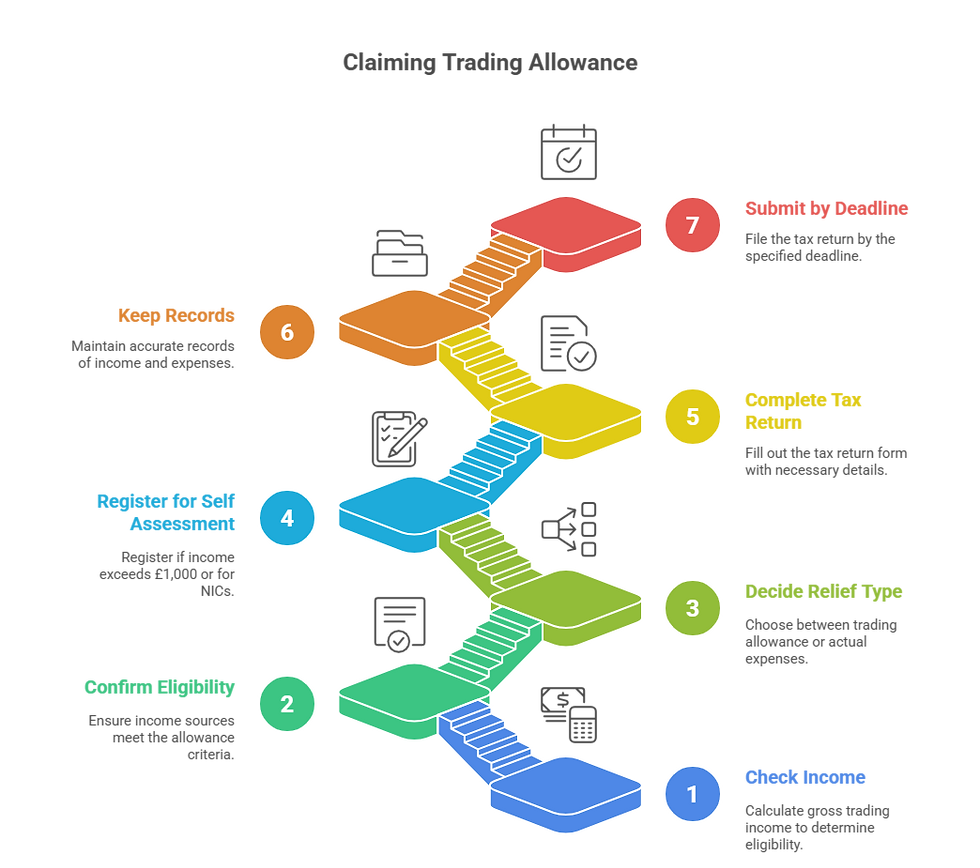

Step-by-Step Guide: Claiming the Trading Allowance

Right, let’s get practical. If you decide the trading allowance is for you, here’s how to claim it for the 2025/26 tax year. Follow these steps to ensure you’re HMRC-compliant and maximising your tax relief:

Check Your Income: Calculate your gross trading income (total earnings before expenses) from all self-employed or casual sources.

Confirm Eligibility: Ensure your income isn’t from partnerships, employers, or the Rent a Room Scheme.

Decide on Relief Type: If your income is £1,000 or less, you get full relief automatically—no tax, no Self Assessment. If over £1,000, decide between the allowance or expenses.

Register for Self Assessment (if needed): If your income exceeds £1,000 or you want to claim benefits like NICs, register by 5 October 2025 via GOV.UK.

Complete Your Tax Return: On your Self Assessment, tick the box to claim the trading allowance (form SA103S for short tax returns or SA100 for full returns).

Keep Records: Store evidence of income (e.g., bank statements, invoices) for at least 5 years, even if you don’t file a return.

Submit by Deadline: File your online tax return by 31 January 2027 for the 2025/26 tax year.

This process is straightforward, but don’t skip the record-keeping—HMRC can request proof years later.

What Happens If You Miss the Self Assessment Deadline?

Be careful! Missing the Self Assessment deadline can sting. If you need to file a tax return (income over £1,000 or claiming benefits), submit it by 31 January 2027 for 2025/26. Late filing triggers an automatic £100 penalty, even if no tax is due. After 3 months, you’ll face £10 daily penalties (up to £900), plus interest on unpaid tax at 7.75% (HMRC’s 2025 rate). For example, Idris, a part-time Uber driver in Manchester, earned £1,500 in 2025/26 and forgot to file. He claimed the trading allowance, so his tax was only £100 (£500 x 20%), but he paid a £100 penalty for late filing, doubling his cost.

To avoid this, set reminders or use HMRC’s free app to track deadlines. If you’re late, file as soon as possible and appeal penalties if you have a reasonable excuse, like illness GOV.UK.

How Does the Proposed £3,000 Reporting Threshold Affect You?

Now, here’s something to watch. In 2024, HMRC proposed raising the Self Assessment reporting threshold from £1,000 to £3,000 for trading and property income, potentially starting in 2026/27. This isn’t confirmed for 2025/26, but GOV.UK suggests it’s under review to reduce admin for small earners. If implemented, you could earn up to £3,000 without registering for Self Assessment, though the trading allowance would likely stay at £1,000 for tax purposes.

For example, if Sian, a Cardiff Etsy seller, earns £2,500 in 2026/27 under the new threshold, she might avoid filing a tax return but still owe tax on £1,500 (£2,500 - £1,000 allowance). Until confirmed, assume the £1,000 threshold applies and plan accordingly.

Case Study: Optimising the Allowance for a Side Hustle

Let’s look at a real-world scenario. Meet Freya, a Leeds-based office worker who started a baking side hustle in 2025. She earns £2,200 selling cakes, with £600 in expenses (ingredients, packaging). Freya compares her options:

● Trading Allowance: Taxable income = £2,200 - £1,000 = £1,200. Tax at 20% = £240.

● Actual Expenses: Taxable income = £2,200 - £600 = £1,600. Tax at 20% = £320.

Freya chooses the allowance, saving £80 and avoiding expense paperwork. She registers for Self Assessment by October 2025, files her return by January 2027, and keeps invoices to prove her income. This choice simplifies her taxes and maximises her take-home pay.

Can the Trading Allowance Reduce Your Tax Bill to Zero?

Now consider this: can the allowance wipe out your tax entirely? Sometimes, yes! If your total taxable income (after all allowances) is below the £12,570 Personal Allowance, you pay no tax. For example, if Raj, a retiree in Birmingham, earns £800 from tutoring and £10,000 from a pension, his trading allowance covers the £800, and his total income (£10,800) is below £12,570. No tax due! But if his pension was £12,570 and he earned £1,200 from tutoring, he’d owe tax on £200 (£1,200 - £1,000) after the allowance.

Key Takeaways and Advanced Tips for the Tax-Free Trading Allowance

How Can You Plan Ahead to Maximise the Allowance?

Now, let’s get strategic. The trading allowance is a fantastic tool, but planning ahead can make it even more powerful. If you’re running a side hustle or a small business, forecasting your income and expenses for the 2025/26 tax year can help you decide whether to claim the allowance or expenses. For instance, if you expect your gross income to hover around £1,000, you might keep it just below to avoid Self Assessment entirely. Alternatively, if you’re scaling up and anticipate high expenses, start tracking them early to claim deductions instead.

Consider keeping a simple spreadsheet to monitor income and costs monthly. This helps you spot trends and make informed choices. For example, if you’re a freelancer like Tamsin in Newcastle, earning £1,200 in 2025/26 with £300 in expenses, you might reduce your income to £1,000 by deferring a December invoice to April 2026, staying tax-free and paperwork-free.

What Are the Risks of Misusing the Allowance?

Be careful! Misunderstanding the trading allowance can land you in hot water with HMRC. A common mistake is assuming all side income qualifies. For example, if you earn £800 from selling personal items (like old clothes) on Vinted, this isn’t trading income unless you’re buying and selling for profit. HMRC distinguishes between casual selling and trading GOV.UK. Another pitfall is failing to keep records. Even if your income is under £1,000, HMRC can request proof of earnings up to 5 years later.

If you claim the allowance but later realise expenses would have saved more tax, you can’t amend your return to switch mid-year—you’re locked into your choice for that tax year. For example, Owain, a Swansea-based tutor, claimed the allowance on £2,000 income but later found £1,500 in deductible expenses. He couldn’t change his 2025/26 return, costing him an extra £100 in tax.

How Does the Allowance Interact with Other Tax Obligations?

Here’s a tricky one: the trading allowance doesn’t exempt you from all tax responsibilities. If you’re self-employed and earning over £1,000, you may need to pay Class 2 and Class 4 National Insurance contributions (NICs). For 2025/26, Class 2 NICs are £3.45 per week (about £180 annually) if your profits exceed £6,725, and Class 4 NICs kick in at 9% on profits above £12,570 GOV.UK. If you claim the trading allowance, your taxable profit is reduced, which can lower your NICs.

For example, if Nia, a Cardiff illustrator, earns £14,000 and claims the £1,000 allowance, her taxable profit is £13,000. She pays Class 4 NICs on £430 (£13,000 - £12,570) at 9% (£38.70) plus Class 2 NICs (£180). If she claimed £2,000 in expenses instead, her profit would be £12,000, below the Class 4 threshold, saving her £38.70 but requiring more paperwork.

Table 3: Impact of Trading Allowance on NICs (2025/26 Example)

Scenario | Trading Allowance | Actual Expenses |

Gross Income | £14,000 | £14,000 |

Deduction | £1,000 (Allowance) | £2,000 (Expenses) |

Taxable Profit | £13,000 | £12,000 |

Class 2 NICs (£3.45/week) | £180 | £180 |

Class 4 NICs (9% on profits > £12,570) | £38.70 (£430 x 9%) | £0 |

Total NICs | £218.70 | £180 |

Tax at 20% | £260 (£1,430 x 20%) | £0 (below £12,570) |

Can You Use the Allowance for Multiple Income Streams?

Now, you might be wondering: what if you have several side gigs? The £1,000 trading allowance covers all your trading income combined, not each activity separately. For example, if Gethin in Liverpool earns £600 from freelance writing and £700 from selling homemade soaps, his total trading income is £1,300. He can claim the allowance to reduce his taxable income to £300, but he must register for Self Assessment as his gross income exceeds £1,000.

If you also have property income, like renting out a parking space, you can use the separate £1,000 property allowance. This makes the allowance system flexible for those juggling multiple hustles, but you’ll need to track each income stream carefully to avoid errors.

What Should You Do If You’re Audited by HMRC?

None of us wants an HMRC audit, but it’s worth knowing what to do. If HMRC questions your use of the trading allowance, they’ll likely ask for evidence of your income and whether it qualifies as trading. For example, if you claimed the allowance on £900 from selling old furniture, HMRC might argue it’s not trading income. To prepare:

● Keep bank statements, invoices, or platform records (e.g., Etsy sales reports).

● Document your intent to profit if selling online (e.g., buying stock to resell).

● Respond promptly to HMRC queries to avoid penalties.

In 2024, HMRC increased scrutiny on online sellers, with 10,000 compliance checks targeting platforms like eBay and Vinted. A case study from Tax Journal (2024) showed a seller fined £300 for incorrectly claiming the allowance on non-trading income. Stay honest and organised to avoid surprises.

Summary of the Most Important Points

The tax-free trading allowance lets you earn up to £1,000 per tax year (2025/26) from self-employment or casual income without paying tax or filing a Self Assessment return.

Eligible income includes freelancing, online sales with profit intent, and casual services, but excludes partnerships, employer-related income, or Rent a Room Scheme earnings.

If your gross income exceeds £1,000, you can claim partial relief (£1,000 deduction) but must register for Self Assessment by 5 October 2025.

You can’t claim actual expenses or capital allowances if you use the trading allowance, so compare both options to minimise your tax bill.

The allowance can be combined with the £1,000 property allowance and £12,570 Personal Allowance for maximum tax-free income.

For Universal Credit, report actual income and expenses, not the allowance-adjusted amount, to avoid payment errors.

Missing the Self Assessment deadline (31 January 2027 for 2025/26) incurs a £100 penalty, plus daily penalties and interest if delayed further.

A proposed £3,000 reporting threshold may start in 2026/27, but for 2025/26, the £1,000 threshold applies for Self Assessment registration.

Keep detailed records of all income, even under £1,000, as HMRC can request proof up to 5 years later.

National Insurance contributions (Class 2 and 4) apply if your profits exceed £6,725 or £12,570, respectively, but the allowance can reduce your taxable profit.

FAQs

Q1: Can someone claim the trading allowance if they’re employed full-time?

A1: Yes, a full-time employee can claim the trading allowance for side income from self-employment or casual work, such as freelancing or selling goods, as long as it meets HMRC’s eligibility criteria.

Q2: Does the trading allowance apply to income from abroad?

A2: The trading allowance applies only to UK-based trading income. Income earned abroad may be subject to different tax rules, depending on tax treaties and residency status.

Q3: Can a person claim the trading allowance if they’re also claiming the property allowance?

A3: Yes, an individual can claim both the £1,000 trading allowance and the £1,000 property allowance in the same tax year, provided the income streams are separate.

Q4: What happens if someone claims the trading allowance but later wants to switch to expenses?

A4: Once the trading allowance is claimed for a tax year, it cannot be changed to actual expenses for that year’s tax return. The decision is final for that filing period.

Q5: Is the trading allowance available to non-UK residents?

A5: Non-UK residents can claim the trading allowance if they earn trading income in the UK and are liable for UK tax, but they must meet HMRC’s eligibility rules.

Q6: Does the trading allowance affect VAT registration?

A6: The trading allowance does not impact VAT registration. VAT applies if taxable turnover exceeds £90,000, regardless of whether the trading allowance is used.

Q7: Can someone use the trading allowance for cryptocurrency trading?

A7: Cryptocurrency trading may qualify for the trading allowance if it’s deemed a trade by HMRC, but casual crypto sales are often treated as capital gains, not trading income.

Q8: How does the trading allowance affect tax codes for PAYE employees?

A8: The trading allowance doesn’t directly affect PAYE tax codes, but if self-employed income exceeds £1,000, HMRC may adjust the tax code to account for additional tax due.

Q9: Can the trading allowance be used for income from online content creation?

A9: Income from content creation, like YouTube or blogging, can qualify for the trading allowance if it’s considered self-employment income with a profit motive.

Q10: What records are needed if someone claims the trading allowance?

A10: Even with the allowance, individuals must keep records of gross income, such as bank statements or sales receipts, for at least 5 years in case HMRC requests proof.

Q11: Does the trading allowance apply to income from sharing economy platforms?

A11: Yes, income from platforms like Uber or Airbnb can qualify for the trading allowance if it’s classified as trading income, but not if it falls under the property allowance.

Q12: Can someone claim the trading allowance if they’re under 18?

A12: Yes, minors can claim the trading allowance if they earn eligible trading income, but they may need a parent or guardian to handle tax filings if required.

Q13: How does the trading allowance affect tax-free childcare eligibility?

A13: Claiming the trading allowance doesn’t directly affect tax-free childcare, but individuals may need to register for Self Assessment to prove self-employed income.

Q14: Can the trading allowance be used if someone is on maternity leave?

A14: Yes, individuals on maternity leave can claim the trading allowance for eligible side income, provided it meets HMRC’s trading criteria.

Q15: Does the trading allowance reduce taxable income for higher-rate taxpayers?

A15: Yes, the £1,000 allowance reduces taxable income for higher-rate taxpayers, potentially saving 40% tax on that amount, but they must file a tax return if income exceeds £1,000.

Q16: Can someone claim the trading allowance if they’ve already paid tax through PAYE?A16: Yes, the allowance can be claimed for separate self-employed income, and any overpaid tax through PAYE can be reclaimed via Self Assessment if applicable.

Q17: Is the trading allowance available for income from selling services abroad?

A17: If the services are performed in the UK, the income may qualify for the trading allowance, but foreign tax obligations must also be considered.

Q18: Can someone use the trading allowance if they’re claiming a trading loss?

A18: No, claiming the trading allowance means an individual cannot claim trading losses for that tax year, as losses require deducting actual expenses.

Q19: Does the trading allowance apply to income from online marketplaces like Amazon?A19: Yes, income from selling on Amazon can qualify for the trading allowance if it’s considered trading income with an intent to profit, not just selling personal items.

Q20: Can the trading allowance be split across multiple tax years?

A20: No, the £1,000 allowance applies per tax year and cannot be carried forward or split across years; unused portions are lost.

About the Author

Mr. Maz Zaheer, FCA, AFA, MAAT, MBA, is the CEO and Chief Accountant of MTA and Total Tax Accountants—two of the UK’s leading tax advisory firms. With over 14 years of hands-on experience in UK taxation, Maz is a seasoned expert in advising individuals, SMEs, and corporations on complex tax matters. A Fellow Chartered Accountant and a prolific tax writer, he is widely respected for simplifying intricate tax concepts through his popular articles. His professional insights empower UK taxpayers to navigate their financial obligations with clarity and confidence.

Disclaimer:

The information provided in our articles is for general informational purposes only and is not intended as professional advice. While we strive to keep the information up-to-date and correct, MTA makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained in the articles for any purpose. Any reliance you place on such information is therefore strictly at your own risk. The graphs may also not be 100% reliable.

We encourage all readers to consult with a qualified professional before making any decisions based on the information provided. The tax and accounting rules in the UK are subject to change and can vary depending on individual circumstances. Therefore, MTA cannot be held liable for any errors, omissions, or inaccuracies published. The firm is not responsible for any losses, injuries, or damages arising from the display or use of this information.

Comments